🌎Palantir: Rocket Growth vs. Sky-High Valuation. Which Will Outweigh the Other?

The quarterly results are very strong, but investors face significant risks. Let's break it down.

🚀 Strengths:

Explosive revenue: $1.18 billion (+63% YoY), EPS: $0.21. Both metrics beat expectations.

Brighter-than-expected future: Q4 guidance ($1.33 billion) and 2025 guidance (~$4.4 billion) are significantly higher than consensus.

Commercial: 121% YoY growth in the US. This is the company's main driver.

Sales are strong: Closed contracts worth $2.8 billion. The client base grew to 911 companies (+45%).

Super-efficient: Revenue +63%, while headcount is only up 10%. An operating margin of 51% is fantastic.

AI is the fuel: Products like AIP are accelerating adoption, and customers are switching en masse to the Palantir platform.

⚠️ What's scary: Risks and "buts"

The price is sky-high: A P/S ratio of 110+ is nonsense, even for a growing company. Market cap is growing faster than revenue.

The model predicts a collapse: Under optimistic scenarios (40% annual growth), the fair price could be tens of percent lower than the current one.

Share dilution: Share-based compensation (SBC) eats up 24% of revenue—a huge amount. Insiders are actively selling.

Shorted a billion: The legendary Michael Burry bought put options on 5 million shares, betting against PLTR. He believes the AI sector is inflating.

Vulnerability: Business is concentrated in the US, creating regulatory and macro risks. Europe is experiencing stagnation.

The quarterly results are very strong, but investors face significant risks. Let's break it down.

🚀 Strengths:

Explosive revenue: $1.18 billion (+63% YoY), EPS: $0.21. Both metrics beat expectations.

Brighter-than-expected future: Q4 guidance ($1.33 billion) and 2025 guidance (~$4.4 billion) are significantly higher than consensus.

Commercial: 121% YoY growth in the US. This is the company's main driver.

Sales are strong: Closed contracts worth $2.8 billion. The client base grew to 911 companies (+45%).

Super-efficient: Revenue +63%, while headcount is only up 10%. An operating margin of 51% is fantastic.

AI is the fuel: Products like AIP are accelerating adoption, and customers are switching en masse to the Palantir platform.

⚠️ What's scary: Risks and "buts"

The price is sky-high: A P/S ratio of 110+ is nonsense, even for a growing company. Market cap is growing faster than revenue.

The model predicts a collapse: Under optimistic scenarios (40% annual growth), the fair price could be tens of percent lower than the current one.

Share dilution: Share-based compensation (SBC) eats up 24% of revenue—a huge amount. Insiders are actively selling.

Shorted a billion: The legendary Michael Burry bought put options on 5 million shares, betting against PLTR. He believes the AI sector is inflating.

Vulnerability: Business is concentrated in the US, creating regulatory and macro risks. Europe is experiencing stagnation.

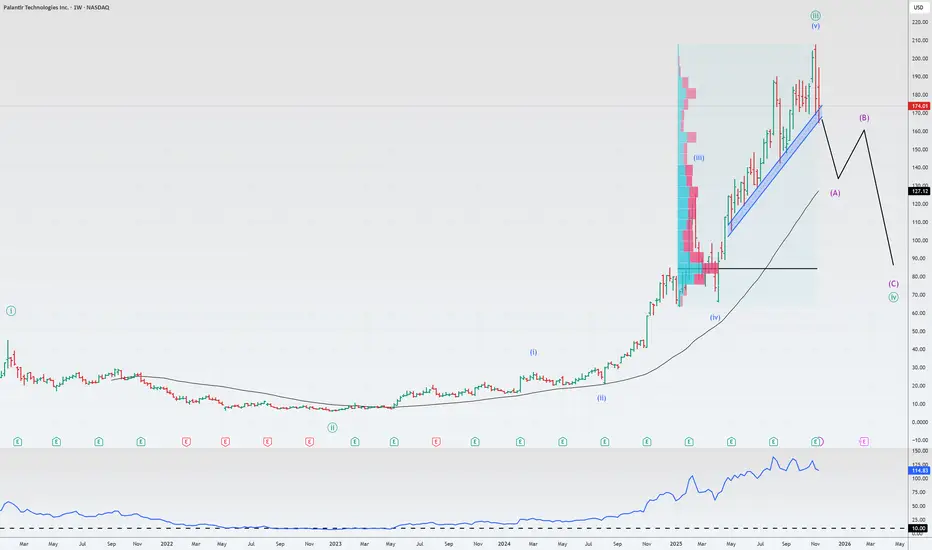

📌 TradingView Ideas (Summary)

📊 Full Analysis → 🌐 t.me/A3MInvestments

📊 Full Analysis → 🌐 t.me/A3MInvestments

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

📌 TradingView Ideas (Summary)

📊 Full Analysis → 🌐 t.me/A3MInvestments

📊 Full Analysis → 🌐 t.me/A3MInvestments

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.