Core economic data disappointed, confirming the economic slowdown.

The core retail sales in the US dropped by 0.3% month-on-month in October (expected to remain unchanged), marking the largest decline since March 2024. At the same time, industrial output dropped by 0.6% month-on-month in October (expected to decline by 0.1%), with both core consumption and production indicators showing synchronous weakness, far exceeding market expectations. Historical data shows that when core retail sales and industrial output decline simultaneously, the probability of the Federal Reserve initiating easing policies within 3 months increases from 58% to 72%. This directly boosts the probability of a December interest rate cut from 44.4% to 48.2%. The early brewing of easing expectations provides strong support for the gold price.

The dovish faction of the Federal Reserve has spoken out, and policy differences have widened.

Federal Reserve Governor Bowman (previously hawkish) stated on November 19 that "We need to closely monitor the impact of economic slowdown signals on inflation. If the economy continues to weaken, we can assess the timing of the interest rate cut in advance." The dovish faction unexpectedly expanded, breaking the previous "hawkish dominance" of the舆论 landscape. Market sensitivity to policy shifts has significantly increased, further weakening the suppression power of hawkish remarks.

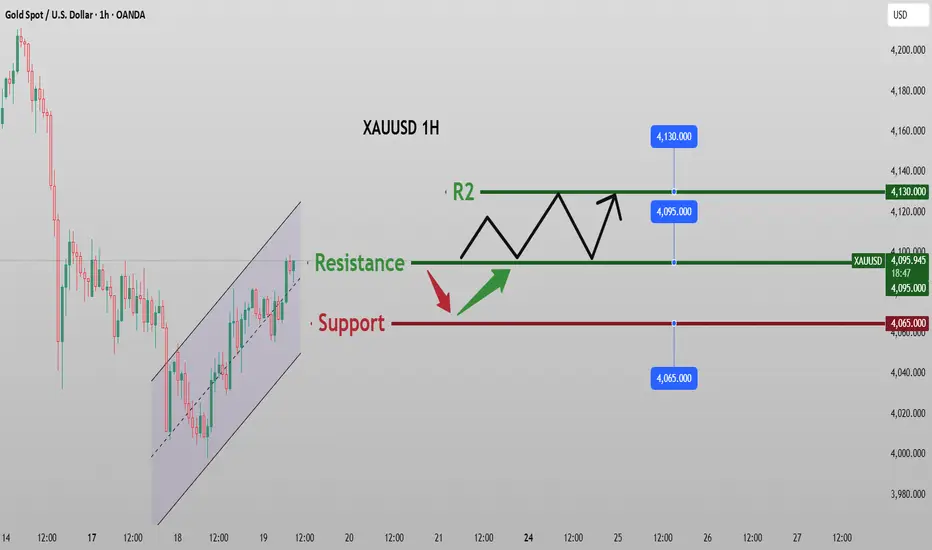

Gold trading strategy

buy:4065-4075

tp:4085-4095-4130

sl:4055

The core retail sales in the US dropped by 0.3% month-on-month in October (expected to remain unchanged), marking the largest decline since March 2024. At the same time, industrial output dropped by 0.6% month-on-month in October (expected to decline by 0.1%), with both core consumption and production indicators showing synchronous weakness, far exceeding market expectations. Historical data shows that when core retail sales and industrial output decline simultaneously, the probability of the Federal Reserve initiating easing policies within 3 months increases from 58% to 72%. This directly boosts the probability of a December interest rate cut from 44.4% to 48.2%. The early brewing of easing expectations provides strong support for the gold price.

The dovish faction of the Federal Reserve has spoken out, and policy differences have widened.

Federal Reserve Governor Bowman (previously hawkish) stated on November 19 that "We need to closely monitor the impact of economic slowdown signals on inflation. If the economy continues to weaken, we can assess the timing of the interest rate cut in advance." The dovish faction unexpectedly expanded, breaking the previous "hawkish dominance" of the舆论 landscape. Market sensitivity to policy shifts has significantly increased, further weakening the suppression power of hawkish remarks.

Gold trading strategy

buy:4065-4075

tp:4085-4095-4130

sl:4055

Trade attivo

The core strategy has shifted from "trend continuation" to "signal capture", featuring "small stop-loss and high risk-reward ratio", and is tailored to meet the demands of short-term high-frequency trading.Trading strategies and analysis: Gold, BTC, crude oil, foreign exchange, etc.

Free trading signals: t.me/+xTRS6kLO0VFkZjIx

Free trading signals: t.me/+xTRS6kLO0VFkZjIx

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Trading strategies and analysis: Gold, BTC, crude oil, foreign exchange, etc.

Free trading signals: t.me/+xTRS6kLO0VFkZjIx

Free trading signals: t.me/+xTRS6kLO0VFkZjIx

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.