OPEN-SOURCE SCRIPT

Game Theory Trading Strategy

Game Theory Trading Strategy: Explanation and Working Logic

This Pine Script (version 5) code implements a trading strategy named "Game Theory Trading Strategy" in TradingView. Unlike the previous indicator, this is a full-fledged strategy with automated entry/exit rules, risk management, and backtesting capabilities. It uses Game Theory principles to analyze market behavior, focusing on herd behavior, institutional flows, liquidity traps, and Nash equilibrium to generate buy (long) and sell (short) signals. Below, I'll explain the strategy's purpose, working logic, key components, and usage tips in detail.

1. General Description

Purpose: The strategy identifies high-probability trading opportunities by combining Game Theory concepts (herd behavior, contrarian signals, Nash equilibrium) with technical analysis (RSI, volume, momentum). It aims to exploit market inefficiencies caused by retail herd behavior, institutional flows, and liquidity traps. The strategy is designed for automated trading with defined risk management (stop-loss/take-profit) and position sizing based on market conditions.

Key Features:

Herd Behavior Detection: Identifies retail panic buying/selling using RSI and volume spikes.

Liquidity Traps: Detects stop-loss hunting zones where price breaks recent highs/lows but reverses.

Institutional Flow Analysis: Tracks high-volume institutional activity via Accumulation/Distribution and volume spikes.

Nash Equilibrium: Uses statistical price bands to assess whether the market is in equilibrium or deviated (overbought/oversold).

Risk Management: Configurable stop-loss (SL) and take-profit (TP) percentages, dynamic position sizing based on Game Theory (minimax principle).

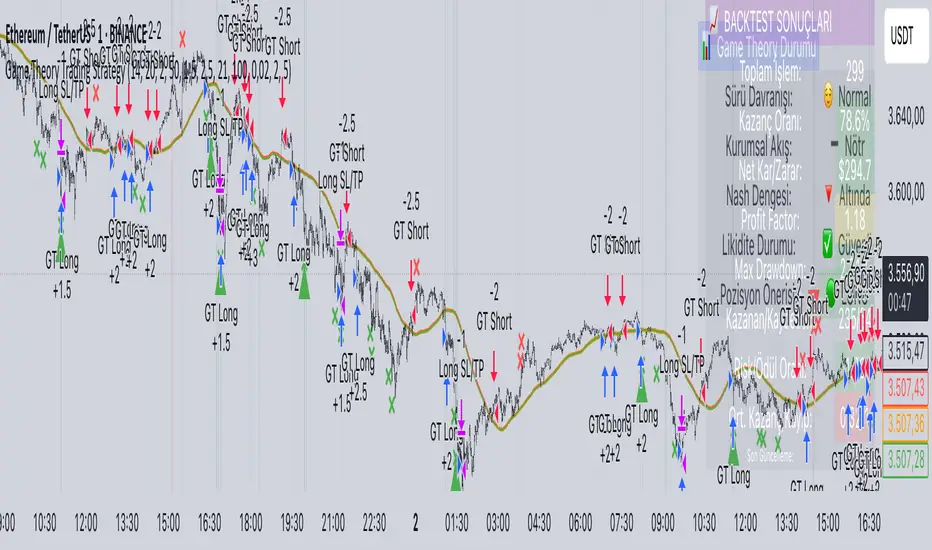

Visualization: Displays Nash bands, signals, background colors, and two tables (Game Theory status and backtest results).

Backtesting: Tracks performance metrics like win rate, profit factor, max drawdown, and Sharpe ratio.

Strategy Settings:

Initial capital: $10,000.

Pyramiding: Up to 3 positions.

Position size: 10% of equity (default_qty_value=10).

Configurable inputs for RSI, volume, liquidity, institutional flow, Nash equilibrium, and risk management.

Warning: This is a strategy, not just an indicator. It executes trades automatically in TradingView's Strategy Tester. Always backtest thoroughly and use proper risk management before live trading.

