🔥 GOLD WEEKLY SNAPSHOT — BY PROJECTSYNDICATE

🏆 High/Close: $4,024.9 → ~$4,003 — sellers faded upticks; weekly close soft but back above the round $4k.

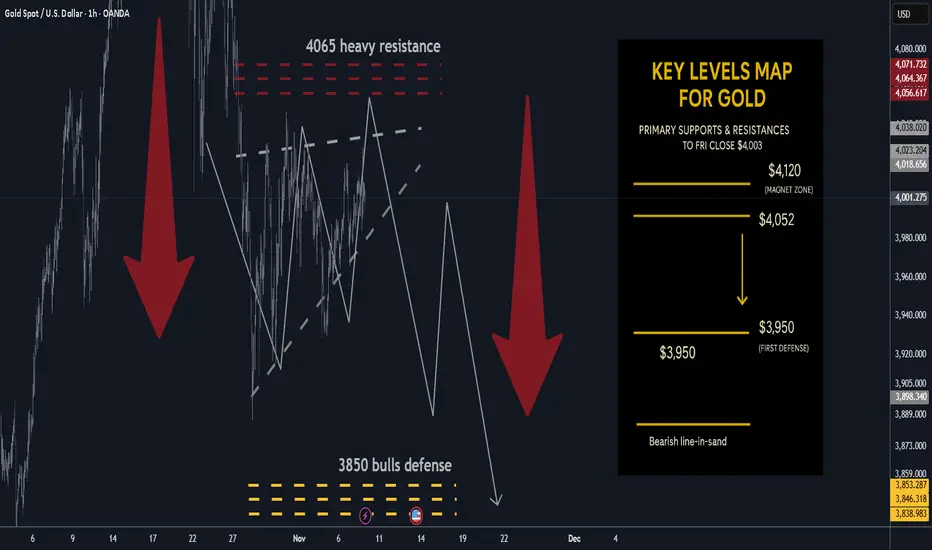

📈 Trend: Neutral / mild correction inside range; not expecting immediate new highs while <$4,080–4,120.

🛡 Supports: $3,950 → $3,900 → $3,850 — pivotal shelves for bears’ take-profit and control.

🚧 Resistances: $4,040 / $4,080 / $4,120 — repeated supply zones; first taps favored for fades.

🧭 Bias next week: Short sells into $4,040–$4,120; TP $3,950 then $3,850 (your plan). Invalidation on sustained reclaim > $4,120–$4,175; loss of $3,850 risks extension lower.

🌍 Macro tailwinds/headwinds (this week’s tape):

• Narrative tone: Kitco flagged “razor’s edge” near $4,000 with mixed views (bubble vs. consolidation), while another Kitco piece framed the stall as a “healthy pause.”

• WSJ flow: Headlines oscillated between “slips below $4,000” and modest up-days; net read is consolidation around $4k with quick two-way trade.

• Levels: Spot finished the week essentially on $4k; intrawEEK high couldn’t clear early-week $4.02–4.03k cap.

🎯 Street view: After last month’s print above $4,000 (first ever), WSJ tone shifted to digestion; rallies still attract supply until a decisive reclaim of upper resistance.

________________________________________

🔝 Key Resistance Zones

• $4,040 — immediate ceiling; weekly high proximity, likely to cap first tests.

• $4,080 — secondary supply ledge from recent failures.

• $4,120 — upper band; acceptance above here starts to neutralize the correction.

🛡 Support Zones

• $3,950 — first defense / first TP.

• $3,900 — round-number shelf; loss invites momentum probes.

• $3,850 — critical structural base and second TP; break risks downside acceleration.

________________________________________

⚖️ Base Case Scenario

Compression within a rising-wedge-like structure, ranging $3,850–$4,120. First pushes into $4,040–$4,120 are sellable for rotations toward $3,950 → $3,850 while the market respects weekly lower highs.

🚀 Breakout / Breakdown Triggers

• Bull trigger: Sustained acceptance > ~$4,120–$4,175 turns the tone constructive again and reopens $4,200+.

• Bear trigger: Daily close < $3,900 increases odds of full $3,850 test; failure of $3,850 risks momentum spill.

💡 Market Drivers to watch

• Fed path / real yields (rate-cut odds vs. sticky inflation narrative in WSJ copy).

• USD swings (no broad USD weakness → upside attempts stall).

• ETF/CB flows (Kitco interviews highlight split sentiment; dip-buyers active, momentum players cautious).

• Event risk (headline sensitivity remains high; quick squeezes into resistance possible).

🔓 Bull / Bear Trigger Lines

• Bullish above: $4,120–$4,175 (sustained).

• Bearish below: $3,900 → $3,850 (risk expands under $3,850).

🧭 Strategy for this week

Short from resistance: Scale in around $4,040 → $4,080 → $4,120;

TP #1: $3,950; TP #2: $3,850;

Risk: Hard stop on a daily close above $4,120 (or intraday breach that holds on retest). Consider trimming if a news-driven squeeze tags $4,175 and fails.

🏆 High/Close: $4,024.9 → ~$4,003 — sellers faded upticks; weekly close soft but back above the round $4k.

📈 Trend: Neutral / mild correction inside range; not expecting immediate new highs while <$4,080–4,120.

🛡 Supports: $3,950 → $3,900 → $3,850 — pivotal shelves for bears’ take-profit and control.

🚧 Resistances: $4,040 / $4,080 / $4,120 — repeated supply zones; first taps favored for fades.

🧭 Bias next week: Short sells into $4,040–$4,120; TP $3,950 then $3,850 (your plan). Invalidation on sustained reclaim > $4,120–$4,175; loss of $3,850 risks extension lower.

