Hey everyone,

What a day!

Many people have been asking me for like, live trade ideas and stuff. So, If you follow me on my futures posts, I did, per many requests, post my day trade plans on futures here:

Those worked out super well!

I did not do one tonight because we are leading into a major news event tomorrow and the next day and am an extremely cautious person.

This past year it has not been hard to predict major news events behavior, but you know, you never know. This could be the one off time and I don't want to be responsible for giving false information. But let me tell you what I am seeing and also, on my weekly update on SPY I left, what I thought, was an interesting Easter Egg I was hoping people would pick up on and comment about, but no one did! Come on guys! You have to put in some of the work! :P

Maybe I will tell you at the end what that was, but go back and read over the probabilities very closely and see if you notice it =).

Anyway, leading into CPI:

So, after that bullish rally, you would think that we would be bullish right?

Mm, I thought so too to be honest but when I corrected the weekly probabilities for this trend day we just had, it actually made the results slightly more bearish. So that's not good.

I was really content because, while I presented a bearish idea on SPY, my own bias is bullish. However, its irresponsible of me to present a bullish thesis just because that's my bias when the data is more bearish, so yeah. But I got excited!

Unfortunately, like I said, amending the data makes things a bit more bearish. So that is strike 1 for leading into CPI.

Strike 2 is, on the YM1! Futures chart, the DOW has not taken out its 99% daily target yet and ES and RTY were very slow to take those out. This is generally behavior I observe before a massive dump. So... be cautious here and this is what I would consider as strike 2.

If you wanna track it real time, here is the level:

That said, overall the outlook on ES1! for tomorrow (I haven't run the probs in SPY because lately I have been on an ES1! kick) is somewhat positive.

And now I think its time to make mention to that little tidbit from my previous post. I will repeat it below:

Probability we will close above next week's open price: 8.65%

Probability we will close below next week's open price: 4.23%

Notice it? Probability we close above our open this week is actually pretty high. SIzeably higher than closing below. Not to an overly significant amount, but still I would call that a sizeable difference.

Whether that will turn out to be true is to be seen.

But that leads me to the next point. Be cautious with any positions you are taking. I expect whipsawing. Will we tank with CPI and rally with FOMC? Inverse? Rally with all? Based on this, it seems that there is a good chance we see an overall net gain on the week, or at least close the week relatively flat if not slightly positive. Again, its odds that I wouldn't bet a sizeable amount of money on (I only bet money on like 80% or higher), but its still something of note.

Thus, we should look for buying to accompany any major selling event this week. Optimism is there and buyers are showing up.

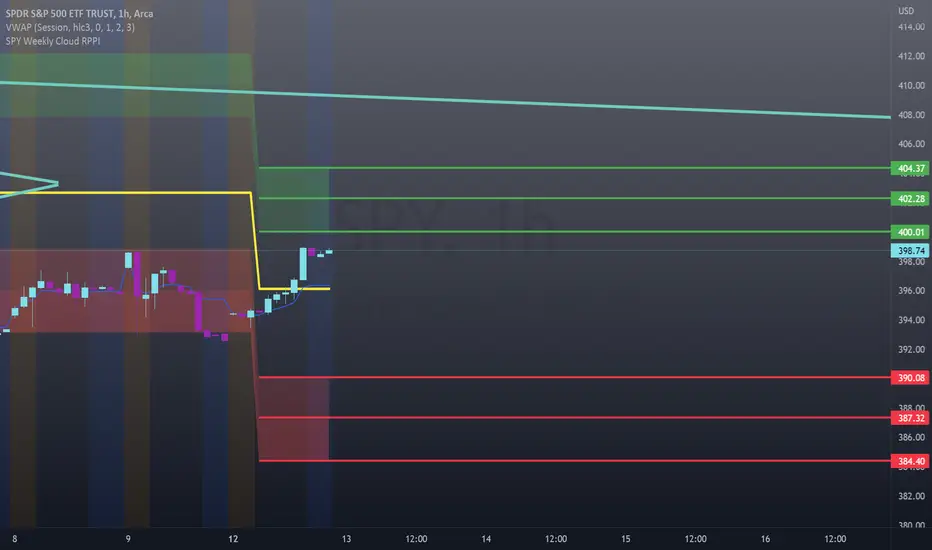

In terms of what levels to watch on SPY, I have posted the real time weekly levels in the chart for you to reference. These are the areas I am watching closely this week. We are approaching the weekly high, which has traditionally been where we have seen our 180s back down on major news releases, so again, be cautious. If we are going to tank with CPI, we should see this bring us to the weekly lows before we get a bounce.

