🔥 GOLD WEEKLY SNAPSHOT — BY PROJECTSYNDICATE 🏆

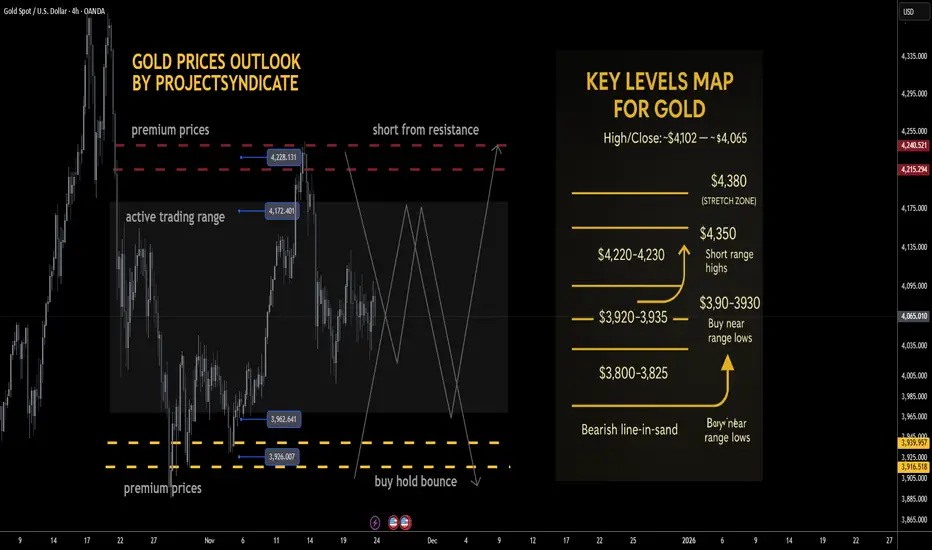

High/Close: ~$4,102 → ~$4,065 — tight, inside-feel week with price holding comfortably above the $4,000 handle. Flows look balanced: steady two-way interest, but no strong directional conviction as the market oscillates within a well-defined range.

________________________________________

📈 Trend:

Still bullish on the higher timeframe, but very clearly in range / two-way mode. As long as we’re capped below the $4,350–4,375 ATH supply block and holding above the $3,900s, the playbook remains “range-trade the extremes” rather than chase breakouts.

________________________________________

🛡 Supports Buy Zones

• $3,920–3,930 — key range lows / primary dip zone:

o Your preferred “buy low” area; recent reactions show responsive buyers defending this shelf.

o This is the first major liquidity pocket for range longs and a natural first target for shorts from resistance.

• $3,800–3,825 — deeper demand pocket / fail-safe shelf:

o Secondary, more extreme downside area where higher-timeframe dip-buyers are likely to step in.

o A clean break and daily close below here would suggest the range is failing and a deeper mean reversion is in play, not just a normal pullback.

________________________________________

🚧 Resistances Short Zones

• $4,220–4,230 — immediate range resistance / short-sell zone:

o Your core “short from resistance” idea; this band remains a logical area to fade strength.

o First tests into this region are attractive for tactical shorts, especially if intraday momentum is stalling.

• $4,350–4,375 — ATH heavy resistance block:

o Still the major supply area above.

o Any spike here is a fade candidate unless price starts accepting above it with strong volume and multiple daily closes.

________________________________________

🧭 Bias – Coming Weeks

Base expectation is continued range-bounce price action between roughly $3,920–$4,220, with the broader structure still nested inside the larger $3,800–$4,350 range:

• Preference to fade strength into $4,220–4,230, targeting rotations back toward $3,920–3,930.

• Conversely, buy dips into $3,920–3,930 for moves back toward $4,220–4,230, as long as we hold the $3,800 shelf on a closing basis.

• Invalidation of the “range grind” idea comes on:

o Sustained acceptance above $4,350–4,375 (turns it back into trend-up).

o Or a decisive loss of $3,800–3,825 (opens a deeper corrective leg).

________________________________________

🔝 Key Resistance Zones

• $4,220–4,230 — front-line ceiling; aligns with your tactical short-sell band. Strong candidate to initiate shorts on first, clean tests.

• $4,350–4,375 — prior ATH / macro supply block. Only flips from “sell zone” to “bullish continuation base” if reclaimed and held as support.

🛡 Support Zones

• $3,920–3,930 — primary range low and first major liquidity shelf; ideal first take-profit for shorts and main dip-buy area.

• $3,800–3,825 — deeper support; loss of this level changes the narrative from “sideways digestion” to “larger corrective structure.”

________________________________________

⚖️ Base Case Scenario – Range / Consolidation

Core view: Market continues to oscillate between $3,920–$4,220, within the broader $3,800–$4,350 band.

• Pushes into $4,220–4,230 are sellable for rotations back toward $3,920–3,930.

