PROTECTED SOURCE SCRIPT

Major S&R Levels with Flips

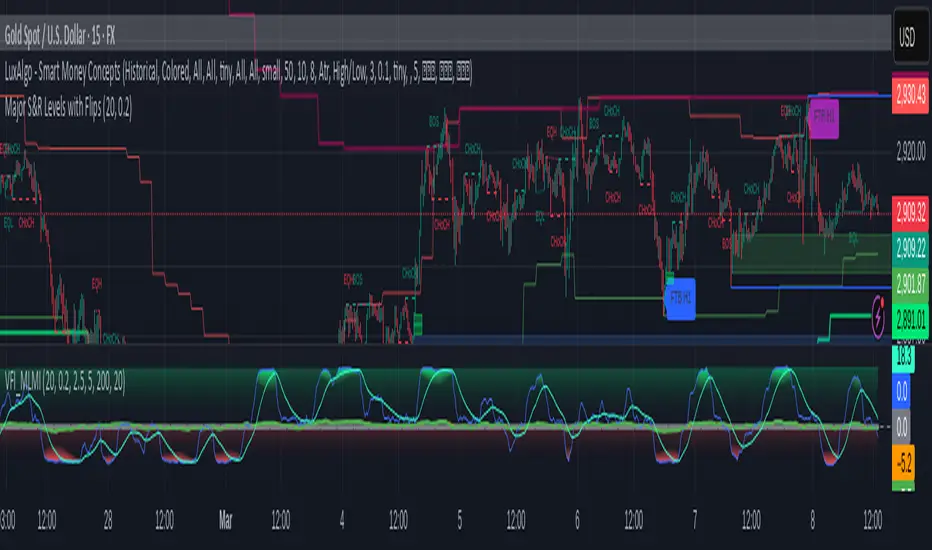

## **Major S&R Levels with Flips**

This script is designed to identify and visualize **Major Support and Resistance (S&R) Levels** across multiple timeframes (H1, H4, D1) and detect **S&R Flip** patterns (FTB, STB, FTR). It also includes customizable alerts for price-level crossings, flip patterns, and level approaches. Below is a detailed breakdown of the script's functionality, inputs, and outputs.

---

## **Script Overview**

The script calculates and plots **Support and Resistance (S&R) Levels** based on the highest highs and lowest lows over a user-defined lookback period. It also detects **S&R Flip Patterns** (First Time Back - FTB, Second Time Back - STB, Failed Test of Resistance/Support - FTR) and provides alerts for key events.

---

## **Key Features**

1. **Multi-Timeframe S&R Levels**:

- Displays S&R levels for **H1**, **H4**, and **D1** timeframes.

- Levels are calculated using the highest highs and lowest lows over a user-defined lookback period.

2. **S&R Flip Detection**:

- Detects and tracks **FTB (First Time Back)**, **STB (Second Time Back)**, and **FTR (Failed Test of Resistance/Support)** patterns.

- Alerts are generated for each flip event.

3. **Customizable Alerts**:

- **Price-Level Crossing Alerts**: Notifies when the price crosses above or below a level.

- **Flip Alerts**: Notifies when a flip pattern (FTB, STB, FTR) is detected.

- **Level Approach Alerts**: Notifies when the price approaches a level within a user-defined threshold.

4. **Efficient Level Updates**:

- Levels are updated periodically (every 10 bars by default) to optimize performance.

5. **Visualization**:

- Plots S&R levels on the chart with distinct colors for each timeframe.

- Displays labels for recent flip events.

---

## **User Inputs**

The script provides several customizable inputs:

### **Level Display**

- **Show H1 Levels**: Toggles visibility of H1 S&R levels.

- **Show H4 Levels**: Toggles visibility of H4 S&R levels.

- **Show D1 Levels**: Toggles visibility of D1 S&R levels.

- **Lookback Period**: Defines the number of bars used to calculate S&R levels (default: 20, range: 5–50).

### **Alerts**

- **Enable Price-Level Crossing Alerts**: Toggles alerts for price crossing above/below S&R levels.

- **Enable SR Flip Alerts**: Toggles alerts for S&R flip patterns (FTB, STB, FTR).

- **Enable Level Approach Alerts**: Toggles alerts for price approaching S&R levels.

- **Approach Threshold**: Defines the percentage threshold for level approach alerts (default: 0.2%, range: 0.05%–1%).

---

## **Script Logic**

### **1. Level Calculation**

- The script calculates S&R levels for each timeframe (H1, H4, D1) using the highest highs and lowest lows over the lookback period.