2. Working Logic (Step by Step)

The strategy processes each bar (candle) to generate signals, manage positions, and update performance metrics. Here's how it works:

a. Input Parameters

The inputs are grouped for clarity:

Herd Behavior (🐑):

RSI Period (14): For overbought/oversold detection.

Volume MA Period (20): To calculate average volume for spike detection.

Herd Threshold (2.0): Volume multiplier for detecting herd activity.

Liquidity Analysis (💧):

Liquidity Lookback (50): Bars to check for recent highs/lows.

Liquidity Sensitivity (1.5): Volume multiplier for trap detection.

Institutional Flow (🏦):

Institutional Volume Multiplier (2.5): For detecting large volume spikes.

Institutional MA Period (21): For Accumulation/Distribution smoothing.

Nash Equilibrium (⚖️):

Nash Period (100): For calculating price mean and standard deviation.

Nash Deviation (0.02): Multiplier for equilibrium bands.

Risk Management (🛡️):

Use Stop-Loss (true): Enables SL at 2% below/above entry price.

Use Take-Profit (true): Enables TP at 5% above/below entry price.

b. Herd Behavior Detection

RSI (14): Checks for extreme conditions:

Overbought: RSI > 70 (potential herd buying).

Oversold: RSI < 30 (potential herd selling).

Volume Spike: Volume > SMA(20) x 2.0 (herd_threshold).

Momentum: Price change over 10 bars (close - close[10]) compared to its SMA(20).

Herd Signals:

Herd Buying: RSI > 70 + volume spike + positive momentum = Retail buying frenzy (red background).

Herd Selling: RSI < 30 + volume spike + negative momentum = Retail selling panic (green background).

c. Liquidity Trap Detection

Recent Highs/Lows: Calculated over 50 bars (liquidity_lookback).

Psychological Levels: Nearest round numbers (e.g., $100, $110) as potential stop-loss zones.

Trap Conditions:

Up Trap: Price breaks recent high, closes below it, with a volume spike (volume > SMA x 1.5).

Down Trap: Price breaks recent low, closes above it, with a volume spike.

Visualization: Traps are marked with small red/green crosses above/below bars.

d. Institutional Flow Analysis

Volume Check: Volume > SMA(20) x 2.5 (inst_volume_mult) = Institutional activity.

Accumulation/Distribution (AD):

Formula: ((close - low) - (high - close)) / (high - low) * volume, cumulated over time.

Smoothed with SMA(21) (inst_ma_length).

Accumulation: AD > MA + high volume = Institutions buying.

Distribution: AD < MA + high volume = Institutions selling.

Smart Money Index: (close - open) / (high - low) * volume, smoothed with SMA(20). Positive = Smart money buying.

e. Nash Equilibrium

Calculation:

Price mean: SMA(100) (nash_period).

Standard deviation: stdev(100).

Upper Nash: Mean + StdDev x 0.02 (nash_deviation).

Lower Nash: Mean - StdDev x 0.02.

Conditions:

Near Equilibrium: Price between upper and lower Nash bands (stable market).

Above Nash: Price > upper band (overbought, sell potential).

Below Nash: Price < lower band (oversold, buy potential).

Visualization: Orange line (mean), red/green lines (upper/lower bands).

f. Game Theory Signals

The strategy generates three types of signals, combined into long/short triggers:

Contrarian Signals:

Buy: Herd selling + (accumulation or down trap) = Go against retail panic.

Sell: Herd buying + (distribution or up trap).

Momentum Signals:

Buy: Below Nash + positive smart money + no herd buying.

Sell: Above Nash + negative smart money + no herd selling.

Nash Reversion Signals:

Buy: Below Nash + rising close (close > close[1]) + volume > MA.

Sell: Above Nash + falling close + volume > MA.

Final Signals:

Long Signal: Contrarian buy OR momentum buy OR Nash reversion buy.

Short Signal: Contrarian sell OR momentum sell OR Nash reversion sell.

g. Position Management

Position Sizing (Minimax Principle):

Default: 1.0 (10% of equity).

