Gold is caught in a tug-of-war between bulls and bears at $3,350.

The bull-bear game and key position decisions within the volatile gold market

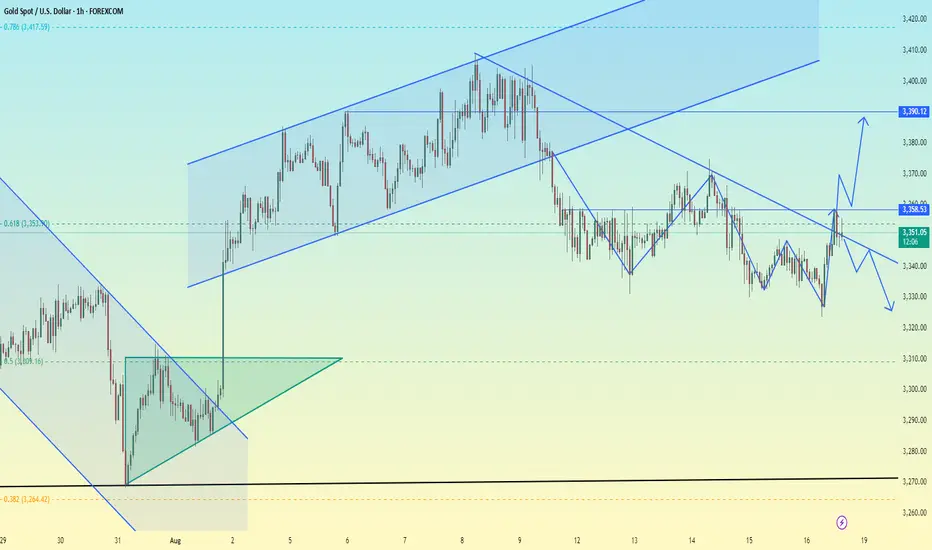

Last Friday, the gold market remained under pressure below $3,350, exhibiting a typical pattern of volatile consolidation. Despite bullish attempts to counterattack during the US trading session, the daily chart ultimately closed with a doji candlestick pattern, highlighting market divergence. This indecisive trend suggests investors are repeatedly balancing expectations of Federal Reserve policy with geopolitical risks. The "deep V" reversal in the early Asian session—gold prices quickly dipped below the $3,323-$25 support level before rising through $3,345 on consecutive days—further escalated the bull-bear battle.

Technical Analysis: The Battle Between Key Support and Resistance Areas

From a 4-hour perspective, gold prices have formed a clear bullish support line in the $3,320-$25 area. The rapid rebound this morning confirms the technical significance of this range. The current price has re-established itself above the 3345 pivot level, with strong short-term momentum. The primary upside target is the 3365-73 resistance zone. This area is not only a high-volume trading zone at previous highs, but also a key node in the daily downtrend. If a breakout fails, the market could relapse into a range-bound trading range between 3330 and 3360. Conversely, a firm break above 3370 would open the way to 3400.

Strategy: Wait patiently for key levels and avoid emotional trading.

In the current volatile market, position trumps direction. For the day, we recommend using 3330-35 as support and 3365-73 as resistance, employing a swing strategy of buying low and selling high. Specifically, try a short position with a small position at 3355. If it rebounds to 3365-73, add to your position in batches. Set a unified stop-loss above 3384, with a target of 3325-30. However, if the price remains above 3345 before the European session, reassess the risk of your short position.

Trading Plan:

For a long position, we recommend entering a long position if the price stabilizes above 3355-3360. Set a stop-loss below the narrow range of 3348. Upper targets are 3375-3390-3400.

For a short position, we recommend entering a position if the price falls below the previous downward trend line. Reference points: 3345-3340. Stop loss at 3355. Downside targets: 3335-3320-3300.