• Dips into $3,920–3,930 are buyable for rotations back toward $4,220–4,230, as long as structure and flows remain balanced.

• While weekly closes keep rejecting the $4,350–4,375 ATH block, the default remains “sell strength, buy clean range lows.”

________________________________________

🚀 Breakout / Breakdown Triggers

• Bull trigger:

o Sustained acceptance above $4,350–$4,375, with multiple daily closes holding above and that band starting to act as support.

o That would shift tone from “range trading” back to full-on bullish trend, reopening path toward and beyond prior extremes (~$4,400+ in your framework).

• Bear trigger:

o A decisive daily close below $3,800 converts the current “healthy sideways correction” into a deeper, more directional liquidation phase, likely targeting prior lower shelves and expanding volatility.

________________________________________

💡 Market Drivers to Watch

Even in a range, macro and flow catalysts dictate which side of the range gets tested first:

• Real yields & Fed path: Any hawkish repricing or upside surprise in data tends to cap rallies near resistance; dovish shifts / easing fears support the lower end of the range.

• U.S. fiscal / political noise: Episodes of stress typically underpin gold; temporary relief or “risk-on” swings can blunt upside and push price back toward range lows.

• Flows & positioning: After a massive secular run, fast money continues to fade extremes, locking in profits into strength and reloading near range lows.

• Cross-asset behavior: If risk-off hits and gold fails to catch a bid (selling alongside equities), expect deeper probes into the lower end of the range before strategic buyers step back in size.

________________________________________

🔓 Bull / Bear Trigger Lines

• Bullish above: $4,350–$4,375 (sustained acceptance; ATH block reclaimed and used as support).

• Bearish below: $3,800 (shifts from contained range to deeper correction regime).

________________________________________

🧭 Strategy – Focus on Trading the Range

Primary plan – short from resistance (core idea):

• Entry zone:

o Scale into shorts around $4,220–$4,230 (front edge of resistance).

• TP #1:

o $3,920–$3,930 — key range lows; logical place to close majority of the short.

• Runner / extension:

o Leave a runner targeting $3,800–$3,825 if momentum and macro tone turn heavier.

• Risk / invalidation:

o Hard invalidation if price accepts above $4,350–$4,375 (multiple daily closes and successful retests from above).

________________________________________

Alternative plan – buy low from key range lows:

• Entry zone:

o Stagger bids in $3,920–$3,930; add more aggressive size only if we see responsive buying and positive reaction there.

o Optional deeper add zone at $3,800–$3,825 for higher conviction swing longs if structure still looks constructive.

• Exit zone / targets:

o First target back into $4,220–$4,230; heavily de-risk or fully exit as we approach that band.

• Risk management:

o Cut or significantly reduce longs on a daily close below $3,800 or if price accelerates through that shelf on high volume.

High/Close: ~$4,102 → ~$4,065 — tight, inside-feel week with price holding comfortably above the $4,000 handle. Flows look balanced: steady two-way interest, but no strong directional conviction as the market oscillates within a well-defined range.

________________________________________

📈 Trend:

Still bullish on the higher timeframe, but very clearly in range / two-way mode. As long as we’re capped below the $4,350–4,375 ATH supply block and holding above the $3,900s, the playbook remains “range-trade the extremes” rather than chase breakouts.

________________________________________

🛡 Supports Buy Zones

• $3,920–3,930 — key range lows / primary dip zone:

o Your preferred “buy low” area; recent reactions show responsive buyers defending this shelf.

o This is the first major liquidity pocket for range longs and a natural first target for shorts from resistance.

• $3,800–3,825 — deeper demand pocket / fail-safe shelf:

o Secondary, more extreme downside area where higher-timeframe dip-buyers are likely to step in.

o A clean break and daily close below here would suggest the range is failing and a deeper mean reversion is in play, not just a normal pullback.

________________________________________

🚧 Resistances Short Zones

• $4,220–4,230 — immediate range resistance / short-sell zone:

o Your core “short from resistance” idea; this band remains a logical area to fade strength.

o First tests into this region are attractive for tactical shorts, especially if intraday momentum is stalling.

• $4,350–4,375 — ATH heavy resistance block:

o Still the major supply area above.

o Any spike here is a fade candidate unless price starts accepting above it with strong volume and multiple daily closes.

________________________________________

🧭 Bias – Coming Weeks

Base expectation is continued range-bounce price action between roughly $3,920–$4,220, with the broader structure still nested inside the larger $3,800–$4,350 range:

• Preference to fade strength into $4,220–4,230, targeting rotations back toward $3,920–3,930.

• Conversely, buy dips into $3,920–3,930 for moves back toward $4,220–4,230, as long as we hold the $3,800 shelf on a closing basis.