In Nash equilibrium: Reduced to 0.5 (conservative).

During institutional volume: Increased to 1.5 (aggressive).

Entries:

Long: If long_signal is true and no existing long position (strategy.position_size <= 0).

Short: If short_signal is true and no existing short position (strategy.position_size >= 0).

Exits:

Stop-Loss: If use_sl=true, set at 2% below/above entry price.

Take-Profit: If use_tp=true, set at 5% above/below entry price.

Pyramiding: Up to 3 concurrent positions allowed.

h. Visualization

Nash Bands: Orange (mean), red (upper), green (lower).

Background Colors:

Herd buying: Red (90% transparency).

Herd selling: Green.

Institutional volume: Blue.

Signals:

Contrarian buy/sell: Green/red triangles below/above bars.

Liquidity traps: Red/green crosses above/below bars.

Tables:

Game Theory Table (Top-Right):

Herd Behavior: Buying frenzy, selling panic, or normal.

Institutional Flow: Accumulation, distribution, or neutral.

Nash Equilibrium: In equilibrium, above, or below.

Liquidity Status: Trap detected or safe.

Position Suggestion: Long (green), Short (red), or Wait (gray).

Backtest Table (Bottom-Right):

Total Trades: Number of closed trades.

Win Rate: Percentage of winning trades.

Net Profit/Loss: In USD, colored green/red.

Profit Factor: Gross profit / gross loss.

Max Drawdown: Peak-to-trough equity drop (%).

Win/Loss Trades: Number of winning/losing trades.

Risk/Reward Ratio: Simplified Sharpe ratio (returns / drawdown).

Avg Win/Loss Ratio: Average win per trade / average loss per trade.

Last Update: Current time.

i. Backtesting Metrics

Tracks:

Total trades, winning/losing trades.

Win rate (%).

Net profit ($).

Profit factor (gross profit / gross loss).

Max drawdown (%).

Simplified Sharpe ratio (returns / drawdown).

Average win/loss ratio.

Updates metrics on each closed trade.

Displays a label on the last bar with backtest period, total trades, win rate, and net profit.

j. Alerts

No explicit alertconditions defined, but you can add them for long_signal and short_signal (e.g., alertcondition(long_signal, "GT Long Entry", "Long Signal Detected!")).

Use TradingView's alert system with Strategy Tester outputs.

3. Usage Tips

Timeframe: Best for H1-D1 timeframes. Shorter frames (M1-M15) may produce noisy signals.

Settings:

Risk Management: Adjust sl_percent (e.g., 1% for volatile markets) and tp_percent (e.g., 3% for scalping).

Herd Threshold: Increase to 2.5 for stricter herd detection in choppy markets.

Liquidity Lookback: Reduce to 20 for faster markets (e.g., crypto).

Nash Period: Increase to 200 for longer-term analysis.

Backtesting:

Use TradingView's Strategy Tester to evaluate performance.

Check win rate (>50%), profit factor (>1.5), and max drawdown (<20%) for viability.

Test on different assets/timeframes to ensure robustness.

Live Trading:

Start with a demo account.

Combine with other indicators (e.g., EMAs, support/resistance) for confirmation.

Monitor liquidity traps and institutional flow for context.

Risk Management:

Always use SL/TP to limit losses.

Adjust position_size for risk tolerance (e.g., 5% of equity for conservative trading).

Avoid over-leveraging (pyramiding=3 can amplify risk).

Troubleshooting:

If no trades are executed, check signal conditions (e.g., lower herd_threshold or liquidity_sensitivity).

Ensure sufficient historical data for Nash and liquidity calculations.

If tables overlap, adjust position.top_right/bottom_right coordinates.

4. Key Differences from the Previous Indicator

Indicator vs. Strategy: The previous code was an indicator (VP + Game Theory Integrated Strategy) focused on visualization and alerts. This is a strategy with automated entries/exits and backtesting.

Volume Profile: Absent in this strategy, making it lighter but less focused on high-volume zones.

