October 19th Gold Weekly Review

In-Depth Analysis of the Gold Market | Technical Correction and Trend Outlook After Reaching a Record High

I. Core Market Review

Milestone Breakthrough: Spot gold hit a record high of $4,380 on Friday (October 17th), with its total market capitalization exceeding $30 trillion for the first time, highlighting global capital demand for safe-haven assets.

Technical Pullback: Gold prices subsequently retreated to around $4,220, with a single-day fluctuation exceeding $190, primarily due to a rebound in the US dollar and profit-taking, but the weekly chart still recorded its ninth consecutive week of gains.

II. Analysis of Multiple Driving Factors

1. Macroeconomic Policy Support

Federal Reserve Rate Cut Expectations: The market is betting on 25 basis point rate cuts in October and December, respectively (with a 96.8% and 81.3% probability). The low interest rate environment continues to weaken the dollar's appeal.

Increasing Fiscal Risks: The continued US government shutdown and regional bank risk events (Zions Bancorp and Western Union Bank) are fueling risk aversion.

2. Geopolitical Tensions

Trade Friction Escalates: Trump's tariff rhetoric and countermeasures against China on rare earth metals have raised uncertainty, but expectations of a high-level meeting have temporarily eased market anxiety.

Global Growth Concerns: Under the dual pressures of the trade deadlock and geopolitical conflicts, demand for gold as the "ultimate safe-haven asset" has surged.

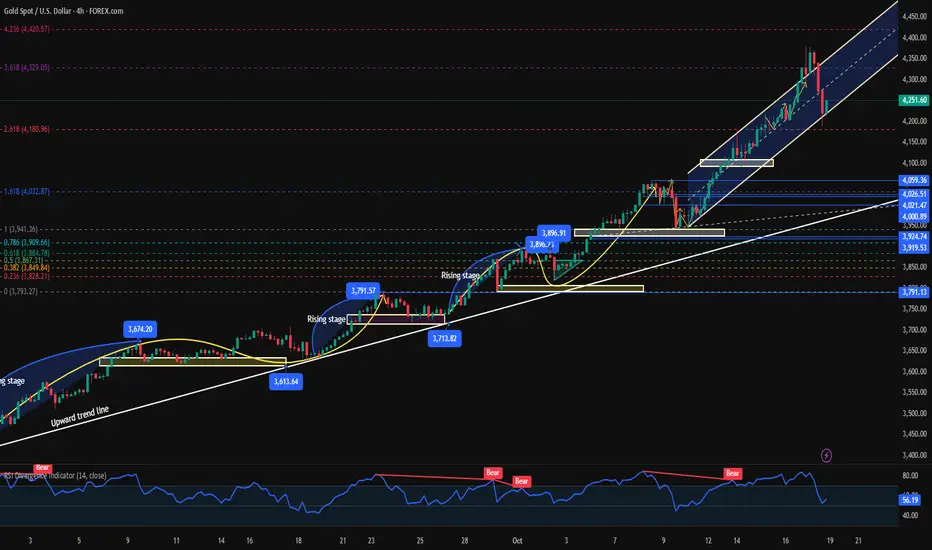

III. In-Depth Technical Analysis

Trend Positioning

Long-Term Pattern: The daily moving average system is bullish, and the $30 trillion market capitalization confirms structural capital inflows, maintaining the bull market's foundation.

Short-Term Adjustment: The 4-hour RSI has retreated from the overbought zone to 53, and the price is testing support at the 21-period moving average ($4,230), indicating a healthy technical correction.

Key Price Levels

Resistance: $4275-4280 (Neckline Conversion), $4379 (All-Time High)

Support: $4180-4160 (Bull Resistance), $4090 (Key Level for Deep Pullbacks)

Market Signals

The 4-hour chart shows a double top formation at $4379. If it falls below the $4180 support level, a deep pullback to the $4090 area could occur.

If it holds above $4230 at the beginning of the week and reclaims $4280, the uptrend is expected to resume, with a target of $4500.

IV. Trading Strategy and Risk Management Guide

Operational Logic

Primary Strategy: Short positions in batches upon a rebound to the $4275-4280 area, with a stop-loss of $8 and a target of $4230-4180.

Secondary Strategy: After a pullback to the $4175-4180 area and stabilization, try a small long position with a stop-loss of $8 and a target of $4230-4250.

