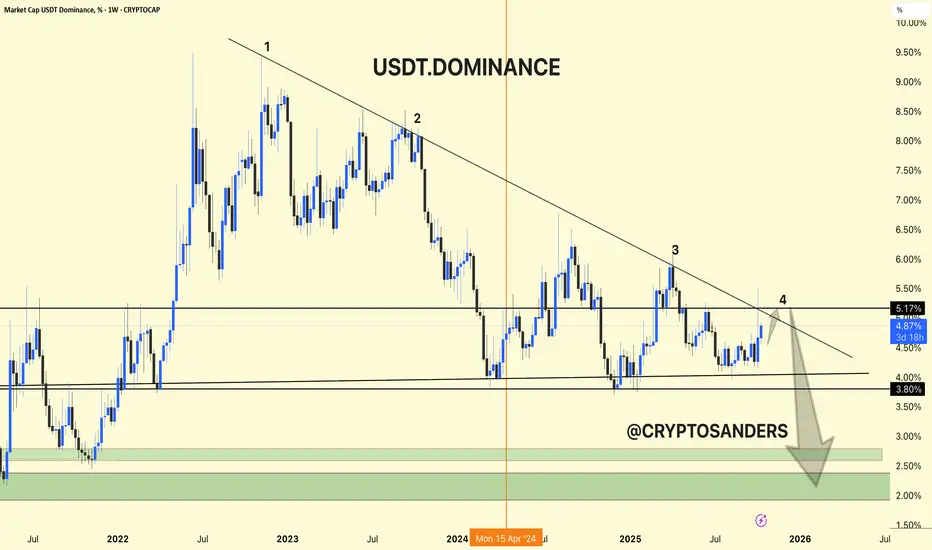

USDT Dominance - Weekly Chart Overview

Current Level: 4.88%

Trend Structure: The chart clearly forms an aspect ratio pattern, consisting of a series of lower highs and lower lows since mid-2022.

Ascending Telgero/Declining Channel - Continuous pressure is being displayed from the ascending Telgero.

1. Key Resistance Area (5.0%–5.2%)

USDT Dominant is currently undergoing a restart test of the ascending critical line, which has acted as strong resistance several times in the past.

Every time the price retests this trend line, it corrects – indicating a shift of funds from stablecoins to crypto assets.

If the price does not close above 5.2%, it could trigger the next bearish move to the downside.

2. Support Levels

First Support: Around 3.8% – a key chocolate demand area.

Key support zone: Between 2.0%-2.5% (green zone applied).

This level is typical of the Initial Petroleum Model and historically marks major crypto bull runs.

3. Uptrend Outlook

The large downward arrow on the chart indicates a continuation of the slope.

If dominance is below 3.8%, it could move towards the 2-2.5% zone, which indicates that traders are shifting investments from USDT to BTC and altcoins – a bullish trend for the crypto market.

This means that traders are selling crypto and holding stablecoins → risk-off, fear in the market.

When USDT dominance falls:

It means that money is flowing from stablecoins to BTC and altcoins → risk-off sentiment, confidence is returning.

DYOR | NFA

Current Level: 4.88%

Trend Structure: The chart clearly forms an aspect ratio pattern, consisting of a series of lower highs and lower lows since mid-2022.

Ascending Telgero/Declining Channel - Continuous pressure is being displayed from the ascending Telgero.

1. Key Resistance Area (5.0%–5.2%)

USDT Dominant is currently undergoing a restart test of the ascending critical line, which has acted as strong resistance several times in the past.

Every time the price retests this trend line, it corrects – indicating a shift of funds from stablecoins to crypto assets.

If the price does not close above 5.2%, it could trigger the next bearish move to the downside.

2. Support Levels

First Support: Around 3.8% – a key chocolate demand area.

Key support zone: Between 2.0%-2.5% (green zone applied).

This level is typical of the Initial Petroleum Model and historically marks major crypto bull runs.

3. Uptrend Outlook

The large downward arrow on the chart indicates a continuation of the slope.

If dominance is below 3.8%, it could move towards the 2-2.5% zone, which indicates that traders are shifting investments from USDT to BTC and altcoins – a bullish trend for the crypto market.

This means that traders are selling crypto and holding stablecoins → risk-off, fear in the market.

When USDT dominance falls:

It means that money is flowing from stablecoins to BTC and altcoins → risk-off sentiment, confidence is returning.

DYOR | NFA

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.