REGN | Regeneron Pharmaceuticals – Macro Reaccumulation Setup

Published by WaverVanir International LLC | 06/12/2025

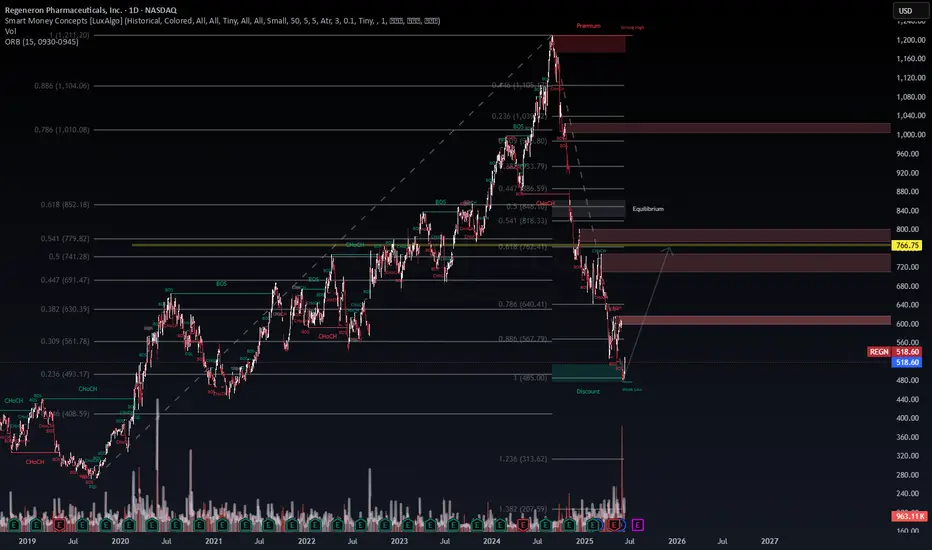

Regeneron has completed a deep retracement, touching the 0.886 Fibonacci level (~$567) and entering a strong discount zone, coinciding with a weak low sweep and increasing volume — suggesting potential accumulation by institutions.

🔍 Key Confluences:

🔄 Internal CHoCH and BOS structure shift indicates short-term reversal

🔵 Entered macro discount territory with a clean sweep of liquidity below $485

🟡 Targeting major inefficiency and liquidity void around $766.75, aligning with 0.5 retracement and prior equilibrium

🟥 Supply zones between $640–$720 may offer resistance/partial profit-taking zones

📉 Risk Framework:

Entry consideration: $500–$520

Stop loss idea: Below $475 (invalidate weak low sweep)

Primary Target: $766.75

Secondary Target (Extended): $818–$852

🧠 Fundamental & Macro Watch:

Upcoming trial results or FDA action could act as a key catalyst

Biotech sector sentiment tied to macro healthcare policy and AI-integration for drug discovery

Recent earnings showed strong forward guidance – potential re-rating ahead

📈 Probabilistic Outlook:

Bullish retracement toward $766.75: 70%

Extended bearish continuation (below $485): 15%

Sideways chop: 15%

🧭 Smart money often reacts to extreme fear – REGN may be entering a mark-up phase if confirmed with institutional follow-through.

#REGN REGN #SmartMoneyConcepts #FibConfluence #WaverVanir #BiotechStocks #SwingTrading #TechnicalAnalysis #InstitutionalOrderFlow

REGN #SmartMoneyConcepts #FibConfluence #WaverVanir #BiotechStocks #SwingTrading #TechnicalAnalysis #InstitutionalOrderFlow

Regeneron has completed a deep retracement, touching the 0.886 Fibonacci level (~$567) and entering a strong discount zone, coinciding with a weak low sweep and increasing volume — suggesting potential accumulation by institutions.

🔍 Key Confluences:

🔄 Internal CHoCH and BOS structure shift indicates short-term reversal

🔵 Entered macro discount territory with a clean sweep of liquidity below $485

🟡 Targeting major inefficiency and liquidity void around $766.75, aligning with 0.5 retracement and prior equilibrium

🟥 Supply zones between $640–$720 may offer resistance/partial profit-taking zones

📉 Risk Framework:

Entry consideration: $500–$520

Stop loss idea: Below $475 (invalidate weak low sweep)

Primary Target: $766.75

Secondary Target (Extended): $818–$852

🧠 Fundamental & Macro Watch:

Upcoming trial results or FDA action could act as a key catalyst

Biotech sector sentiment tied to macro healthcare policy and AI-integration for drug discovery

Recent earnings showed strong forward guidance – potential re-rating ahead

📈 Probabilistic Outlook:

Bullish retracement toward $766.75: 70%

Extended bearish continuation (below $485): 15%

Sideways chop: 15%

🧭 Smart money often reacts to extreme fear – REGN may be entering a mark-up phase if confirmed with institutional follow-through.

#REGN

Trade attivo

Nota

Regeneron Pharmaceuticals (Ticker: REGN)Linvoseltamab for relapsed or refractory multiple myeloma (PDUFA by July 10, 2025)

Odronextamab for relapsed/refractory follicular lymphoma (PDUFA by July 30, 2025)

WaverVanir ⚡ To grow and conquer

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

WaverVanir ⚡ To grow and conquer

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

stocktwits.com/WaverVanir | wavervanir.com | buymeacoffee.com/wavervanir

Not Investment Advice

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.