• Invalidation of the “range grind” idea comes on:

o Sustained acceptance above $4,350–4,375 (turns it back into trend-up).

o Or a decisive loss of $3,800–3,825 (opens a deeper corrective leg).

________________________________________

🔝 Key Resistance Zones

• $4,220–4,230 — front-line ceiling; aligns with your tactical short-sell band. Strong candidate to initiate shorts on first, clean tests.

• $4,350–4,375 — prior ATH / macro supply block. Only flips from “sell zone” to “bullish continuation base” if reclaimed and held as support.

🛡 Support Zones

• $3,920–3,930 — primary range low and first major liquidity shelf; ideal first take-profit for shorts and main dip-buy area.

• $3,800–3,825 — deeper support; loss of this level changes the narrative from “sideways digestion” to “larger corrective structure.”

________________________________________

⚖️ Base Case Scenario – Range / Consolidation

Core view: Market continues to oscillate between $3,920–$4,220, within the broader $3,800–$4,350 band.

• Pushes into $4,220–4,230 are sellable for rotations back toward $3,920–3,930.

• Dips into $3,920–3,930 are buyable for rotations back toward $4,220–4,230, as long as structure and flows remain balanced.

• While weekly closes keep rejecting the $4,350–4,375 ATH block, the default remains “sell strength, buy clean range lows.”

________________________________________

🚀 Breakout / Breakdown Triggers

• Bull trigger:

o Sustained acceptance above $4,350–$4,375, with multiple daily closes holding above and that band starting to act as support.

o That would shift tone from “range trading” back to full-on bullish trend, reopening path toward and beyond prior extremes (~$4,400+ in your framework).

• Bear trigger:

o A decisive daily close below $3,800 converts the current “healthy sideways correction” into a deeper, more directional liquidation phase, likely targeting prior lower shelves and expanding volatility.

________________________________________

💡 Market Drivers to Watch

Even in a range, macro and flow catalysts dictate which side of the range gets tested first:

• Real yields & Fed path: Any hawkish repricing or upside surprise in data tends to cap rallies near resistance; dovish shifts / easing fears support the lower end of the range.

• U.S. fiscal / political noise: Episodes of stress typically underpin gold; temporary relief or “risk-on” swings can blunt upside and push price back toward range lows.

• Flows & positioning: After a massive secular run, fast money continues to fade extremes, locking in profits into strength and reloading near range lows.

• Cross-asset behavior: If risk-off hits and gold fails to catch a bid (selling alongside equities), expect deeper probes into the lower end of the range before strategic buyers step back in size.

________________________________________

🔓 Bull / Bear Trigger Lines

• Bullish above: $4,350–$4,375 (sustained acceptance; ATH block reclaimed and used as support).

• Bearish below: $3,800 (shifts from contained range to deeper correction regime).

________________________________________

🧭 Strategy – Focus on Trading the Range

Primary plan – short from resistance (core idea):

• Entry zone:

o Scale into shorts around $4,220–$4,230 (front edge of resistance).

• TP #1:

o $3,920–$3,930 — key range lows; logical place to close majority of the short.

• Runner / extension:

o Leave a runner targeting $3,800–$3,825 if momentum and macro tone turn heavier.

• Risk / invalidation:

o Hard invalidation if price accepts above $4,350–$4,375 (multiple daily closes and successful retests from above).

________________________________________

Alternative plan – buy low from key range lows:

• Entry zone:

o Stagger bids in $3,920–$3,930; add more aggressive size only if we see responsive buying and positive reaction there.

o Optional deeper add zone at $3,800–$3,825 for higher conviction swing longs if structure still looks constructive.

• Exit zone / targets:

o First target back into $4,220–$4,230; heavily de-risk or fully exit as we approach that band.

• Risk management:

o Cut or significantly reduce longs on a daily close below $3,800 or if price accelerates through that shelf on high volume.

Nota

🟡 Price held firm above $4,000 despite tight-range week (High/Close: $4,102 → $4,065).🟡 Market stuck in well-defined range: $3,920–3,930 support vs. $4,220–4,230 resistance.

🟡 Bias: Tactical two-way market — fade strength, buy clean dips.

🟡 Primary short zone: $4,220–4,230 (sell first tests).

🟡 Primary dip-buy zone: $3,920–3,930 (responsive buyers defending).

🟡 Deeper demand: $3,800–3,825 — failure here turns correction heavier.

🟡 Upper macro resistance: $4,350–4,375 ATH block — acceptance above flips market bullish.

🟡 Strategy: Short range highs → target $3,920s; Buy range lows → target $4,220s.

🟡 Bear trigger: Daily close < $3,800.

🟡 Bull trigger: Multi-day hold > $4,350–4,375.

Nota

🎁Please hit the like button and🎁Leave a comment to support our team!

Nota

let me know your thoughts on the above in the comments section 🔥🏧🚀taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.