- Levels are updated periodically (every 10 bars by default) to optimize performance.

### **2. Flip Detection**

- The script detects **FTB**, **STB**, and **FTR** patterns:

- **FTB (First Time Back)**: Price crosses a level for the first time.

- **STB (Second Time Back)**: Price retests the level after FTB.

- **FTR (Failed Test of Resistance/Support)**: Price fails to break the level after STB.

- Flip events are tracked and stored in arrays for visualization and alerts.

### **3. Alerts**

- **Price-Level Crossing Alerts**: Triggered when the price crosses above/below a level.

- **Flip Alerts**: Triggered when a flip pattern (FTB, STB, FTR) is detected.

- **Level Approach Alerts**: Triggered when the price approaches a level within the defined threshold.

### **4. Visualization**

- S&R levels are plotted on the chart with distinct colors for each timeframe.

- Labels are displayed for recent flip events (up to 15 labels by default).

---

## **Outputs**

### **1. Plots**

- **H1 Levels**:

- Support: Green shaded area.

- Resistance: Red shaded area.

- **H4 Levels**:

- Support: Lime shaded area.

- Resistance: Maroon shaded area.

- **D1 Levels**:

- Support: Teal shaded area.

- Resistance: Purple shaded area.

### **2. Labels**

- Labels are displayed for recent flip events:

- **FTB**: Blue label.

- **STB**: Yellow label.

- **FTR**: Purple label.

### **3. Alerts**

- Alerts are generated for:

- Price-level crossings.

- Flip patterns (FTB, STB, FTR).

- Price approaching levels.

---

## **Usage Instructions**

1. **Add the Script**:

- Copy and paste the script into a new Pine Script editor in TradingView.

- Save and add the script to your chart.

2. **Customize Inputs**:

- Adjust the inputs (e.g., lookback period, alert settings) in the script settings panel.

3. **Interpret the Output**:

- Use the plotted levels and labels to identify key S&R zones and flip patterns.

- Monitor alerts for trading opportunities.

4. **Optimize for Your Strategy**:

- Adjust the lookback period and alert thresholds to suit your trading style.

---

## **Example Use Cases**

1. **Trend Identification**:

- Use the D1 levels to identify major S&R zones for long-term trend analysis.

- Combine with H4 and H1 levels for intraday trading opportunities.

2. **Flip Patterns**:

- Look for FTB and STB patterns to identify potential reversals.

- Use FTR patterns to confirm failed breakouts.

3. **Alerts for Trading**:

- Set up alerts for price-level crossings and flip patterns to stay informed of key market movements.

---

## **Notes**

- The script is optimized for performance by updating levels periodically and limiting the number of tracked flips.

- Alerts are designed to minimize noise by triggering only once per bar or bar close.

---

## **Disclaimer**

This script is for educational and informational purposes only. It should not be considered financial advice. Always conduct your own analysis and backtesting before using any trading strategy.

---

This documentation provides a comprehensive guide to using the **Major S&R Levels with Flips** script. If you have any questions or need further assistance, feel free to reach out!

This script is designed to identify and visualize **Major Support and Resistance (S&R) Levels** across multiple timeframes (H1, H4, D1) and detect **S&R Flip** patterns (FTB, STB, FTR). It also includes customizable alerts for price-level crossings, flip patterns, and level approaches. Below is a detailed breakdown of the script's functionality, inputs, and outputs.

---

## **Script Overview**

The script calculates and plots **Support and Resistance (S&R) Levels** based on the highest highs and lowest lows over a user-defined lookback period. It also detects **S&R Flip Patterns** (First Time Back - FTB, Second Time Back - STB, Failed Test of Resistance/Support - FTR) and provides alerts for key events.

---

## **Key Features**

1. **Multi-Timeframe S&R Levels**:

- Displays S&R levels for **H1**, **H4**, and **D1** timeframes.

- Levels are calculated using the highest highs and lowest lows over a user-defined lookback period.

2. **S&R Flip Detection**:

- Detects and tracks **FTB (First Time Back)**, **STB (Second Time Back)**, and **FTR (Failed Test of Resistance/Support)** patterns.

- Alerts are generated for each flip event.

3. **Customizable Alerts**:

- **Price-Level Crossing Alerts**: Notifies when the price crosses above or below a level.

- **Flip Alerts**: Notifies when a flip pattern (FTB, STB, FTR) is detected.

- **Level Approach Alerts**: Notifies when the price approaches a level within a user-defined threshold.