Wick Analysis: Not included here, unlike the previous indicator's heavy reliance on wick patterns.

Backtesting: This strategy includes detailed performance metrics and a backtest table, absent in the indicator.

Simpler Signals: Focuses on Game Theory signals (contrarian, momentum, Nash reversion) without the "Power/Ultra Power" hierarchy.

Risk Management: Explicit SL/TP and dynamic position sizing, not present in the indicator.

5. Conclusion

The "Game Theory Trading Strategy" is a sophisticated system leveraging herd behavior, institutional flows, liquidity traps, and Nash equilibrium to trade market inefficiencies. It’s designed for traders who understand Game Theory principles and want automated execution with robust risk management. However, it requires thorough backtesting and parameter optimization for specific markets (e.g., forex, crypto, stocks). The backtest table and visual aids make it easy to monitor performance, but always combine with other analysis tools and proper capital management.

If you need help with backtesting, adding alerts, or optimizing parameters, let me know!

This Pine Script (version 5) code implements a trading strategy named "Game Theory Trading Strategy" in TradingView. Unlike the previous indicator, this is a full-fledged strategy with automated entry/exit rules, risk management, and backtesting capabilities. It uses Game Theory principles to analyze market behavior, focusing on herd behavior, institutional flows, liquidity traps, and Nash equilibrium to generate buy (long) and sell (short) signals. Below, I'll explain the strategy's purpose, working logic, key components, and usage tips in detail.

1. General Description

Purpose: The strategy identifies high-probability trading opportunities by combining Game Theory concepts (herd behavior, contrarian signals, Nash equilibrium) with technical analysis (RSI, volume, momentum). It aims to exploit market inefficiencies caused by retail herd behavior, institutional flows, and liquidity traps. The strategy is designed for automated trading with defined risk management (stop-loss/take-profit) and position sizing based on market conditions.

Key Features:

Herd Behavior Detection: Identifies retail panic buying/selling using RSI and volume spikes.

Liquidity Traps: Detects stop-loss hunting zones where price breaks recent highs/lows but reverses.

Institutional Flow Analysis: Tracks high-volume institutional activity via Accumulation/Distribution and volume spikes.

Nash Equilibrium: Uses statistical price bands to assess whether the market is in equilibrium or deviated (overbought/oversold).

Risk Management: Configurable stop-loss (SL) and take-profit (TP) percentages, dynamic position sizing based on Game Theory (minimax principle).

Visualization: Displays Nash bands, signals, background colors, and two tables (Game Theory status and backtest results).

Backtesting: Tracks performance metrics like win rate, profit factor, max drawdown, and Sharpe ratio.

Strategy Settings:

Initial capital: $10,000.

Pyramiding: Up to 3 positions.

Position size: 10% of equity (default_qty_value=10).

Configurable inputs for RSI, volume, liquidity, institutional flow, Nash equilibrium, and risk management.

Warning: This is a strategy, not just an indicator. It executes trades automatically in TradingView's Strategy Tester. Always backtest thoroughly and use proper risk management before live trading.

2. Working Logic (Step by Step)

The strategy processes each bar (candle) to generate signals, manage positions, and update performance metrics. Here's how it works:

a. Input Parameters

The inputs are grouped for clarity:

Herd Behavior (🐑):

RSI Period (14): For overbought/oversold detection.

Volume MA Period (20): To calculate average volume for spike detection.

Herd Threshold (2.0): Volume multiplier for detecting herd activity.

Liquidity Analysis (💧):

Liquidity Lookback (50): Bars to check for recent highs/lows.

Liquidity Sensitivity (1.5): Volume multiplier for trap detection.

Institutional Flow (🏦):

Institutional Volume Multiplier (2.5): For detecting large volume spikes.

Institutional MA Period (21): For Accumulation/Distribution smoothing.

Nash Equilibrium (⚖️):

Nash Period (100): For calculating price mean and standard deviation.

Nash Deviation (0.02): Multiplier for equilibrium bands.

Risk Management (🛡️):

Use Stop-Loss (true): Enables SL at 2% below/above entry price.

