OPEN-SOURCE SCRIPT

Aggiornato VWAP Multi-Timeframe

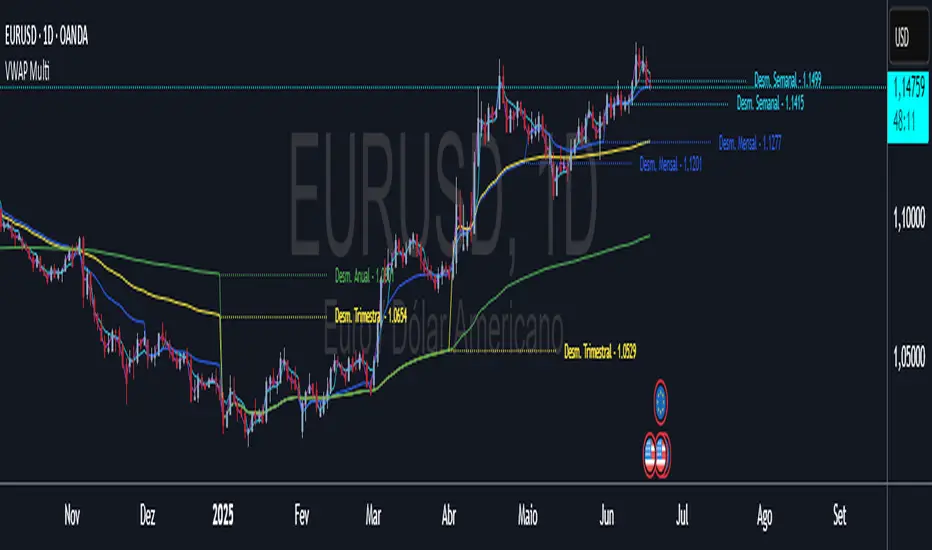

VWAP Multi-Timeframe - Complete Professional Indicator

🚀 WHAT IS IT?

The VWAP Multi-Timeframe is an advanced indicator that combines 5 different VWAP periods in a single tool, providing a complete view of market fair value levels across multiple time scales.

⭐ KEY FEATURES

📊 5 Configurable VWAPs:

🟡 Daily VWAP - Ideal for day trading and intraday operations

🟠 Weekly VWAP - Perfect for swing trading

🔵 Monthly VWAP - Excellent for medium-term analysis

🔴 Quarterly VWAP - Essential for quarterly strategies

🟢 Yearly VWAP - Fundamental for long-term investments

🎯 Multiple Price Sources:

Choose the source that best fits your strategy:

Close - Closing price (most common)

OHLC4 - Complete average (smoother)

HLC3 - Typical price (default)

HL2 - Period midpoint

Open/High/Low - Specific prices

💡 HOW TO USE

For Day Traders:

Use Daily VWAP as main fair value reference

Prices above = buying pressure / Prices below = selling pressure

For Swing Traders:

Combine Weekly and Monthly VWAP to identify trends

Look for confluences between different timeframes

For Investors:

Quarterly and Yearly VWAP show long-term value levels

Excellent for identifying entry points in investments

🔧 TECHNICAL FEATURES

✅ Pine Script v6 - Latest and optimized version

✅ Clean Interface - User-friendly design

🚀 WHAT IS IT?

The VWAP Multi-Timeframe is an advanced indicator that combines 5 different VWAP periods in a single tool, providing a complete view of market fair value levels across multiple time scales.

⭐ KEY FEATURES

📊 5 Configurable VWAPs:

🟡 Daily VWAP - Ideal for day trading and intraday operations

🟠 Weekly VWAP - Perfect for swing trading

🔵 Monthly VWAP - Excellent for medium-term analysis

🔴 Quarterly VWAP - Essential for quarterly strategies

🟢 Yearly VWAP - Fundamental for long-term investments

🎯 Multiple Price Sources:

Choose the source that best fits your strategy:

Close - Closing price (most common)

OHLC4 - Complete average (smoother)

HLC3 - Typical price (default)

HL2 - Period midpoint

Open/High/Low - Specific prices

💡 HOW TO USE

For Day Traders:

Use Daily VWAP as main fair value reference

Prices above = buying pressure / Prices below = selling pressure

For Swing Traders:

Combine Weekly and Monthly VWAP to identify trends

Look for confluences between different timeframes

For Investors:

Quarterly and Yearly VWAP show long-term value levels

Excellent for identifying entry points in investments

🔧 TECHNICAL FEATURES

✅ Pine Script v6 - Latest and optimized version

✅ Clean Interface - User-friendly design

Note di rilascio

VWAP Multi-Timeframe with Smart Dismount SystemThis advanced VWAP indicator provides comprehensive multi-timeframe analysis with an innovative dismount tracking system that identifies key VWAP reset levels across different time periods.

🎯 Key Features:

Multi-Timeframe VWAP Analysis:

Daily, Weekly, Monthly, Quarterly, and Yearly VWAPs

Customizable price source (Close, Open, High, Low, HL2, HLC3, OHLC4)

Professional color-coded visualization

Smart Dismount System:

The unique dismount feature tracks and displays the last two VWAP reset levels for each timeframe, showing where institutional money flow patterns change. These dismount lines represent:

Daily: Current and previous day reset levels

Weekly: Current and previous week reset levels

Monthly: Current and previous month reset levels

Quarterly: Current and previous quarter reset levels

Yearly: Current and previous year reset levels

🔧 Advanced Customization:

Individual control for each timeframe's dismount visibility

Customizable line styles (Solid, Dashed, Dotted)

Adjustable line width and length

Color-coordinated dismount lines matching their respective VWAPs

Optional price labels with configurable font sizes

📊 Clean Interface:

VWAPs controlled via Style tab (visibility, colors, width)

Dismount settings organized in dedicated groups in Inputs tab

No duplicate controls - streamlined user experience

Maximum 10 dismount lines displayed (2 per timeframe) for clean charts

🎨 Professional Defaults:

Carefully selected color palette for optimal contrast

Dotted dismount lines for subtle reference without chart clutter

Compact 30-bar line length for relevant historical context

Small font labels for essential information display

💡 Trading Applications:

Identify key institutional support/resistance levels

Track VWAP reset points for entry/exit strategies

Analyze multi-timeframe confluence zones

Monitor institutional money flow pattern changes

Perfect for both scalping and swing trading strategies

⚙️ Technical Implementation:

Efficient array-based system stores only the most recent dismount levels

Optimized performance with minimal memory usage

Real-time calculation with confirmed bar detection

Compatible with all chart timeframes and instruments

This indicator is ideal for traders who need precise VWAP analysis combined with institutional level tracking across multiple timeframes. The dismount system provides unique insights into where significant market participants are likely to reassess their positions, making it an invaluable tool for modern algorithmic and institutional trading strategies.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.