Background:

On 30th June, Nifty50 made a high of 25,699.35. From that point, the index entered a bearish trend, which extended down to the recent low of 24,337.50. This low marked a Break of Structure (BoS), signaling that a pullback phase was likely to follow.

-----------------------------------------------------------------------------------------------------------------

Pullback Phase:

The pullback began on 11th August, when price failed to break below the previous low and started forming higher highs (HH) and higher lows (HL).

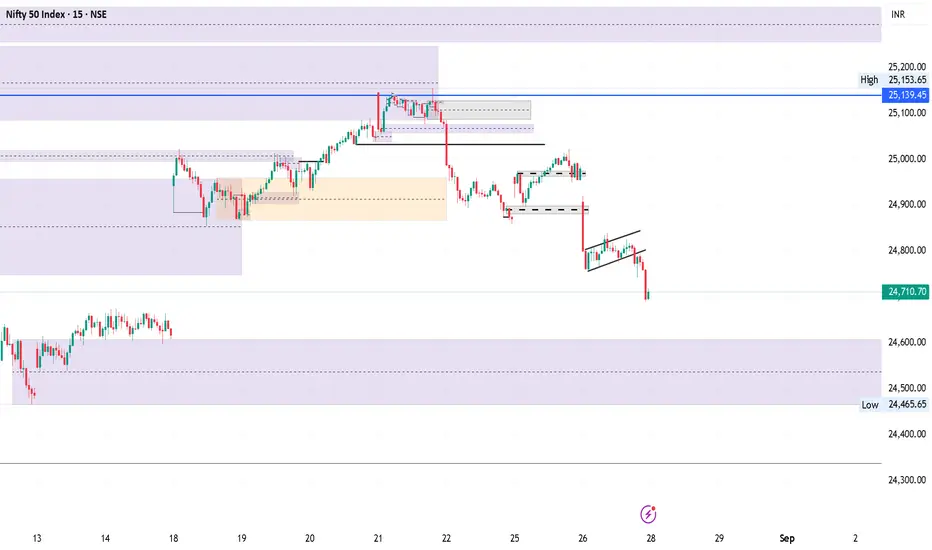

If we plot a Fibonacci retracement from 30th June (high) to 11th August (low), the 0.618 (golden ratio) comes in around 25,139.45.

-----------------------------------------------------------------------------------------------------------------

Price Action:

On 14th August, the market opened with a gap up, likely leaving some unfilled buy orders behind. This gap also opened within the supply premium zone around the golden fib level.

Since then, the price has reversed to the downside, forming lower lows (LL) and lower highs (LH) aligning with the higher time frame bearish trend.

------------------------------------------------------------------------------------------------------------------

Key Levels to Watch:

24,600 – 24,465: Important POI (Point of Interest) for buyers.

24,337.50: A crucial structural level. If this level holds and price begins to form HH and HL again, it can be considered a strong low for buyers.

-------------------------------------------------------------------------------------------------------------------

Chart Patterns (15m timeframe):

Head & Shoulders formation.

Bear Flag pattern.

------------------------------------------------------------------------------------------------------------------

Additionally, Gift Nifty is already showing signs of weakness near 24,600. With markets closed tomorrow for the festive holiday, Thursday could potentially open with a gap down.

On 30th June, Nifty50 made a high of 25,699.35. From that point, the index entered a bearish trend, which extended down to the recent low of 24,337.50. This low marked a Break of Structure (BoS), signaling that a pullback phase was likely to follow.

-----------------------------------------------------------------------------------------------------------------

Pullback Phase:

The pullback began on 11th August, when price failed to break below the previous low and started forming higher highs (HH) and higher lows (HL).

If we plot a Fibonacci retracement from 30th June (high) to 11th August (low), the 0.618 (golden ratio) comes in around 25,139.45.

-----------------------------------------------------------------------------------------------------------------

Price Action:

On 14th August, the market opened with a gap up, likely leaving some unfilled buy orders behind. This gap also opened within the supply premium zone around the golden fib level.

Since then, the price has reversed to the downside, forming lower lows (LL) and lower highs (LH) aligning with the higher time frame bearish trend.

------------------------------------------------------------------------------------------------------------------

Key Levels to Watch:

24,600 – 24,465: Important POI (Point of Interest) for buyers.

24,337.50: A crucial structural level. If this level holds and price begins to form HH and HL again, it can be considered a strong low for buyers.

-------------------------------------------------------------------------------------------------------------------

Chart Patterns (15m timeframe):

Head & Shoulders formation.

Bear Flag pattern.

------------------------------------------------------------------------------------------------------------------

Additionally, Gift Nifty is already showing signs of weakness near 24,600. With markets closed tomorrow for the festive holiday, Thursday could potentially open with a gap down.

Nota

today is monthly expiry + whatever we had in outlook already mitigated, so its better not to trade in second half , can get good trend friday or next week Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.