MPS: Strategia operativa con un occhio alla semestrale in uscita🔹 TRADEPLAN 🔹

BANCA MONTE DEI PASCHI di SIENA MIL:BMPS

Un titolo che potrebbe ancora esprimere una crescita a doppia cifra è MPS. La banca senese, impegnata nell’OPS su Mediobanca, sembra sempre più vicina all’obiettivo, come dimostra il progressivo assottigliamento dello sconto implicito nell’offerta. Il CEO Luigi Lovaglio guarda già oltre, ipotizzando la nascita di un polo bancario più ampio.

Le prospettive sono interessanti e attirano l’attenzione degli investitori: il consenso di mercato stima un upside del 14,7% per i prossimi 12 mesi, con target price medio a 8,19€ rispetto agli attuali 7,19€.

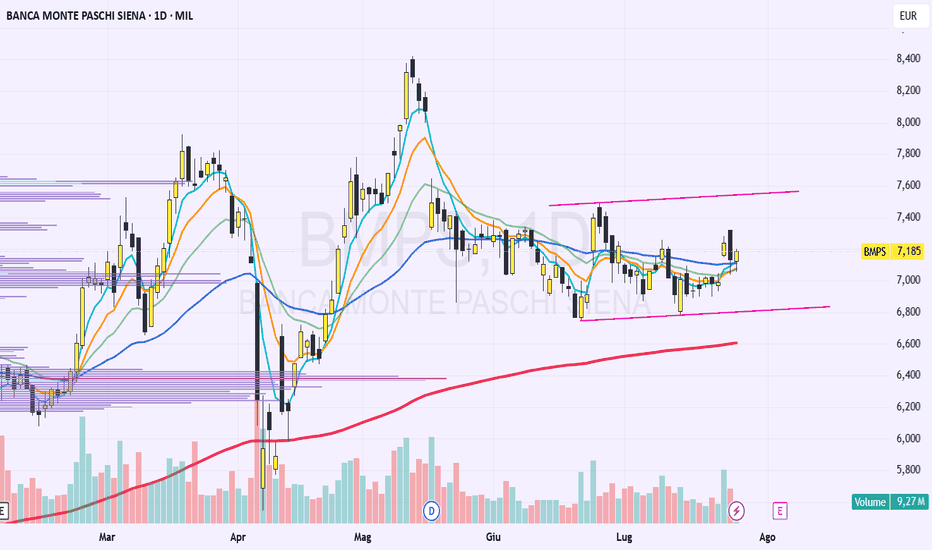

📊 Analisi tecnica

Dopo i recenti massimi a 8,42€, il titolo ha registrato un ritracciamento compreso tra il 50% e il 61,8% di Fibonacci.

Su grafico weekly, l’assenza dell’incrocio rialzista del MACD non è particolarmente rilevante nel medio periodo.

Sul timeframe daily, emerge una flag rialzista, con primo target a 7,54€, coincidente con il lato alto della figura. L’RSI appare ben orientato ma non in area di ipercomprato, lasciando spazio potenziale a ulteriori rialzi.

⚠️ Attenzione al gap aperto in area 8€, che potrebbe essere oggetto di ricopertura.

📅 Focus anche sul market mover dei risultati semestrali attesi il 5 agosto.

Area 6,50€ rappresenta un solido supporto tecnico, rafforzato da volumi significativi e dalla confluenza con l’EMA 50 su timeframe weekly.

📌 Se trovi utili le mie analisi, lascia un LIKE/BOOST all’articolo e segui il profilo. Il tuo supporto mi aiuterà a continuare a condividere contenuti gratuitamente! 🚀

BMPS

BMPS TREND TRAILINGSTOP//@version=5

strategy(title="Exponential Moving Average", shorttitle="CANALCAVERAL", overlay=true, initial_capital = 100000, commission_type=strategy.commission.cash_per_order,commission_value=19, default_qty_type=strategy.percent_of_equity, default_qty_value=100, use_bar_magnifier = true)

outlow = ta.ema(close, 6)

outlowmedium = ta.ema(close, 9)

outmedium = ta.ema(close, 10)

outhighmedium = ta.ema(close, 50)

outhigh = ta.ema(close, 200)

plot(outlow, title="EMA", color=color.rgb(33, 243, 86), linewidth = 2)

plot(outlowmedium, title="EMA", color=color.rgb(240, 243, 33), linewidth = 2)

plot(outmedium, title="EMA", color=color.rgb(214, 26, 204), linewidth = 2)

plot(outhighmedium, title="EMA", color=color.rgb(243, 82, 33), linewidth = 2)

plot(outhigh, title="EMA", color=color.rgb(249, 249, 249), linewidth = 2)

k = ta.sma(ta.stoch(close, high, low, 14), 1)

d = ta.sma(k, 3)

plot(k, title="%K", color=#2962FF)

plot(d, title="%D", color=#FF6D00)

h0 = hline(80, "Upper Band", color=#787B86)

hline(50, "Middle Band", color=color.new(#787B86, 50))

h1 = hline(20, "Lower Band", color=#787B86)

fill(h0, h1, color=color.rgb(33, 150, 243, 90), title="Background")

ma(source, length, type) =>

switch type

"SMA" => ta.sma(source, length)

