The risk of a US government shutdown has fueled increased risk aversion in the market. Meanwhile, the Federal Reserve's lack of key economic data has further solidified expectations of a rate cut at its October meeting, pushing down the US dollar and providing momentum for silver prices.

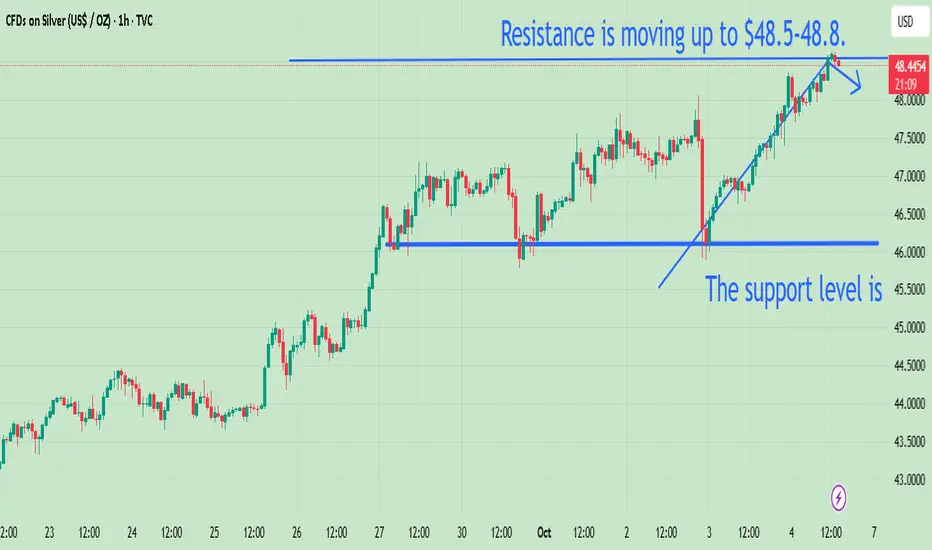

Silver experienced a significant correction last week, but the bullish trend remains strong. This week, it continued its upward trend, reaching a new high of $48.5. Currently, the support level is gradually shifting upward, with $46 as support. We can watch for pullbacks and buy long positions above this support level. Meanwhile, the upward pressure is also very strong. After the market digests the news, the lack of momentum will inevitably lead to a pullback. Therefore, we can focus on establishing short positions around $48.5.

For short-term trading, the most important thing is to master the timing, which requires strong professional knowledge and experience. For investors currently holding short positions or unsure how to trade, please like and follow my channel. I will provide exclusive trading services to members.

Silver experienced a significant correction last week, but the bullish trend remains strong. This week, it continued its upward trend, reaching a new high of $48.5. Currently, the support level is gradually shifting upward, with $46 as support. We can watch for pullbacks and buy long positions above this support level. Meanwhile, the upward pressure is also very strong. After the market digests the news, the lack of momentum will inevitably lead to a pullback. Therefore, we can focus on establishing short positions around $48.5.

For short-term trading, the most important thing is to master the timing, which requires strong professional knowledge and experience. For investors currently holding short positions or unsure how to trade, please like and follow my channel. I will provide exclusive trading services to members.

Investment Guide: Share the best investment and financial management tips to lead you on the road to wealth appreciation!

⭐t.me/Gold4my_love

⭐t.me/Gold4my_love

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Investment Guide: Share the best investment and financial management tips to lead you on the road to wealth appreciation!

⭐t.me/Gold4my_love

⭐t.me/Gold4my_love

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.