Risk Management Key Points

Position Management: Open a single position ≤ 20% of your total position to avoid excessive risk exposure;

Stop-loss Discipline: Strictly set physical stop-losses to guard against unilateral fluctuations;

Cycle Adaptation: Short-term traders focus on 4-hour momentum, while medium- and long-term investors focus on the integrity of the daily trend.

V. Response Plans for Special Market Conditions

Position Unwinding Recommendations

Deeply trapped positions (>$100): If a trend reversal signal is confirmed, decisively reduce your position and stop loss, freeing up funds to participate in rebound opportunities;

Shallowly trapped positions (<$30): Use support/resistance levels to cover your position to increase the average price, or hedge and lock in your position to wait for a technical correction.

Beginner's Guide

Avoid blindly chasing gains and losses; instead, consider trading based on fundamental and technical signals.

For first-time traders, a three-step transition model is recommended: simulated trading, light positions, and regular copy trading.

VI. Market Outlook

Despite short-term technical correction pressure, the three core drivers of the Federal Reserve's easing cycle, global debt inflation, and the normalization of geopolitical risks continue to support the long-term bull market for gold. Investors should focus on the defensive strength of the 4180-4160 area. If effective support forms here, gold prices could potentially reach a new high of $4,500.

If you're facing:

🔴 Deeply trapped positions and feeling overwhelmed

🔴 Repeated losses and a lack of a trading system

🔴 Missing out on key market opportunities

👉 Please send a private message with "Solution" to receive:

Account Diagnostic Report

Personalized Trading Plan

Next Week's Key Gold Trading Positions

Professionalism Makes Trading Simple | We Focus on Building a Sustainable Profitable System

In-Depth Analysis of the Gold Market | Technical Correction and Trend Outlook After Reaching a Record High

I. Core Market Review

Milestone Breakthrough: Spot gold hit a record high of $4,380 on Friday (October 17th), with its total market capitalization exceeding $30 trillion for the first time, highlighting global capital demand for safe-haven assets.

Technical Pullback: Gold prices subsequently retreated to around $4,220, with a single-day fluctuation exceeding $190, primarily due to a rebound in the US dollar and profit-taking, but the weekly chart still recorded its ninth consecutive week of gains.

II. Analysis of Multiple Driving Factors

1. Macroeconomic Policy Support

Federal Reserve Rate Cut Expectations: The market is betting on 25 basis point rate cuts in October and December, respectively (with a 96.8% and 81.3% probability). The low interest rate environment continues to weaken the dollar's appeal.

Increasing Fiscal Risks: The continued US government shutdown and regional bank risk events (Zions Bancorp and Western Union Bank) are fueling risk aversion.

2. Geopolitical Tensions

Trade Friction Escalates: Trump's tariff rhetoric and countermeasures against China on rare earth metals have raised uncertainty, but expectations of a high-level meeting have temporarily eased market anxiety.

Global Growth Concerns: Under the dual pressures of the trade deadlock and geopolitical conflicts, demand for gold as the "ultimate safe-haven asset" has surged.

III. In-Depth Technical Analysis

Trend Positioning

Long-Term Pattern: The daily moving average system is bullish, and the $30 trillion market capitalization confirms structural capital inflows, maintaining the bull market's foundation.

Short-Term Adjustment: The 4-hour RSI has retreated from the overbought zone to 53, and the price is testing support at the 21-period moving average ($4,230), indicating a healthy technical correction.

Key Price Levels

Resistance: $4275-4280 (Neckline Conversion), $4379 (All-Time High)

Support: $4180-4160 (Bull Resistance), $4090 (Key Level for Deep Pullbacks)

Market Signals

The 4-hour chart shows a double top formation at $4379. If it falls below the $4180 support level, a deep pullback to the $4090 area could occur.

If it holds above $4230 at the beginning of the week and reclaims $4280, the uptrend is expected to resume, with a target of $4500.

IV. Trading Strategy and Risk Management Guide

Operational Logic

Primary Strategy: Short positions in batches upon a rebound to the $4275-4280 area, with a stop-loss of $8 and a target of $4230-4180.

Secondary Strategy: After a pullback to the $4175-4180 area and stabilization, try a small long position with a stop-loss of $8 and a target of $4230-4250.

