OPEN-SOURCE SCRIPT

ADX and DI - Trader Felipe

ADX and DI - Trader Felipe

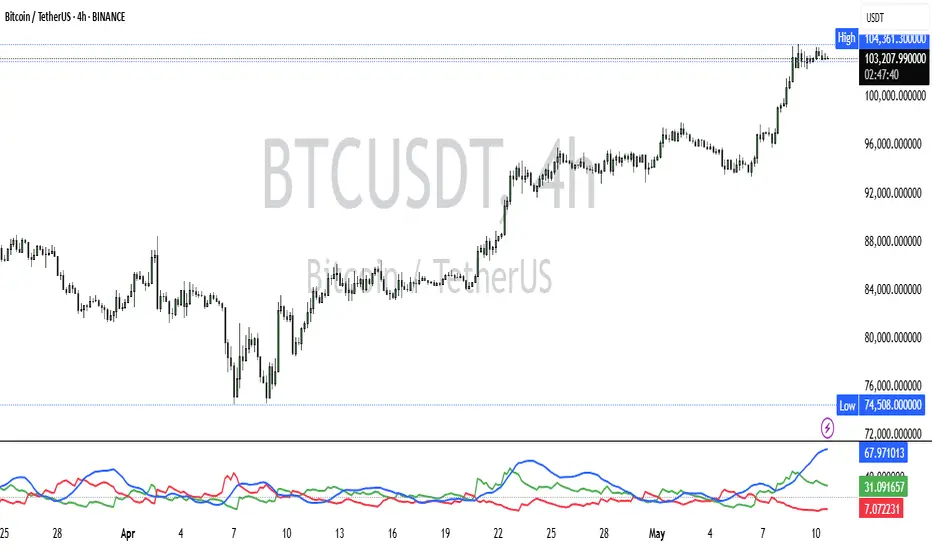

This indicator combines the Average Directional Index (ADX) and the Directional Indicators (DI+ and DI-) to help traders assess market trends and their strength. It is designed to provide a clear view of whether the market is in a trending phase (either bullish or bearish) and helps identify potential entry and exit points.

What is ADX and DI?

DI+ (Green Line):

DI+ measures the strength of upward (bullish) price movements. When DI+ is above DI-, it signals that the market is experiencing upward momentum.

DI- (Red Line):

DI- measures the strength of downward (bearish) price movements. When DI- is above DI+, it suggests that the market is in a bearish phase, with downward momentum.

ADX (Blue Line):

ADX quantifies the strength of the trend, irrespective of whether it is bullish or bearish. The higher the ADX, the stronger the trend:

ADX > 20: Indicates a trending market (either up or down).

ADX < 20: Indicates a weak or sideways market with no clear trend.

Threshold Line (Gray Line):

This horizontal line, typically set at 20, represents the threshold for identifying whether the market is trending or not. If ADX is above 20, the market is considered to be in a trend. If ADX is below 20, it suggests that the market is not trending and is likely in a consolidation phase.

Summary of How to Use the Indicator:

Trend Confirmation: Use ADX > 20 to confirm a trending market. If ADX is below 20, avoid trading.

Long Entry: Enter a long position when DI+ > DI- and ADX > 20.

Short Entry: Enter a short position when DI- > DI+ and ADX > 20.

Avoid Sideways Markets: Do not trade when ADX is below 20. Look for other strategies for consolidation phases.

Exit Strategy: Exit the trade if ADX starts to decline or if the DI lines cross in the opposite direction.

Combine with Other Indicators: Use additional indicators like RSI, moving averages, or support/resistance to filter and confirm signals.

This indicator combines the Average Directional Index (ADX) and the Directional Indicators (DI+ and DI-) to help traders assess market trends and their strength. It is designed to provide a clear view of whether the market is in a trending phase (either bullish or bearish) and helps identify potential entry and exit points.

What is ADX and DI?

DI+ (Green Line):

DI+ measures the strength of upward (bullish) price movements. When DI+ is above DI-, it signals that the market is experiencing upward momentum.

DI- (Red Line):

DI- measures the strength of downward (bearish) price movements. When DI- is above DI+, it suggests that the market is in a bearish phase, with downward momentum.

ADX (Blue Line):

ADX quantifies the strength of the trend, irrespective of whether it is bullish or bearish. The higher the ADX, the stronger the trend:

ADX > 20: Indicates a trending market (either up or down).

ADX < 20: Indicates a weak or sideways market with no clear trend.

Threshold Line (Gray Line):

This horizontal line, typically set at 20, represents the threshold for identifying whether the market is trending or not. If ADX is above 20, the market is considered to be in a trend. If ADX is below 20, it suggests that the market is not trending and is likely in a consolidation phase.

Summary of How to Use the Indicator:

Trend Confirmation: Use ADX > 20 to confirm a trending market. If ADX is below 20, avoid trading.

Long Entry: Enter a long position when DI+ > DI- and ADX > 20.

Short Entry: Enter a short position when DI- > DI+ and ADX > 20.

Avoid Sideways Markets: Do not trade when ADX is below 20. Look for other strategies for consolidation phases.

Exit Strategy: Exit the trade if ADX starts to decline or if the DI lines cross in the opposite direction.

Combine with Other Indicators: Use additional indicators like RSI, moving averages, or support/resistance to filter and confirm signals.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.