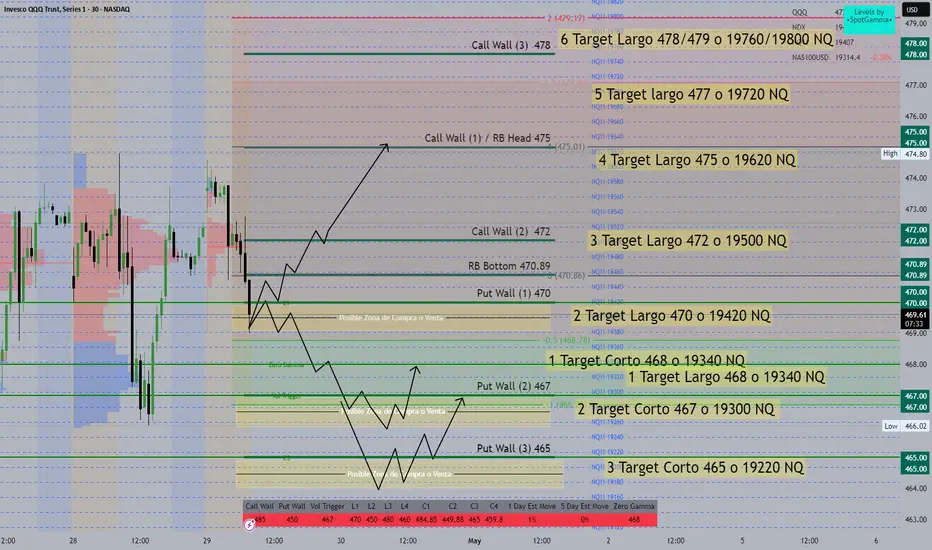

Market Outlook (QQQ / NQ Analysis)

📅 Date: April 29, 2025

🕰 Timeframe: 30-minute

📈 Asset: Invesco QQQ Trust (NASDAQ: QQQ) / NQ Futures

📊 Gamma Reference: SpotGamma levels with Zero Gamma & Put/Call Walls

🧠 Key Levels & Price Map

Level Type QQQ Price NQ Equivalent Comment

Call Wall (3) 478 19760 / 19800 🔼 Target 6 - Bullish Exhaustion

Target Long 477 19720 🔼 Target 5

Call Wall / RB Head 475 19620 🔼 Target 4 / High Confluence

Call Wall 472 19500 🔼 Target 3

RB Bottom 470.89 — Intermediate Resistance

Put Wall (1) 470 19420 🔼 Target 2 (bullish if broken)

Fib 0.5 468.78 — Reversal Zone

Put Wall (2) 467 19340 🔽 Target 1 - Short Bias Begins

Put Wall (3) 465 19220 🔽 Target 3 - Strong Bearish Zone

📉 Gamma & Sentiment Context

Zero Gamma: At 468 – market may be more volatile below this level.

Vol Trigger: At 467 – below this level, dealers may hedge by selling, increasing downside pressure.

Put Walls: Act as potential support or reversal zones (465, 467, 470).

Call Walls: Act as resistance or bullish break levels (472, 475, 478).

🧭 Possible Scenarios

📈 Bullish Path

If price breaks above 470, next long target is 472, then 475 (high confluence with RB Head and Call Wall).

Above 475, potential acceleration toward 478–479 (high call gamma zone).

📉 Bearish Path

Rejection at 470–472 could lead to a retest of 467, then 465.

Below 465, expect a push toward 19300–19220 NQ, aligning with the lower Put Walls.

📅 Date: April 29, 2025

🕰 Timeframe: 30-minute

📈 Asset: Invesco QQQ Trust (NASDAQ: QQQ) / NQ Futures

📊 Gamma Reference: SpotGamma levels with Zero Gamma & Put/Call Walls

🧠 Key Levels & Price Map

Level Type QQQ Price NQ Equivalent Comment

Call Wall (3) 478 19760 / 19800 🔼 Target 6 - Bullish Exhaustion

Target Long 477 19720 🔼 Target 5

Call Wall / RB Head 475 19620 🔼 Target 4 / High Confluence

Call Wall 472 19500 🔼 Target 3

RB Bottom 470.89 — Intermediate Resistance

Put Wall (1) 470 19420 🔼 Target 2 (bullish if broken)

Fib 0.5 468.78 — Reversal Zone

Put Wall (2) 467 19340 🔽 Target 1 - Short Bias Begins

Put Wall (3) 465 19220 🔽 Target 3 - Strong Bearish Zone

📉 Gamma & Sentiment Context

Zero Gamma: At 468 – market may be more volatile below this level.

Vol Trigger: At 467 – below this level, dealers may hedge by selling, increasing downside pressure.

Put Walls: Act as potential support or reversal zones (465, 467, 470).

Call Walls: Act as resistance or bullish break levels (472, 475, 478).

🧭 Possible Scenarios

📈 Bullish Path

If price breaks above 470, next long target is 472, then 475 (high confluence with RB Head and Call Wall).

Above 475, potential acceleration toward 478–479 (high call gamma zone).

📉 Bearish Path

Rejection at 470–472 could lead to a retest of 467, then 465.

Below 465, expect a push toward 19300–19220 NQ, aligning with the lower Put Walls.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.