Although cooling US inflation data has boosted expectations of a rate cut, recent hawkish comments from Federal Reserve officials remain a heavyweight. Meanwhile, the Middle East situation and rising US stock market volatility have provided safe-haven support for gold. This conflicting fundamental backdrop aptly explains why gold prices have been unable to break out of a unilateral trend. As traders, we must monitor the evening speeches of Federal Reserve officials while also being wary of impulsive market fluctuations triggered by unexpected geopolitical news.

Recommended trading plan for investors: Until a clear breakout from the 3330-3370 range, adhere to the principle of "avoiding the middle and striking hard at key levels." Remember, true opportunities often arise when market sentiment reaches its extremes, and our priority is to ensure our guns are loaded precisely at those moments.

The bull-bear game and key position decisions within the volatile gold market

Last Friday, the gold market remained under pressure below $3,350, exhibiting a typical pattern of volatile consolidation. Despite bullish attempts to counterattack during the US trading session, the daily chart ultimately closed with a doji candlestick pattern, highlighting market divergence. This indecisive trend suggests investors are repeatedly balancing expectations of Federal Reserve policy with geopolitical risks. The "deep V" reversal in the early Asian session—gold prices quickly dipped below the $3,323-$25 support level before rising through $3,345 on consecutive days—further escalated the bull-bear battle.

Technical Analysis: The Battle Between Key Support and Resistance Areas

From a 4-hour perspective, gold prices have formed a clear bullish support line in the $3,320-$25 area. The rapid rebound this morning confirms the technical significance of this range. The current price has re-established itself above the 3345 pivot level, with strong short-term momentum. The primary upside target is the 3365-73 resistance zone. This area is not only a high-volume trading zone at previous highs, but also a key node in the daily downtrend. If a breakout fails, the market could relapse into a range-bound trading range between 3330 and 3360. Conversely, a firm break above 3370 would open the way to 3400.

Strategy: Wait patiently for key levels and avoid emotional trading.

In the current volatile market, position trumps direction. For the day, we recommend using 3330-35 as support and 3365-73 as resistance, employing a swing strategy of buying low and selling high. Specifically, try a short position with a small position at 3355. If it rebounds to 3365-73, add to your position in batches. Set a unified stop-loss above 3384, with a target of 3325-30. However, if the price remains above 3345 before the European session, reassess the risk of your short position.

Trading Plan:

For a long position, we recommend entering a long position if the price stabilizes above 3355-3360. Set a stop-loss below the narrow range of 3348. Upper targets are 3375-3390-3400.

For a short position, we recommend entering a position if the price falls below the previous downward trend line. Reference points: 3345-3340. Stop loss at 3355. Downside targets: 3335-3320-3300.

Although cooling US inflation data has boosted expectations of a rate cut, recent hawkish comments from Federal Reserve officials remain a heavyweight. Meanwhile, the Middle East situation and rising US stock market volatility have provided safe-haven support for gold. This conflicting fundamental backdrop aptly explains why gold prices have been unable to break out of a unilateral trend. As traders, we must monitor the evening speeches of Federal Reserve officials while also being wary of impulsive market fluctuations triggered by unexpected geopolitical news.

Recommended trading plan for investors: Until a clear breakout from the 3330-3370 range, adhere to the principle of "avoiding the middle and striking hard at key levels." Remember, true opportunities often arise when market sentiment reaches its extremes, and our priority is to ensure our guns are loaded precisely at those moments.

Trade attivo

After a rebound and correction, gold surged towards the 3358 level on the hourly chart before coming under pressure. Its upward momentum diminished, leading to a weak correction.

Short-term trading is in a narrow range. Support lies below the 3340 level.

XAUUSD sell @3348-3350

sl:3360

tp1- 3340

tp2- 3332

tp3- 3320

Trade chiuso: obiettivo raggiunto

Gold is under pressure and falling! In the short term, the weak structural trend has been confirmed.This short position has triggered both TP1 and TP2. Currently, the profit margin is around 170 points.

Following this, watch for support at 3330.

Free signals!:t.me/+BrA6m-vhXtg1MzU0

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Free signals!:t.me/+BrA6m-vhXtg1MzU0

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.