If we rally with CPI, we should see it bring us to at least the high range of the weekly highs with the ultimate end result being we probably surpass the weekly highs.

Oh, future Steven jumping in:

Our weekly 99% targets have all been hit except..... ON TSLA!!!! :O!!!! And its a good one, really juicy one.

And that is where we are at.

Trade cautiously and expect a wild, roller-coaster this week! Its actually kind of exciting. A little early Christmas fun :-).

Trade safe everyone and let me know your questions/ comments and critiques below!

What a day!

Many people have been asking me for like, live trade ideas and stuff. So, If you follow me on my futures posts, I did, per many requests, post my day trade plans on futures here:

Those worked out super well!

I did not do one tonight because we are leading into a major news event tomorrow and the next day and am an extremely cautious person.

This past year it has not been hard to predict major news events behavior, but you know, you never know. This could be the one off time and I don't want to be responsible for giving false information. But let me tell you what I am seeing and also, on my weekly update on SPY I left, what I thought, was an interesting Easter Egg I was hoping people would pick up on and comment about, but no one did! Come on guys! You have to put in some of the work! :P

Maybe I will tell you at the end what that was, but go back and read over the probabilities very closely and see if you notice it =).

Anyway, leading into CPI:

So, after that bullish rally, you would think that we would be bullish right?

Mm, I thought so too to be honest but when I corrected the weekly probabilities for this trend day we just had, it actually made the results slightly more bearish. So that's not good.

I was really content because, while I presented a bearish idea on SPY, my own bias is bullish. However, its irresponsible of me to present a bullish thesis just because that's my bias when the data is more bearish, so yeah. But I got excited!

Unfortunately, like I said, amending the data makes things a bit more bearish. So that is strike 1 for leading into CPI.

Strike 2 is, on the YM1! Futures chart, the DOW has not taken out its 99% daily target yet and ES and RTY were very slow to take those out. This is generally behavior I observe before a massive dump. So... be cautious here and this is what I would consider as strike 2.

If you wanna track it real time, here is the level:

That said, overall the outlook on ES1! for tomorrow (I haven't run the probs in SPY because lately I have been on an ES1! kick) is somewhat positive.

And now I think its time to make mention to that little tidbit from my previous post. I will repeat it below:

Probability we will close above next week's open price: 8.65%

Probability we will close below next week's open price: 4.23%

Notice it? Probability we close above our open this week is actually pretty high. SIzeably higher than closing below. Not to an overly significant amount, but still I would call that a sizeable difference.

Whether that will turn out to be true is to be seen.

But that leads me to the next point. Be cautious with any positions you are taking. I expect whipsawing. Will we tank with CPI and rally with FOMC? Inverse? Rally with all? Based on this, it seems that there is a good chance we see an overall net gain on the week, or at least close the week relatively flat if not slightly positive. Again, its odds that I wouldn't bet a sizeable amount of money on (I only bet money on like 80% or higher), but its still something of note.

Thus, we should look for buying to accompany any major selling event this week. Optimism is there and buyers are showing up.

In terms of what levels to watch on SPY, I have posted the real time weekly levels in the chart for you to reference. These are the areas I am watching closely this week. We are approaching the weekly high, which has traditionally been where we have seen our 180s back down on major news releases, so again, be cautious. If we are going to tank with CPI, we should see this bring us to the weekly lows before we get a bounce.

If we rally with CPI, we should see it bring us to at least the high range of the weekly highs with the ultimate end result being we probably surpass the weekly highs.

Oh, future Steven jumping in:

Our weekly 99% targets have all been hit except..... ON TSLA!!!! :O!!!! And its a good one, really juicy one.

And that is where we are at.

Trade cautiously and expect a wild, roller-coaster this week! Its actually kind of exciting. A little early Christmas fun :-).

Trade safe everyone and let me know your questions/ comments and critiques below!

Get:

- Live Updates,

- Discord access,

- Access to my Proprietary Merlin Software,

- Access to premium indicators,

patreon.com/steversteves

Now on X!

- Live Updates,

- Discord access,

- Access to my Proprietary Merlin Software,

- Access to premium indicators,

patreon.com/steversteves

Now on X!

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Get:

- Live Updates,

- Discord access,

- Access to my Proprietary Merlin Software,

- Access to premium indicators,

patreon.com/steversteves

Now on X!

- Live Updates,

- Discord access,

- Access to my Proprietary Merlin Software,

- Access to premium indicators,

patreon.com/steversteves

Now on X!

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.