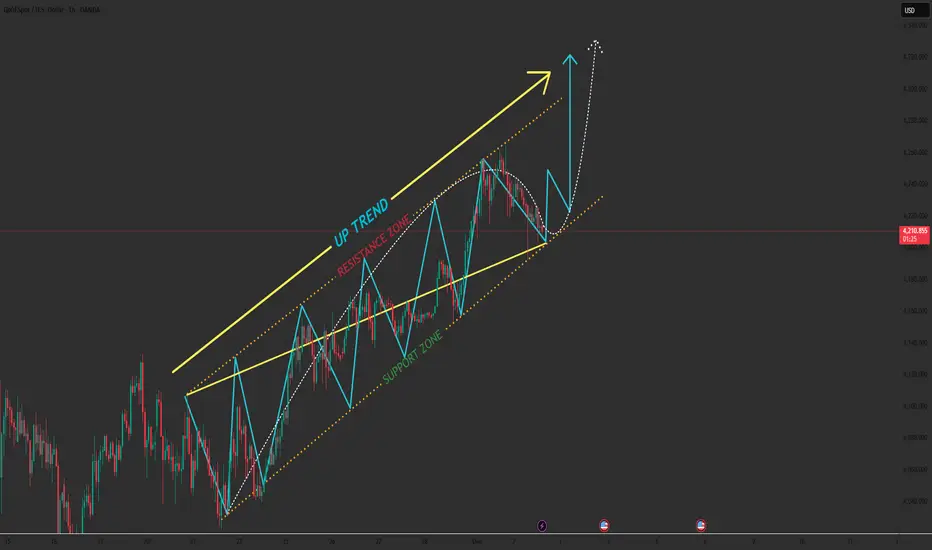

1️⃣ Price Retracing Into Key Support

Gold is dipping into the support zone just below yesterday’s low.

This zone aligns with:

- The lower boundary of the short-term retracement channel

- The midline of the major ascending channel

- A liquidity pocket where buyers previously stepped in aggressively

This creates a textbook buy-the-pullback setup.

2️⃣ Trend Structure: Buyers Still in Control

Despite the temporary pullback:

- Trendline remains intact

- Momentum is still upward

- No major swing low has been broken

As long as 4,190 holds, the market favors continuation to the upside.

3️⃣ Expected Upside Rotation

If price stabilizes above 4,190–4,200 and intraday buyers return:

- Gold may begin a new bullish swing

- First target sits at 4,260

- Main target aligns with the upper boundary of the channel → 4,290

This completes the wave cycle shown in the chart (blue pattern).

4️⃣ Risk Scenario

⚠️ If Gold cleanly breaks below the channel and invalidates the trendline:

Price can correct toward 4,120 and even retest 4,100 before rebuilding bullish structure.

This does not kill the uptrend — but it delays the next bullish leg.

➡️ Primary Scenario

Pullback holds above 4,190 → bullish continuation → target 4,260 → 4,290.

⚠️ Risk Scenario

Break below the channel = short-term drop toward 4,120–4,100.

If this analysis resonates with you or if you see a different angle drop your thoughts in the comments. I’d love to hear your view!

Gold is dipping into the support zone just below yesterday’s low.

This zone aligns with:

- The lower boundary of the short-term retracement channel

- The midline of the major ascending channel

- A liquidity pocket where buyers previously stepped in aggressively

This creates a textbook buy-the-pullback setup.

2️⃣ Trend Structure: Buyers Still in Control

Despite the temporary pullback:

- Trendline remains intact

- Momentum is still upward

- No major swing low has been broken

As long as 4,190 holds, the market favors continuation to the upside.

3️⃣ Expected Upside Rotation

If price stabilizes above 4,190–4,200 and intraday buyers return:

- Gold may begin a new bullish swing

- First target sits at 4,260

- Main target aligns with the upper boundary of the channel → 4,290

This completes the wave cycle shown in the chart (blue pattern).

4️⃣ Risk Scenario

⚠️ If Gold cleanly breaks below the channel and invalidates the trendline:

Price can correct toward 4,120 and even retest 4,100 before rebuilding bullish structure.

This does not kill the uptrend — but it delays the next bullish leg.

➡️ Primary Scenario

Pullback holds above 4,190 → bullish continuation → target 4,260 → 4,290.

⚠️ Risk Scenario

Break below the channel = short-term drop toward 4,120–4,100.

If this analysis resonates with you or if you see a different angle drop your thoughts in the comments. I’d love to hear your view!

Trade attivo

📌 XAUUSD Update — Short-Term Pullback, Long-Term Bullish Outlook

Gold is experiencing a short-term decline, but the long-term trajectory remains strongly bullish. This temporary dip is healthy and expected, especially when considering the major global factors that continue to support higher gold prices:

🌍 3 Key Reasons Gold Is Still Bullish Long-Term

1️⃣ Federal Reserve Policy Shift

The Fed is moving closer to rate cuts as inflation cools, reducing the strength of the USD. Lower interest rates historically weaken the dollar and boost demand for gold as a safe-haven asset.

2️⃣ Geopolitical Tensions & Global Instability

Ongoing conflicts and rising geopolitical uncertainties—whether in Eastern Europe, the Middle East, or Asia—continue to push investors toward gold as a reliable store of value.

3️⃣ Central Bank Buying at Record Levels

Many major central banks, especially in emerging markets, are aggressively increasing their gold reserves to diversify away from the USD. This sustained demand strongly supports gold’s long-term bullish trend.

MY COMMUNITY GROUP FREE SIGNAL

✅ 100% Free — I don’t take a penny from anyone

✅ Free Signal: 4 - 6 signals

✅ Trading Idea / Setup / Technical

✅ JOIN MY COMMUNITY GROUP IN Telegram:

t.me/+2pCKgjf_zxplMmQ1

✅ 100% Free — I don’t take a penny from anyone

✅ Free Signal: 4 - 6 signals

✅ Trading Idea / Setup / Technical

✅ JOIN MY COMMUNITY GROUP IN Telegram:

t.me/+2pCKgjf_zxplMmQ1

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

MY COMMUNITY GROUP FREE SIGNAL

✅ 100% Free — I don’t take a penny from anyone

✅ Free Signal: 4 - 6 signals

✅ Trading Idea / Setup / Technical

✅ JOIN MY COMMUNITY GROUP IN Telegram:

t.me/+2pCKgjf_zxplMmQ1

✅ 100% Free — I don’t take a penny from anyone

✅ Free Signal: 4 - 6 signals

✅ Trading Idea / Setup / Technical

✅ JOIN MY COMMUNITY GROUP IN Telegram:

t.me/+2pCKgjf_zxplMmQ1

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.