Short

Bitcoin Weekly Supports Another Pump, Depending Where You Look

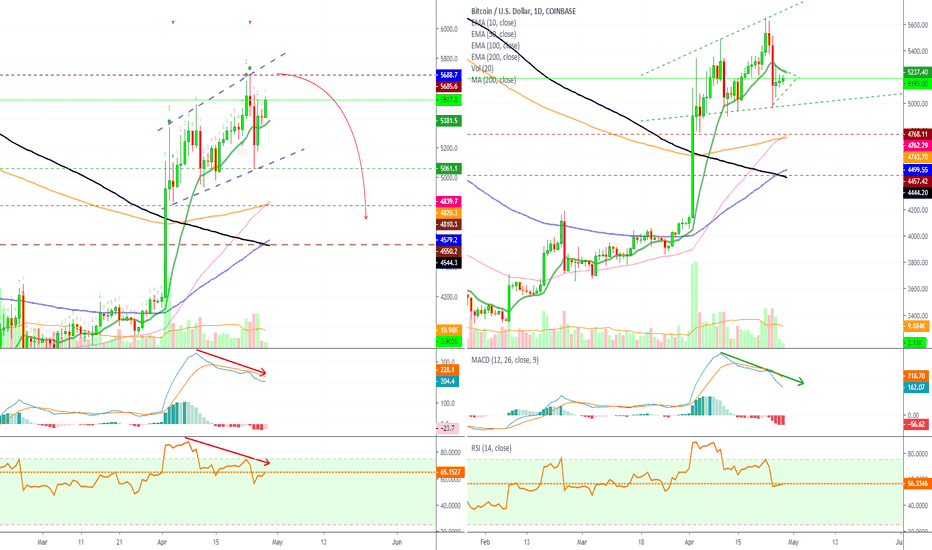

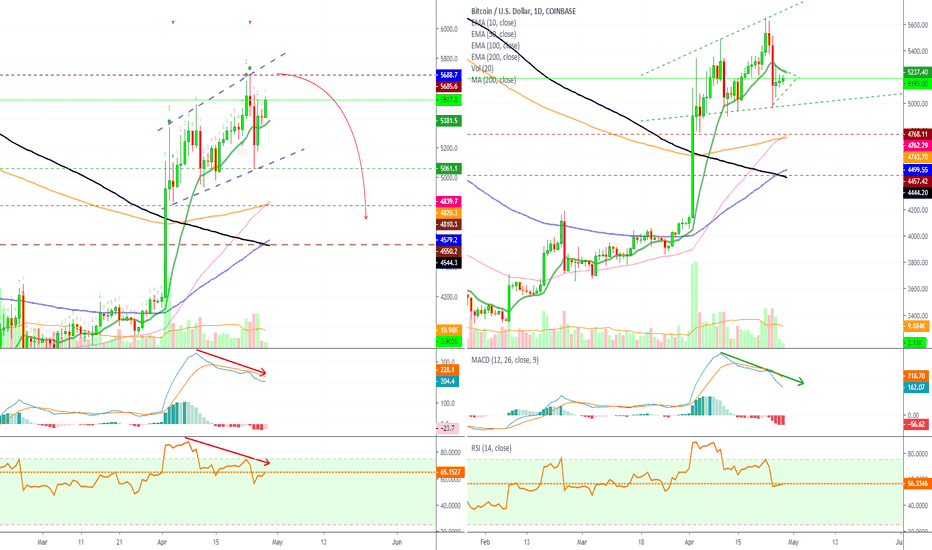

Bitcoin (BTCUSD) is showing us quite the mixed signals on the weekly time frame when we compare BitFinex to other exchanges, here I am looking at it vs BitMEX, but this also applies to CoinBase, BitStamp, and others.

On the left side, we have the BitFinex chart, which is really bullish right now with BTCUSD trading above EMA50 and EMA100 within an ascending channel.

The MaCD and RSI are also pretty solid here and clearly leaning towards the bulls. Trading volume this week is above average.

On the right side, we have the BitMEX chart, which is leaning more towards the bears. Bitcoin (XBTUSD) is trading below EMA50 and EMA100 with increasing bear volume.

The MACD is slightly curving, while the RSI peaked last weak and is showing bearish divergence. Trading volume is also high here compared to average.

Can BitFinex break to the upside while other exchanges break to the downside, is this possible?

I highly believe that this price difference is starting to become way too big and it is only going to translate into 'trouble' pretty soon... Here you can read the full details about this situation:

And here:

What's your take on this huge price spread between BitFinex and other exchanges? Will this really produce a pump or a dump?

Please share your thoughts in the comments section below.

Thanks a lot for reading.

Namaste.

On the left side, we have the BitFinex chart, which is really bullish right now with BTCUSD trading above EMA50 and EMA100 within an ascending channel.

The MaCD and RSI are also pretty solid here and clearly leaning towards the bulls. Trading volume this week is above average.

On the right side, we have the BitMEX chart, which is leaning more towards the bears. Bitcoin (XBTUSD) is trading below EMA50 and EMA100 with increasing bear volume.

The MACD is slightly curving, while the RSI peaked last weak and is showing bearish divergence. Trading volume is also high here compared to average.

Can BitFinex break to the upside while other exchanges break to the downside, is this possible?

I highly believe that this price difference is starting to become way too big and it is only going to translate into 'trouble' pretty soon... Here you can read the full details about this situation:

And here:

What's your take on this huge price spread between BitFinex and other exchanges? Will this really produce a pump or a dump?

Please share your thoughts in the comments section below.

Thanks a lot for reading.

Namaste.

🚨 Long-term Success & Freedom Available Now! (Avoid Mistakes) —PREMIUM Channels 👉 lamatrades.com (Since 2017)

🥇 9999% Results

t.me/alansantana1111/5935

t.me/anandatrades/971

🏆 FREE Trade-Numbers

anandatrades.com

🥇 9999% Results

t.me/alansantana1111/5935

t.me/anandatrades/971

🏆 FREE Trade-Numbers

anandatrades.com

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

🚨 Long-term Success & Freedom Available Now! (Avoid Mistakes) —PREMIUM Channels 👉 lamatrades.com (Since 2017)

🥇 9999% Results

t.me/alansantana1111/5935

t.me/anandatrades/971

🏆 FREE Trade-Numbers

anandatrades.com

🥇 9999% Results

t.me/alansantana1111/5935

t.me/anandatrades/971

🏆 FREE Trade-Numbers

anandatrades.com

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.