Use Take-Profit (true): Enables TP at 5% above/below entry price.

b. Herd Behavior Detection

RSI (14): Checks for extreme conditions:

Overbought: RSI > 70 (potential herd buying).

Oversold: RSI < 30 (potential herd selling).

Volume Spike: Volume > SMA(20) x 2.0 (herd_threshold).

Momentum: Price change over 10 bars (close - close[10]) compared to its SMA(20).

Herd Signals:

Herd Buying: RSI > 70 + volume spike + positive momentum = Retail buying frenzy (red background).

Herd Selling: RSI < 30 + volume spike + negative momentum = Retail selling panic (green background).

c. Liquidity Trap Detection

Recent Highs/Lows: Calculated over 50 bars (liquidity_lookback).

Psychological Levels: Nearest round numbers (e.g., $100, $110) as potential stop-loss zones.

Trap Conditions:

Up Trap: Price breaks recent high, closes below it, with a volume spike (volume > SMA x 1.5).

Down Trap: Price breaks recent low, closes above it, with a volume spike.

Visualization: Traps are marked with small red/green crosses above/below bars.

d. Institutional Flow Analysis

Volume Check: Volume > SMA(20) x 2.5 (inst_volume_mult) = Institutional activity.

Accumulation/Distribution (AD):

Formula: ((close - low) - (high - close)) / (high - low) * volume, cumulated over time.

Smoothed with SMA(21) (inst_ma_length).

Accumulation: AD > MA + high volume = Institutions buying.

Distribution: AD < MA + high volume = Institutions selling.

Smart Money Index: (close - open) / (high - low) * volume, smoothed with SMA(20). Positive = Smart money buying.

e. Nash Equilibrium

Calculation:

Price mean: SMA(100) (nash_period).

Standard deviation: stdev(100).

Upper Nash: Mean + StdDev x 0.02 (nash_deviation).

Lower Nash: Mean - StdDev x 0.02.

Conditions:

Near Equilibrium: Price between upper and lower Nash bands (stable market).

Above Nash: Price > upper band (overbought, sell potential).

Below Nash: Price < lower band (oversold, buy potential).

Visualization: Orange line (mean), red/green lines (upper/lower bands).

f. Game Theory Signals

The strategy generates three types of signals, combined into long/short triggers:

Contrarian Signals:

Buy: Herd selling + (accumulation or down trap) = Go against retail panic.

Sell: Herd buying + (distribution or up trap).

Momentum Signals:

Buy: Below Nash + positive smart money + no herd buying.

Sell: Above Nash + negative smart money + no herd selling.

Nash Reversion Signals:

Buy: Below Nash + rising close (close > close[1]) + volume > MA.

Sell: Above Nash + falling close + volume > MA.

Final Signals:

Long Signal: Contrarian buy OR momentum buy OR Nash reversion buy.

Short Signal: Contrarian sell OR momentum sell OR Nash reversion sell.

g. Position Management

Position Sizing (Minimax Principle):

Default: 1.0 (10% of equity).

In Nash equilibrium: Reduced to 0.5 (conservative).

During institutional volume: Increased to 1.5 (aggressive).

Entries:

Long: If long_signal is true and no existing long position (strategy.position_size <= 0).

Short: If short_signal is true and no existing short position (strategy.position_size >= 0).

Exits:

Stop-Loss: If use_sl=true, set at 2% below/above entry price.

Take-Profit: If use_tp=true, set at 5% above/below entry price.

Pyramiding: Up to 3 concurrent positions allowed.

h. Visualization

Nash Bands: Orange (mean), red (upper), green (lower).

Background Colors:

Herd buying: Red (90% transparency).

Herd selling: Green.

Institutional volume: Blue.

Signals:

Contrarian buy/sell: Green/red triangles below/above bars.

Liquidity traps: Red/green crosses above/below bars.

Tables:

Game Theory Table (Top-Right):

Herd Behavior: Buying frenzy, selling panic, or normal.

