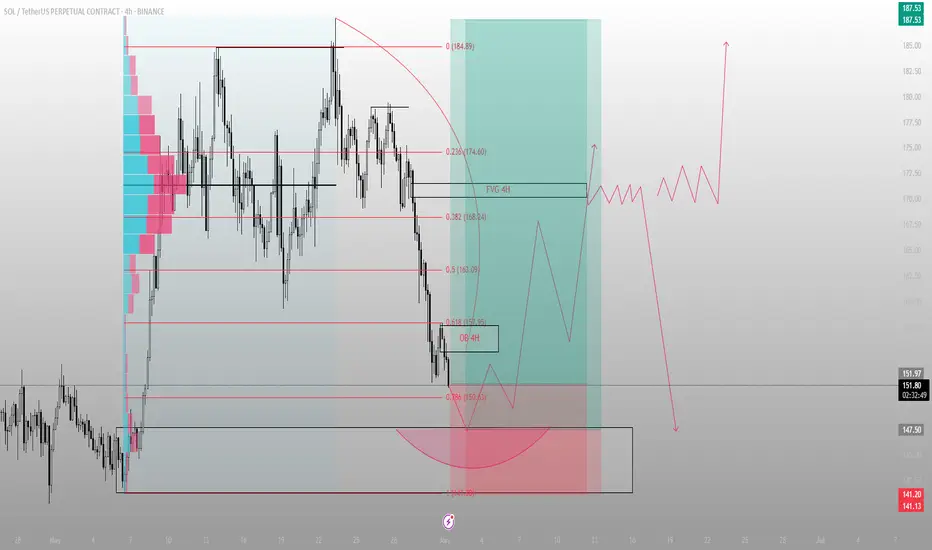

SOL just kissed the 0.786 retracement at 150.6 — and did so with precision, not hesitation.

Below that sits a 4H OB that hasn’t been touched since the impulse leg began. That zone, now swept, resets the auction. We’ve completed the delivery cycle down, and Smart Money is reloading while the herd panics.

The rejection from this OB aligns with a thin LVN pocket — a classic bounce zone for engineered reaccumulation. From here, I’m watching for expansion into the inefficiency above: the 4H FVG at 174.6. That’s the draw.

Structure shows that the 163–168 zone (0.5 to 0.382) will act as a decision shelf. If price respects that as a new support, this entire move becomes the foundation for a higher macro expansion into 185+.

If we fail? The resting liquidity at 141 is still untouched.

Execution bias:

🟩 Bid zone: 150.6–147.5 (OB + 0.786)

🎯 Target 1: 163.09

🎯 Target 2: 174.6 (4H FVG)

❌ Invalidation: Full body breakdown below 141.13

This isn’t about catching a bounce.

It’s about understanding where Smart Money needs to rebalance.

I don’t trade candles. I trade consequences.

Below that sits a 4H OB that hasn’t been touched since the impulse leg began. That zone, now swept, resets the auction. We’ve completed the delivery cycle down, and Smart Money is reloading while the herd panics.

The rejection from this OB aligns with a thin LVN pocket — a classic bounce zone for engineered reaccumulation. From here, I’m watching for expansion into the inefficiency above: the 4H FVG at 174.6. That’s the draw.

Structure shows that the 163–168 zone (0.5 to 0.382) will act as a decision shelf. If price respects that as a new support, this entire move becomes the foundation for a higher macro expansion into 185+.

If we fail? The resting liquidity at 141 is still untouched.

Execution bias:

🟩 Bid zone: 150.6–147.5 (OB + 0.786)

🎯 Target 1: 163.09

🎯 Target 2: 174.6 (4H FVG)

❌ Invalidation: Full body breakdown below 141.13

This isn’t about catching a bounce.

It’s about understanding where Smart Money needs to rebalance.

I don’t trade candles. I trade consequences.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.