ZM Earnings (QuantSignals V3 | 2025-11-24)

Direction: BUY CALLS

Confidence: 58%

Expiry: 2025-11-28 (4 days)

Strike Focus: $80.00

Entry Range: $2.82 – $3.05 (mid: $2.93)

Target 1: $4.23 (50% gain)

Target 2: $5.49 (95% gain)

Stop Loss: $2.05 (30% loss)

Position Size: 2.5% of portfolio

Implied Move: $6.08 (~7.6%)

24h Price Move: –5.52%

Put/Call Ratio: 0.83 (Neutral)

Flow Intel: Neutral

Risk Level: 🔴 High Risk — small size recommended

Earnings Date: 2025-11-24 | Estimate: $1.48

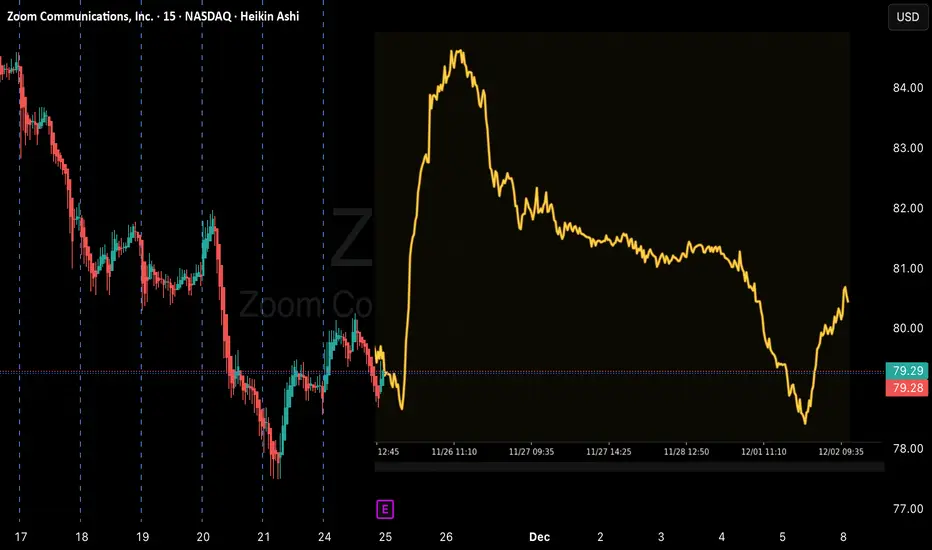

📈 Technical Overview

Current Price: ~$79.87

Support: $77.42

Resistance: $84.46

RSI: Oversold / bounce potential

Volume: 1.6× average → elevated pre-earnings activity

Trend: Moderate bullish momentum after selloff

Chart Tips:

Draw support at $77.42 and resistance at $84.46

Highlight option entry band $2.82–$3.05

Mark targets $4.23 / $5.49 and stop $2.05

Monitor RSI and post-earnings volatility

📰 Fundamental / Sentiment Notes

Earnings released today

Revenue growth: +1250%

Fed dovish remarks support tech

Neutral news sentiment but oversold technicals provide bounce opportunity

⚠️ Risk Notes

High implied volatility (VIX 23.43)

Moderate conviction due to pre-earnings selloff

Break below support $77.42 invalidates bullish thesis

Direction: BUY CALLS

Confidence: 58%

Expiry: 2025-11-28 (4 days)

Strike Focus: $80.00

Entry Range: $2.82 – $3.05 (mid: $2.93)

Target 1: $4.23 (50% gain)

Target 2: $5.49 (95% gain)

Stop Loss: $2.05 (30% loss)

Position Size: 2.5% of portfolio

Implied Move: $6.08 (~7.6%)

24h Price Move: –5.52%

Put/Call Ratio: 0.83 (Neutral)

Flow Intel: Neutral

Risk Level: 🔴 High Risk — small size recommended

Earnings Date: 2025-11-24 | Estimate: $1.48

📈 Technical Overview

Current Price: ~$79.87

Support: $77.42

Resistance: $84.46

RSI: Oversold / bounce potential

Volume: 1.6× average → elevated pre-earnings activity

Trend: Moderate bullish momentum after selloff

Chart Tips:

Draw support at $77.42 and resistance at $84.46

Highlight option entry band $2.82–$3.05

Mark targets $4.23 / $5.49 and stop $2.05

Monitor RSI and post-earnings volatility

📰 Fundamental / Sentiment Notes

Earnings released today

Revenue growth: +1250%

Fed dovish remarks support tech

Neutral news sentiment but oversold technicals provide bounce opportunity

⚠️ Risk Notes

High implied volatility (VIX 23.43)

Moderate conviction due to pre-earnings selloff

Break below support $77.42 invalidates bullish thesis

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Free Signals Based on Latest AI models💰: QuantSignals.xyz

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.