🌍 Macro tailwinds/headwinds (this week’s tape):

• Narrative tone: Kitco flagged “razor’s edge” near $4,000 with mixed views (bubble vs. consolidation), while another Kitco piece framed the stall as a “healthy pause.”

• WSJ flow: Headlines oscillated between “slips below $4,000” and modest up-days; net read is consolidation around $4k with quick two-way trade.

• Levels: Spot finished the week essentially on $4k; intrawEEK high couldn’t clear early-week $4.02–4.03k cap.

🎯 Street view: After last month’s print above $4,000 (first ever), WSJ tone shifted to digestion; rallies still attract supply until a decisive reclaim of upper resistance.

________________________________________

🔝 Key Resistance Zones

• $4,040 — immediate ceiling; weekly high proximity, likely to cap first tests.

• $4,080 — secondary supply ledge from recent failures.

• $4,120 — upper band; acceptance above here starts to neutralize the correction.

🛡 Support Zones

• $3,950 — first defense / first TP.

• $3,900 — round-number shelf; loss invites momentum probes.

• $3,850 — critical structural base and second TP; break risks downside acceleration.

________________________________________

⚖️ Base Case Scenario

Compression within a rising-wedge-like structure, ranging $3,850–$4,120. First pushes into $4,040–$4,120 are sellable for rotations toward $3,950 → $3,850 while the market respects weekly lower highs.

🚀 Breakout / Breakdown Triggers

• Bull trigger: Sustained acceptance > ~$4,120–$4,175 turns the tone constructive again and reopens $4,200+.

• Bear trigger: Daily close < $3,900 increases odds of full $3,850 test; failure of $3,850 risks momentum spill.

💡 Market Drivers to watch

• Fed path / real yields (rate-cut odds vs. sticky inflation narrative in WSJ copy).

• USD swings (no broad USD weakness → upside attempts stall).

• ETF/CB flows (Kitco interviews highlight split sentiment; dip-buyers active, momentum players cautious).

• Event risk (headline sensitivity remains high; quick squeezes into resistance possible).

🔓 Bull / Bear Trigger Lines

• Bullish above: $4,120–$4,175 (sustained).

• Bearish below: $3,900 → $3,850 (risk expands under $3,850).

🧭 Strategy for this week

Short from resistance: Scale in around $4,040 → $4,080 → $4,120;

TP #1: $3,950; TP #2: $3,850;

Risk: Hard stop on a daily close above $4,120 (or intraday breach that holds on retest). Consider trimming if a news-driven squeeze tags $4,175 and fails.

Nota

🏆 GOLD WEEKLY OUTLOOK — RANGE COMPRESSION PLAY💰 $4,024 → $4,003 — Weekly close steady above $4k; sellers capped upside.

⚖️ Trend: Neutral / corrective; range-bound under $4,080–$4,120.

🏗 Structure: Rising wedge compression — momentum fading.

🎯 Strategy: Short $4,040–$4,120; targets $3,950 → $3,850.

🧱 Supports: $3,950 / $3,900 / $3,850 — bears’ take-profit zones.

🚧 Resistances: $4,040 / $4,080 / $4,120 — repeated supply caps.

🌍 Macro tone: WSJ & Kitco — “consolidation near $4k,” real yields firm, USD mixed.

🔥 Bear trigger: Daily close < $3,900 → opens $3,850 test.

🚀 Bull trigger: Sustained > $4,120–$4,175 → reversal risk.

🧭 Bias: Sell strength, stay nimble; rising wedge = fade rallies, book profits on dips.

Nota

🎁Please hit the like button and🎁Leave a comment to support our team!

Nota

let me know your thoughts on the above in the comments section 🔥🏧🚀Nota

🪙 GOLD WEEKLY SNAPSHOT — BY PROJECTSYNDICATE🏆 High/Close: $4,244 → $4,085 — wide-range week but close comfortably above $4,000, confirming buyers defended the key psychological pivot.

📉 Trend: Uptrend moderates after testing fresh highs; momentum cooling yet structure remains constructive above $4,000. Bulls still in control but losing short-term traction.

🛡 Supports: $4,000 / $3,960 / $3,920 — the $4,000 zone is now first-line defense; sustained closes below would weaken near-term tone.

🚧 Resistances: $4,200 / $4,225 / $4,250 — upper boundary of current range; breakout attempts likely fade into offers unless macro catalyst emerges.

🧭 Bias next week: Neutral → Range-bound. Expect consolidation between $4,000 and $4,250. Dip-buyers active near $4,000, but upside likely capped by profit-taking into $4,240–$4,250. A daily close below $4,000 turns bias short-term bearish toward $3,950; close above $4,250 revives momentum to $4,300+.

Nota

🏅 GOLD WEEKLY SUMMARY — SHORT THE RIPS🪙 Trend: Uptrend intact long-term, but near-term tape turning distributive.

🏔️ Key Sell Zone: $4,220–$4,320 — prime area to short rips into supply.

🐻 Bear Liquidity: $4,350 (fresh liquidity) → expect rejection / reversal.

📉 Stretch Stop-Run: $4,380 — only hit on squeeze; short bias still valid below here.

📊 Downside Targets: $4,060 → $4,000 → $3,960.

🛡️ Major Support: $3,930–$3,940 bullish block (HTF buyers defend).

⛔ Bear Expansion: Break below $3,930 = opens $3,880–$3,850.

💱 Macro: Lower real yields + softer USD = supportive but not enough to chase highs.

🏦 Flows: Strong central-bank buying keeps floor firm but upside crowded.

🎯 Strategy: Fade all strength into $4,220–$4,350; take profits down into $4,060–$3,960.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.