4. **Efficient Level Updates**:

- Levels are updated periodically (every 10 bars by default) to optimize performance.

5. **Visualization**:

- Plots S&R levels on the chart with distinct colors for each timeframe.

- Displays labels for recent flip events.

---

## **User Inputs**

The script provides several customizable inputs:

### **Level Display**

- **Show H1 Levels**: Toggles visibility of H1 S&R levels.

- **Show H4 Levels**: Toggles visibility of H4 S&R levels.

- **Show D1 Levels**: Toggles visibility of D1 S&R levels.

- **Lookback Period**: Defines the number of bars used to calculate S&R levels (default: 20, range: 5–50).

### **Alerts**

- **Enable Price-Level Crossing Alerts**: Toggles alerts for price crossing above/below S&R levels.

- **Enable SR Flip Alerts**: Toggles alerts for S&R flip patterns (FTB, STB, FTR).

- **Enable Level Approach Alerts**: Toggles alerts for price approaching S&R levels.

- **Approach Threshold**: Defines the percentage threshold for level approach alerts (default: 0.2%, range: 0.05%–1%).

---

## **Script Logic**

### **1. Level Calculation**

- The script calculates S&R levels for each timeframe (H1, H4, D1) using the highest highs and lowest lows over the lookback period.

- Levels are updated periodically (every 10 bars by default) to optimize performance.

### **2. Flip Detection**

- The script detects **FTB**, **STB**, and **FTR** patterns:

- **FTB (First Time Back)**: Price crosses a level for the first time.

- **STB (Second Time Back)**: Price retests the level after FTB.

- **FTR (Failed Test of Resistance/Support)**: Price fails to break the level after STB.

- Flip events are tracked and stored in arrays for visualization and alerts.

### **3. Alerts**

- **Price-Level Crossing Alerts**: Triggered when the price crosses above/below a level.

- **Flip Alerts**: Triggered when a flip pattern (FTB, STB, FTR) is detected.

- **Level Approach Alerts**: Triggered when the price approaches a level within the defined threshold.

### **4. Visualization**

- S&R levels are plotted on the chart with distinct colors for each timeframe.

- Labels are displayed for recent flip events (up to 15 labels by default).

---

## **Outputs**

### **1. Plots**

- **H1 Levels**:

- Support: Green shaded area.

- Resistance: Red shaded area.

- **H4 Levels**:

- Support: Lime shaded area.

- Resistance: Maroon shaded area.

- **D1 Levels**:

- Support: Teal shaded area.

- Resistance: Purple shaded area.

### **2. Labels**

- Labels are displayed for recent flip events:

- **FTB**: Blue label.

- **STB**: Yellow label.

- **FTR**: Purple label.

### **3. Alerts**

- Alerts are generated for:

- Price-level crossings.

- Flip patterns (FTB, STB, FTR).

- Price approaching levels.

---

## **Usage Instructions**

1. **Add the Script**:

- Copy and paste the script into a new Pine Script editor in TradingView.

- Save and add the script to your chart.

2. **Customize Inputs**:

- Adjust the inputs (e.g., lookback period, alert settings) in the script settings panel.

3. **Interpret the Output**:

- Use the plotted levels and labels to identify key S&R zones and flip patterns.

- Monitor alerts for trading opportunities.

4. **Optimize for Your Strategy**:

- Adjust the lookback period and alert thresholds to suit your trading style.

---

## **Example Use Cases**

1. **Trend Identification**:

- Use the D1 levels to identify major S&R zones for long-term trend analysis.

- Combine with H4 and H1 levels for intraday trading opportunities.

2. **Flip Patterns**:

- Look for FTB and STB patterns to identify potential reversals.

- Use FTR patterns to confirm failed breakouts.

3. **Alerts for Trading**:

- Set up alerts for price-level crossings and flip patterns to stay informed of key market movements.

---

## **Notes**

- The script is optimized for performance by updating levels periodically and limiting the number of tracked flips.

- Alerts are designed to minimize noise by triggering only once per bar or bar close.

---

## **Disclaimer**

This script is for educational and informational purposes only. It should not be considered financial advice. Always conduct your own analysis and backtesting before using any trading strategy.

---

This documentation provides a comprehensive guide to using the **Major S&R Levels with Flips** script. If you have any questions or need further assistance, feel free to reach out!

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarle liberamente e senza alcuna limitazione – ulteriori informazioni qui.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarle liberamente e senza alcuna limitazione – ulteriori informazioni qui.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.