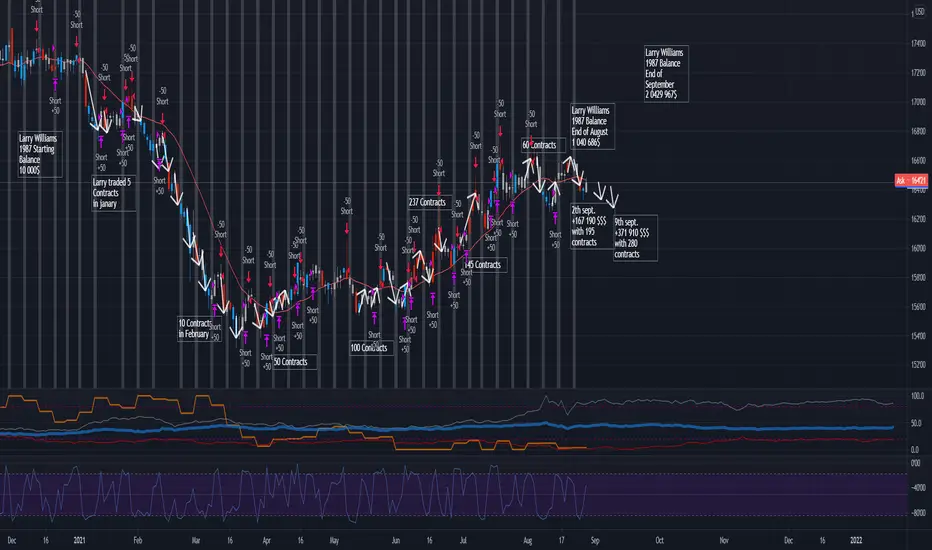

No investment advice but Larry Williams traded the Treasury Bonds pretty good in 1987 by relying on indicators like PercentR

Look for his trading record where he turned 10k into 2 mil by end of september 1987 with trading bonds and S&P 500.

On the Chart you can see his 1987 entry dates but applied on a 2021 chart, so there are plenty of opportunties to apply his strategy this year.

Obviouly the short entries if PercentR indicator was above -17 are only one part of the equation.

Position sizing is key, larry started with 1 contract but quickly went to 5,10, 50, 100 contracts to archive a 10.000%+ performance.

Going Long if PercentR is below -80 is also an option but first there needs to be an uptrend in place.

Back in 1987 larrys biggest winning trade was 1328$ profit per contract (280 contracts closed on 9th september)

Keep in mind that his biggest loosing trade was with 400 t-bonds on 19th october (629k loss)

To avoid bigger losses any strategy should be seen as a setup on a daily chart but then on the lower time frame you can place a much more reasonable trade with a pre-defined stoploss level.

Look for his trading record where he turned 10k into 2 mil by end of september 1987 with trading bonds and S&P 500.

On the Chart you can see his 1987 entry dates but applied on a 2021 chart, so there are plenty of opportunties to apply his strategy this year.

Obviouly the short entries if PercentR indicator was above -17 are only one part of the equation.

Position sizing is key, larry started with 1 contract but quickly went to 5,10, 50, 100 contracts to archive a 10.000%+ performance.

Going Long if PercentR is below -80 is also an option but first there needs to be an uptrend in place.

Back in 1987 larrys biggest winning trade was 1328$ profit per contract (280 contracts closed on 9th september)

Keep in mind that his biggest loosing trade was with 400 t-bonds on 19th october (629k loss)

To avoid bigger losses any strategy should be seen as a setup on a daily chart but then on the lower time frame you can place a much more reasonable trade with a pre-defined stoploss level.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.