Open interest (OI) is the total number of active contracts held by traders at any moment. It helps gauge market activity and trends, especially in futures and options trading.

Increasing OI: More money is entering the market, suggesting a bullish trend.

Decreasing O: Indicates a potential end to the current price trend.

What is Volume?

Volume measures the number of contracts traded in a day. It shows how many transactions occurred, regardless of whether they were new or existing contracts.

Key Difference: Open interest counts active contracts, while volume counts contracts traded.

What is Price Action?

Price action tracks how a security's price moves over time, indicating trends.

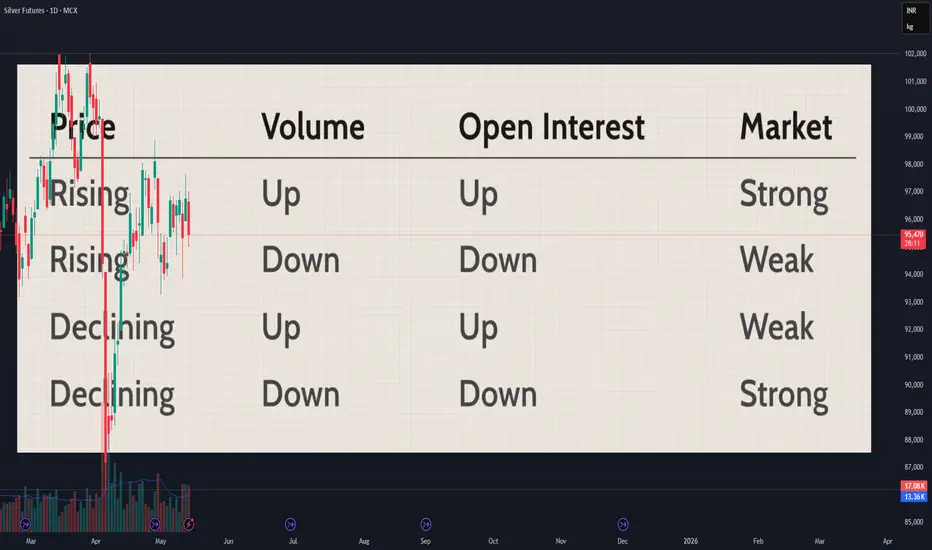

Market Strength: If prices rise with increasing volume and OI, the market is strong.

Market Weakness: If prices rise but volume and OI fall, the market may be weak.

How is Open Interest Calculated?

For example, if Trader A buys 1 contract from Trader B, OI increases by 1. If Trader C buys 2 contracts from Trader D, OI rises by 2, totaling 3. If Trader A closes their position, OI decreases unless a new trader opens a position.

Analyzing Open Interest Data:

1. Rising OI + Rising Prices: Bullish market with active buyers.

2. Rising Prices + Falling O: Money may be leaving, indicating a bear market.

3. High OI + Falling Prices: Potential panic selling as buyers lose money.

4. Falling Prices + Decreasing OI: Sellers under pressure, suggesting a negative outlook.

Understanding these concepts helps traders make smarter decisions in the market.

LOW RISK? PLAY HUGE!

Follow for latest updates and valuable financial content

✆ t.me/iVishalPal

Yt: t.ly/frb4G

LinkedIn: t.ly/g_SjB

WhatsApp: t.ly/_6T9j

TradingView: t.ly/-UGgZ

Telegram: t.me/traderpulseyt

Follow for latest updates and valuable financial content

✆ t.me/iVishalPal

Yt: t.ly/frb4G

LinkedIn: t.ly/g_SjB

WhatsApp: t.ly/_6T9j

TradingView: t.ly/-UGgZ

Telegram: t.me/traderpulseyt

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

LOW RISK? PLAY HUGE!

Follow for latest updates and valuable financial content

✆ t.me/iVishalPal

Yt: t.ly/frb4G

LinkedIn: t.ly/g_SjB

WhatsApp: t.ly/_6T9j

TradingView: t.ly/-UGgZ

Telegram: t.me/traderpulseyt

Follow for latest updates and valuable financial content

✆ t.me/iVishalPal

Yt: t.ly/frb4G

LinkedIn: t.ly/g_SjB

WhatsApp: t.ly/_6T9j

TradingView: t.ly/-UGgZ

Telegram: t.me/traderpulseyt

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.