🌐 Fundamental & Macro Landscape

The recent US–EU trade and defense pact has temporarily reduced gold’s appeal as a safe haven.

The US Dollar and stock markets remain strong thanks to positive macroeconomic data.

Current sentiment is risk-on, which typically shifts capital away from metals and into riskier assets.

But the real volatility could come later this week:

📅 High-Impact Events to Watch:

US ADP Employment Report

FOMC Statement + Nonfarm Payrolls (NFP)

These will likely decide whether gold resumes its uptrend or continues sliding lower.

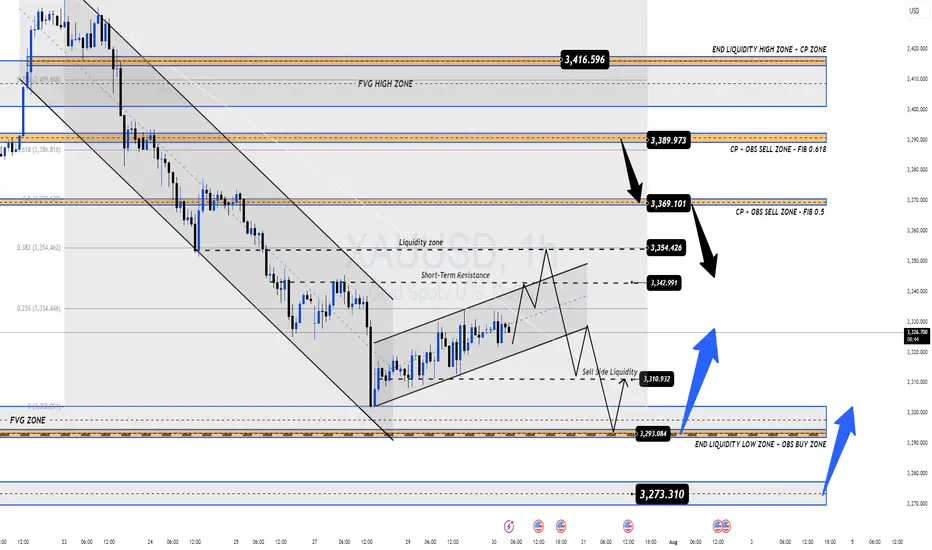

📊 Technical Outlook (H1–H4)

Gold is currently trading within a parallel bullish channel after rebounding from local lows.

However, price is now approaching a key resistance zone around 3342, where we might see either a breakout or a rejection, depending on market sentiment during the upcoming data releases.

🔍 Key Price Zones

🔺 Short-Term Resistance: 3342

🔺 Major Supply Zone: 3369–3388 (Order Block + FVG + Fib 0.5–0.618)

🔻 High-Liquidity Demand Area: 3293–3290

🔻 Deep Demand Zone (FVG): 3275–3273

🔺 Long-Term Resistance Target: 3416

📈 Trade Plan – Based on Price Reaction, Not Prediction

The best trades come from waiting for the right reaction at key zones. No chasing. No guessing.

✅ Scenario 1 – Buy the Dip (Scalp Setup)

Entry: 3293 – 3291

Stop Loss: 3286

Targets: 3296 → 3300 → 3304 → 3308 → 3312 → 3315 → 3320 → 3330

🟢 Works well in high-liquidity zones for quick short-term gains.

✅ Scenario 2 – Buy from Deeper Support (Swing Setup)

Entry: 3275 – 3273

Stop Loss: 3269

Targets: 3280 → 3284 → 3288 → 3292 → 3300 → 3305 → 3310 → 3320 → 3330

🟢 Great setup if price absorbs selling pressure and reverses from FVG demand.

❌ Scenario 3 – Short from Short-Term Resistance

Entry: 3340 – 3342

Stop Loss: 3346

Targets: 3335 → 3330 → 3325 → 3320 → 3310

🔴 Valid only if price fails to reclaim above 3342.

❌ Scenario 4 – Short from Major Supply Zone

Entry: 3369 – 3372

Stop Loss: 3376

Targets: 3365 → 3360 → 3355 → 3350 → 3345 → 3340 → 3330 → 3320

🔴 Higher risk – only act after confirmation (e.g., rejection wicks or bearish candle pattern).

⚠️ Risk Management Tips

Avoid entering right at London or New York opens – too much volatility and false breakouts.

Always wait for confirmation (candle rejection, pin bars, engulfing, etc.).

Use strict stop-loss rules – FOMC + NFP can spike price in both directions.

💡 Final Tips for Indian Traders

Trade with patience – the best setups often appear when others are panicking.

Respect your capital – don’t overleverage during high-volatility news events.

Focus on price action – not emotions or fixed bias.

📌 If you found this gold analysis helpful, feel free to drop your thoughts in the comments or follow for daily updates on XAU/USD.

Let’s grow and trade smarter, one setup at a time.

Namaste 🙏 | Trade safe, trade with clarity.

The recent US–EU trade and defense pact has temporarily reduced gold’s appeal as a safe haven.

The US Dollar and stock markets remain strong thanks to positive macroeconomic data.

Current sentiment is risk-on, which typically shifts capital away from metals and into riskier assets.

But the real volatility could come later this week:

📅 High-Impact Events to Watch:

US ADP Employment Report

FOMC Statement + Nonfarm Payrolls (NFP)

These will likely decide whether gold resumes its uptrend or continues sliding lower.