Risk Management Key Points

Position Management: Open a single position ≤ 20% of your total position to avoid excessive risk exposure;

Stop-loss Discipline: Strictly set physical stop-losses to guard against unilateral fluctuations;

Cycle Adaptation: Short-term traders focus on 4-hour momentum, while medium- and long-term investors focus on the integrity of the daily trend.

V. Response Plans for Special Market Conditions

Position Unwinding Recommendations

Deeply trapped positions (>$100): If a trend reversal signal is confirmed, decisively reduce your position and stop loss, freeing up funds to participate in rebound opportunities;

Shallowly trapped positions (<$30): Use support/resistance levels to cover your position to increase the average price, or hedge and lock in your position to wait for a technical correction.

Beginner's Guide

Avoid blindly chasing gains and losses; instead, consider trading based on fundamental and technical signals.

For first-time traders, a three-step transition model is recommended: simulated trading, light positions, and regular copy trading.

VI. Market Outlook

Despite short-term technical correction pressure, the three core drivers of the Federal Reserve's easing cycle, global debt inflation, and the normalization of geopolitical risks continue to support the long-term bull market for gold. Investors should focus on the defensive strength of the 4180-4160 area. If effective support forms here, gold prices could potentially reach a new high of $4,500.

If you're facing:

🔴 Deeply trapped positions and feeling overwhelmed

🔴 Repeated losses and a lack of a trading system

🔴 Missing out on key market opportunities

👉 Please send a private message with "Solution" to receive:

Account Diagnostic Report

Personalized Trading Plan

Next Week's Key Gold Trading Positions

Professionalism Makes Trading Simple | We Focus on Building a Sustainable Profitable System

Trade attivo

Next Week's Precise Strategies

Key Position Attack and Defense System

Bull Vital Line: 4180-4160 Area (Weekly Core Support)

Bear Watershed: 4280-4300 (Breakthrough Opens 4500)

Breakdown Warning Line: 4090 (Loss Triggers a Deep Pullback)

Major Tactical Layout

Trend Continuation Strategy

Buy on a pullback to 4175-4185, stop loss at 4150, target 4250-4280

Technical Correction

Buy short positions in batches on a rebound to 4275-4280, stop loss at 4300, target 4200-4180

Breakthrough Pursuit Strategy

Buy on a strong break above 4300, stop loss at 4270, target 4380-4390 4400

Customized 3D Unwinding Plans

Emergency Management for Deeply Trapped Positions

Limited Position Reset Method: If floating losses exceed 100 points, immediately reduce your position by 50%, freeing up funds for trend trading

Hedging and Cost Reduction Method: After locking your position, focus on short-term swing trading, taking 50% of each profit to cover the original loss

Technical Unwinding of Shallow Trapped Positions

Pyramiding: Add to your position in batches at the 4160/4130/4090 levels, and exit once your cost is evened out

Trading Time for Space: Switch your trapped position to a mid-term position, with three preset take-profit levels at 4200/4250/4280

Real-Time Equity

Real-Time Strategy Push: Accurate buy/sell/stop-loss/take-profit orders

Position Diagnosis and Optimization: Provide rebalancing suggestions and risk management enhancements for each order

Late-Night Emergency Response: Manual alerts for major market fluctuations

Immediate Action Guide

If you are facing:

🔴 Deeply trapped in positions, feeling lost

🔴 Repeated losses and lack of a system

🔴 Missing key market opportunities

👉 Send a private message with "Plan" to receive:

Account Diagnostic Report

Personalized Trading Plan

Next Week's Key Gold Trading Positions

Professionalism Makes Trading Simple | We Focus on Building a Sustainable Profitable System

Global Gold Analysis

Real-time strategy sharing. Here are the features:

🔥 Free trading signals:t.me/+IfIgG4N_J-U3YWFh

🔥 Risk control and position management advice

Real-time strategy sharing. Here are the features:

🔥 Free trading signals:t.me/+IfIgG4N_J-U3YWFh

🔥 Risk control and position management advice

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Global Gold Analysis

Real-time strategy sharing. Here are the features:

🔥 Free trading signals:t.me/+IfIgG4N_J-U3YWFh

🔥 Risk control and position management advice

Real-time strategy sharing. Here are the features:

🔥 Free trading signals:t.me/+IfIgG4N_J-U3YWFh

🔥 Risk control and position management advice

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.