The Market Flow | Oct 27, 2025

Technical Overview

Weekly / Daily:

• Price has reached the 138.2% Fibonacci extension, aligning with the upper boundary of the long-term impulse zone.

• This region represents a potential profit-taking area within an extended expansion phase.

• The daily structure completed an impulse to the 161.8% Fibonacci target.

• Market currently trades inside a high-probability reaction zone, suggesting risk of corrective flow.

H4:

• Price action shows initial hesitation beneath the prior breakout.

• Intermediate structural support rests near 47,330–47,200, representing the first countertrend target.

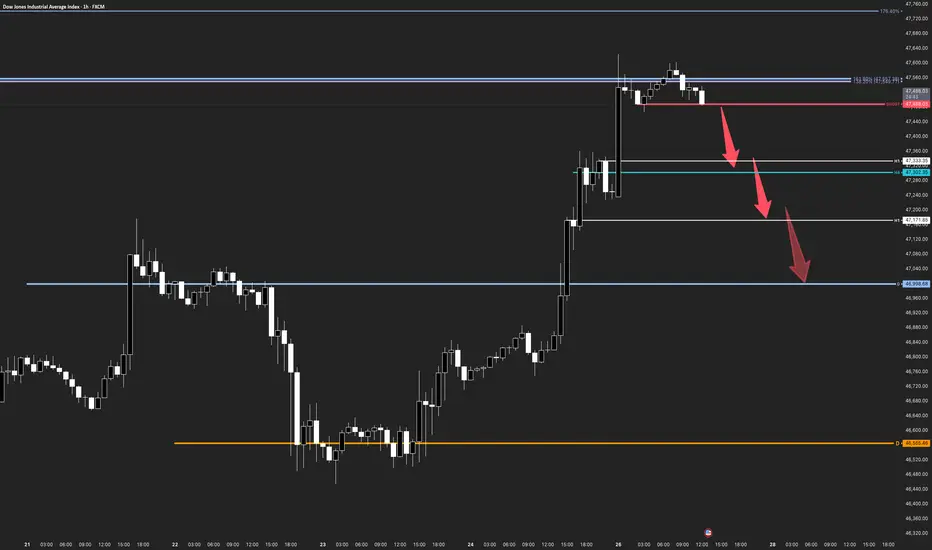

H1:

• A defined trigger = 47,488 (red SHORT level) marks potential short confirmation if broken with a 1–2–3 sequence on M15.

• Below this level, the path → 47,333 → 47,171 → 46,998 aligns with visible breakout retests.

Trade Structure & Levels

• Bias: Bearish countertrend short below 47,488

• Trigger = 47,488

• Invalidation = 47,580 (H1 structure high)

• Path → 47,333 → 47,171 → 46,998

• Phase: Countertrend within extended impulse reaching long-term target zone

Risk & Event Context

• Long-term momentum remains bullish, but exhaustion signals at key Fibonacci confluence may induce a corrective phase.

• Watch for volatility spikes near macro releases or equity session opens that could accelerate profit-taking.

Conclusion

US30 sits within its long-term Fibonacci target zone. A confirmed lower-timeframe trigger below 47,488 would validate a short-term countertrend move toward daily breakout levels before broader structure reassessment.

Technical Overview

Weekly / Daily:

• Price has reached the 138.2% Fibonacci extension, aligning with the upper boundary of the long-term impulse zone.

• This region represents a potential profit-taking area within an extended expansion phase.

• The daily structure completed an impulse to the 161.8% Fibonacci target.

• Market currently trades inside a high-probability reaction zone, suggesting risk of corrective flow.

H4:

• Price action shows initial hesitation beneath the prior breakout.

• Intermediate structural support rests near 47,330–47,200, representing the first countertrend target.

H1:

• A defined trigger = 47,488 (red SHORT level) marks potential short confirmation if broken with a 1–2–3 sequence on M15.

• Below this level, the path → 47,333 → 47,171 → 46,998 aligns with visible breakout retests.

Trade Structure & Levels

• Bias: Bearish countertrend short below 47,488

• Trigger = 47,488

• Invalidation = 47,580 (H1 structure high)

• Path → 47,333 → 47,171 → 46,998

• Phase: Countertrend within extended impulse reaching long-term target zone

Risk & Event Context

• Long-term momentum remains bullish, but exhaustion signals at key Fibonacci confluence may induce a corrective phase.

• Watch for volatility spikes near macro releases or equity session opens that could accelerate profit-taking.

Conclusion

US30 sits within its long-term Fibonacci target zone. A confirmed lower-timeframe trigger below 47,488 would validate a short-term countertrend move toward daily breakout levels before broader structure reassessment.

Day trader capitalizing on the expansion phases of emerging trends.

MORE CHARTS & FREE EDUCATION

SUBSCRIBE 🚀 themarketflow.trading

MORE CHARTS & FREE EDUCATION

SUBSCRIBE 🚀 themarketflow.trading

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Day trader capitalizing on the expansion phases of emerging trends.

MORE CHARTS & FREE EDUCATION

SUBSCRIBE 🚀 themarketflow.trading

MORE CHARTS & FREE EDUCATION

SUBSCRIBE 🚀 themarketflow.trading

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.