📊 Technical Outlook (H1–H4)

Gold is currently trading within a parallel bullish channel after rebounding from local lows.

However, price is now approaching a key resistance zone around 3342, where we might see either a breakout or a rejection, depending on market sentiment during the upcoming data releases.

🔍 Key Price Zones

🔺 Short-Term Resistance: 3342

🔺 Major Supply Zone: 3369–3388 (Order Block + FVG + Fib 0.5–0.618)

🔻 High-Liquidity Demand Area: 3293–3290

🔻 Deep Demand Zone (FVG): 3275–3273

🔺 Long-Term Resistance Target: 3416

📈 Trade Plan – Based on Price Reaction, Not Prediction

The best trades come from waiting for the right reaction at key zones. No chasing. No guessing.

✅ Scenario 1 – Buy the Dip (Scalp Setup)

Entry: 3293 – 3291

Stop Loss: 3286

Targets: 3296 → 3300 → 3304 → 3308 → 3312 → 3315 → 3320 → 3330

🟢 Works well in high-liquidity zones for quick short-term gains.

✅ Scenario 2 – Buy from Deeper Support (Swing Setup)

Entry: 3275 – 3273

Stop Loss: 3269

Targets: 3280 → 3284 → 3288 → 3292 → 3300 → 3305 → 3310 → 3320 → 3330

🟢 Great setup if price absorbs selling pressure and reverses from FVG demand.

❌ Scenario 3 – Short from Short-Term Resistance

Entry: 3340 – 3342

Stop Loss: 3346

Targets: 3335 → 3330 → 3325 → 3320 → 3310

🔴 Valid only if price fails to reclaim above 3342.

❌ Scenario 4 – Short from Major Supply Zone

Entry: 3369 – 3372

Stop Loss: 3376

Targets: 3365 → 3360 → 3355 → 3350 → 3345 → 3340 → 3330 → 3320

🔴 Higher risk – only act after confirmation (e.g., rejection wicks or bearish candle pattern).

⚠️ Risk Management Tips

Avoid entering right at London or New York opens – too much volatility and false breakouts.

Always wait for confirmation (candle rejection, pin bars, engulfing, etc.).

Use strict stop-loss rules – FOMC + NFP can spike price in both directions.

💡 Final Tips for Indian Traders

Trade with patience – the best setups often appear when others are panicking.

Respect your capital – don’t overleverage during high-volatility news events.

Focus on price action – not emotions or fixed bias.

📌 If you found this gold analysis helpful, feel free to drop your thoughts in the comments or follow for daily updates on XAU/USD.

Let’s grow and trade smarter, one setup at a time.

Namaste 🙏 | Trade safe, trade with clarity.

Trade attivo

XAU/USD – GOLD: Breaks out of bullish channel after strong ADP dataGold has broken down from the ascending channel formed over the past 2 days following much stronger-than-expected ADP employment data from the US.

Currently, price is reacting to the short-term support zone at 3310–3308. However, there's still no strong BUY volume, so it's best to stay cautious and wait for confirmation before buying.

👉 Watch the liquidity zone around 329x for potential high-probability long setups aligned with smart money flow.

🔗 Chart:

Trade chiuso: obiettivo raggiunto

🔹 Gold BUY SCALP Plan in Play – FVG Low Zone Pays OffThe buy scalp setup from the liquidity end zone (3291 – 3293) has delivered over 90 pips profit so far, and the bullish move is still continuing.

As we await the FOMC announcement, the market remains highly reactive.

Well done to those who were patient and caught the end-of-liquidity sweep at the FVG Low Zone — an area we've been eyeing for several days.

🔗 Chart:

Nota

[XAU/USD] – GOLD RESPECTS FINAL LIQUIDITY PLAN AFTER FOMC 🔁📌 As forecasted in our previous outlook, Gold dipped into the final liquidity zone before bouncing back strongly after the FOMC release.

The market structure played out exactly as mapped in our MMF model:

👉 A clean Breakdown from the accumulation channel

👉 Sweep of the low-side liquidity

👉 Followed by a strong bullish reversal

🗓 While the Fed held rates steady, this still sets the stage for increased speculation and volatility in future rate cuts — which could provide further tailwinds for gold in the coming sessions.

🎯 The plan remains on track: liquidity objectives have been met, and the next phase may be a significant bullish expansion.

🔍 Stay connected to MMF ViewGold to keep ahead of both price action and news-driven volatility. We break down the market from a liquidity-first, structure-based perspective – not the noise.

📈 See full chart here:

💬 How are you positioning post-FOMC?

Drop your thoughts or chart views below and let’s trade smart – not loud.

⚜️Trade with Money Market Flow, logic, Price action

🔥Live Market Updates-Realtime Trading Plans & Signal

👉t.me/+KLdjQ2d0LjszNTk1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

🔥Live Market Updates-Realtime Trading Plans & Signal

👉t.me/+KLdjQ2d0LjszNTk1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

⚜️Trade with Money Market Flow, logic, Price action

🔥Live Market Updates-Realtime Trading Plans & Signal

👉t.me/+KLdjQ2d0LjszNTk1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

🔥Live Market Updates-Realtime Trading Plans & Signal

👉t.me/+KLdjQ2d0LjszNTk1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.