Institutional Flow: Accumulation, distribution, or neutral.

Nash Equilibrium: In equilibrium, above, or below.

Liquidity Status: Trap detected or safe.

Position Suggestion: Long (green), Short (red), or Wait (gray).

Backtest Table (Bottom-Right):

Total Trades: Number of closed trades.

Win Rate: Percentage of winning trades.

Net Profit/Loss: In USD, colored green/red.

Profit Factor: Gross profit / gross loss.

Max Drawdown: Peak-to-trough equity drop (%).

Win/Loss Trades: Number of winning/losing trades.

Risk/Reward Ratio: Simplified Sharpe ratio (returns / drawdown).

Avg Win/Loss Ratio: Average win per trade / average loss per trade.

Last Update: Current time.

i. Backtesting Metrics

Tracks:

Total trades, winning/losing trades.

Win rate (%).

Net profit ($).

Profit factor (gross profit / gross loss).

Max drawdown (%).

Simplified Sharpe ratio (returns / drawdown).

Average win/loss ratio.

Updates metrics on each closed trade.

Displays a label on the last bar with backtest period, total trades, win rate, and net profit.

j. Alerts

No explicit alertconditions defined, but you can add them for long_signal and short_signal (e.g., alertcondition(long_signal, "GT Long Entry", "Long Signal Detected!")).

Use TradingView's alert system with Strategy Tester outputs.

3. Usage Tips

Timeframe: Best for H1-D1 timeframes. Shorter frames (M1-M15) may produce noisy signals.

Settings:

Risk Management: Adjust sl_percent (e.g., 1% for volatile markets) and tp_percent (e.g., 3% for scalping).

Herd Threshold: Increase to 2.5 for stricter herd detection in choppy markets.

Liquidity Lookback: Reduce to 20 for faster markets (e.g., crypto).

Nash Period: Increase to 200 for longer-term analysis.

Backtesting:

Use TradingView's Strategy Tester to evaluate performance.

Check win rate (>50%), profit factor (>1.5), and max drawdown (<20%) for viability.

Test on different assets/timeframes to ensure robustness.

Live Trading:

Start with a demo account.

Combine with other indicators (e.g., EMAs, support/resistance) for confirmation.

Monitor liquidity traps and institutional flow for context.

Risk Management:

Always use SL/TP to limit losses.

Adjust position_size for risk tolerance (e.g., 5% of equity for conservative trading).

Avoid over-leveraging (pyramiding=3 can amplify risk).

Troubleshooting:

If no trades are executed, check signal conditions (e.g., lower herd_threshold or liquidity_sensitivity).

Ensure sufficient historical data for Nash and liquidity calculations.

If tables overlap, adjust position.top_right/bottom_right coordinates.

4. Key Differences from the Previous Indicator

Indicator vs. Strategy: The previous code was an indicator (VP + Game Theory Integrated Strategy) focused on visualization and alerts. This is a strategy with automated entries/exits and backtesting.

Volume Profile: Absent in this strategy, making it lighter but less focused on high-volume zones.

Wick Analysis: Not included here, unlike the previous indicator's heavy reliance on wick patterns.

Backtesting: This strategy includes detailed performance metrics and a backtest table, absent in the indicator.

Simpler Signals: Focuses on Game Theory signals (contrarian, momentum, Nash reversion) without the "Power/Ultra Power" hierarchy.

Risk Management: Explicit SL/TP and dynamic position sizing, not present in the indicator.

5. Conclusion

The "Game Theory Trading Strategy" is a sophisticated system leveraging herd behavior, institutional flows, liquidity traps, and Nash equilibrium to trade market inefficiencies. It’s designed for traders who understand Game Theory principles and want automated execution with robust risk management. However, it requires thorough backtesting and parameter optimization for specific markets (e.g., forex, crypto, stocks). The backtest table and visual aids make it easy to monitor performance, but always combine with other analysis tools and proper capital management.

If you need help with backtesting, adding alerts, or optimizing parameters, let me know!

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.