Good Afternoon,

Hope all is well. Here is a review on NPWR

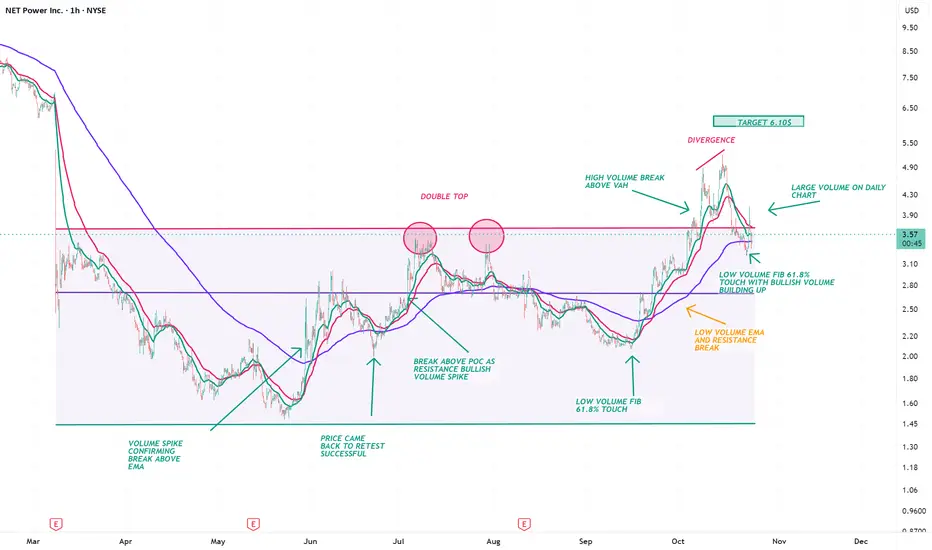

As a clean energy technology company, NET Power has received mixed ratings from analysts, and its stock has experienced volatility. A major shareholder, NPEH, recently sold $1.68 million worth of shares between October 20 and October 22, 2025, amid a 12% drop in the stock price the previous week.

Other factors impacting the company include:

Project Permian (SN1): Progress is being made on the company's first commercial-scale facility to identify potential cost savings.

Feasibility Studies: Studies for a standardized, modular multi-unit plant are underway to reduce future project costs and meet larger generation capacity demands.

High Capital Expenditure: The initial capital expenditure for the first plant remains high, estimated between $1.6 and $1.9 billion.

Technology Concerns: The NET Power cycle requires a significant auxiliary load, and full commercialization of the core cycle is not expected until 2030.

Trade Safely!

Enjoy!

Hope all is well. Here is a review on NPWR

As a clean energy technology company, NET Power has received mixed ratings from analysts, and its stock has experienced volatility. A major shareholder, NPEH, recently sold $1.68 million worth of shares between October 20 and October 22, 2025, amid a 12% drop in the stock price the previous week.

Other factors impacting the company include:

Project Permian (SN1): Progress is being made on the company's first commercial-scale facility to identify potential cost savings.

Feasibility Studies: Studies for a standardized, modular multi-unit plant are underway to reduce future project costs and meet larger generation capacity demands.

High Capital Expenditure: The initial capital expenditure for the first plant remains high, estimated between $1.6 and $1.9 billion.

Technology Concerns: The NET Power cycle requires a significant auxiliary load, and full commercialization of the core cycle is not expected until 2030.

Trade Safely!

Enjoy!

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.