"Bollinger Bands" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

rsiLengthInput = input.int(14, minval=1, title="RSI Length", group="RSI Settings")

rsiSourceInput = input.source(close, "Source", group="RSI Settings")

maTypeInput = input.string("SMA", title="MA Type", options= , group="MA Settings")

maLengthInput = input.int(14, title="MA Length", group="MA Settings")

bbMultInput = input.float(2.0, minval=0.001, maxval=50, title="BB StdDev", group="MA Settings")

up = ta.rma(math.max(ta.change(rsiSourceInput), 0), rsiLengthInput)

down = ta.rma(-math.min(ta.change(rsiSourceInput), 0), rsiLengthInput)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

rsiMA = ma(rsi, maLengthInput, maTypeInput)

isBB = maTypeInput == "Bollinger Bands"

plot(rsi, "RSI", color=#7E57C2)

plot(rsiMA, "RSI-based MA", color=color.yellow)

rsiUpperBand = hline(70, "RSI Upper Band", color=#787B86)

hline(50, "RSI Middle Band", color=color.new(#787B86, 50))

rsiLowerBand = hline(30, "RSI Lower Band", color=#787B86)

fill(rsiUpperBand, rsiLowerBand, color=color.rgb(126, 87, 194, 90), title="RSI Background Fill")

bbUpperBand = plot(isBB ? rsiMA + ta.stdev(rsi, maLengthInput) * bbMultInput : na, title = "Upper Bollinger Band", color=color.green)

bbLowerBand = plot(isBB ? rsiMA - ta.stdev(rsi, maLengthInput) * bbMultInput : na, title = "Lower Bollinger Band", color=color.green)

fill(bbUpperBand, bbLowerBand, color= isBB ? color.new(color.green, 90) : na, title="Bollinger Bands Background Fill")

fast_length = input(title="Fast Length", defval=12)

slow_length = input(title="Slow Length", defval=26)

src = input(title="Source", defval=close)

signal_length = input.int(title="Signal Smoothing", minval = 1, maxval = 50, defval = 9)

sma_source = input.string(title="Oscillator MA Type", defval="EMA", options= )

sma_signal = input.string(title="Signal Line MA Type", defval="EMA", options= )

// Plot colors

col_macd = input(#2962FF, "MACD Line ", group="Color Settings", inline="MACD")

col_signal = input(#FF6D00, "Signal Line ", group="Color Settings", inline="Signal")

col_grow_above = input(#26A69A, "Above Grow", group="Histogram", inline="Above")

col_fall_above = input(#B2DFDB, "Fall", group="Histogram", inline="Above")

col_grow_below = input(#FFCDD2, "Below Grow", group="Histogram", inline="Below")

col_fall_below = input(#FF5252, "Fall", group="Histogram", inline="Below")

// Calculating

fast_ma = sma_source == "SMA" ? ta.sma(src, fast_length) : ta.ema(src, fast_length)

slow_ma = sma_source == "SMA" ? ta.sma(src, slow_length) : ta.ema(src, slow_length)

macd = fast_ma - slow_ma

signal = sma_signal == "SMA" ? ta.sma(macd, signal_length) : ta.ema(macd, signal_length)

hist = macd - signal

hline(0, "Zero Line", color=color.new(#787B86, 50))

plot(hist, title="Histogram", style=plot.style_columns, color=(hist>=0 ? (hist < hist ? col_grow_above : col_fall_above) : (hist < hist ? col_grow_below : col_fall_below)))

plot(macd, title="MACD", color=col_macd)

plot(signal, title="Signal", color=col_signal)

stoca = (k>d)

suka = (rsi>rsiMA)

ciucia = (macd>signal)

longmedia = ta.crossover(outlow, outmedium)

longcondition = stoca and longmedia and suka and ciucia

//longcondition = longmedia

shortcondition = ta.crossunder(close, outlow)

strategy.entry("L", strategy.long, when =longcondition)

strategy.exit("Exit Long", from_entry="L", trail_points=5, trail_offset=8)

strategy.close("L", when = shortcondition)

Bca MPS (BMPS), prezzi lanciati verso le resistenzeNon sono visibili ancora segnali di esaurimento del ribasso. Ritengo tuttavia ci siano le condizioni per un test pieno delle resistenze poste adesso a 2.600 e 2.750/775 (target principale). I supporti a sostegno dello scenario sono disposti a 2.365 e 2.22.

Intendo accumulare posizioni long da prezzi non inferiori a 2.400 ed in caso di arretramenti fino a 2.28. Ho fissato lo stop in chiusura daily sotto 2.22. Prossimi aggiornamenti su TradingLift.

prezzi in avvicinamento a forti supporti di lungo periodoI maggiori supporti fino alla fine di aprile solo localizzati non prima di 2.712/736 ed a 2.638/660, mentre le resistenze sono disposte a 2.96/99 ed a 3.100.

Ritengo probabile un ultimo colpo di coda ribassista fino ai supporti prima dell'avvio di un serio tentativo di inversione al rialzo. Da oggi fino al termine di aprile accumulo posizioni long solo in caso di arretramenti almeno a 2.77 e fino a 2.68. Ho fissato il mio stop in chiusura daily inferiore a 2.638.

Aggiornerò l'analisi per fissare un target rialzista solo dopo il raggiungimento almeno di quota 2.77. I supporti potranno essere alzati con nuove analisi solo dopo il superamento di quota 3.100 con una chiusura daily.