PROTECTED SOURCE SCRIPT

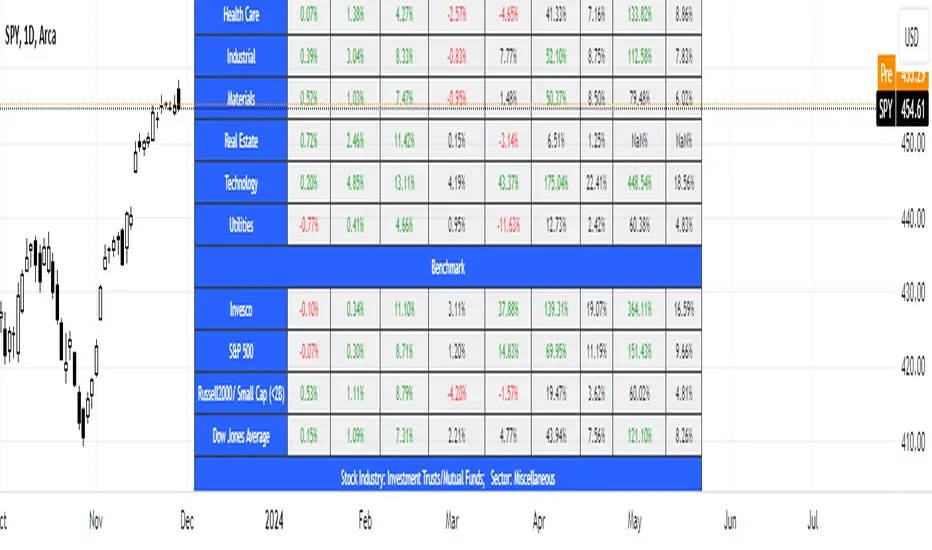

Aggiornato SFC Valuation Model - US Sector

Sector analysis is an assessment of the economic and financial condition and prospects of a given sector of the economy. Sector analysis serves to provide an investor with a judgment about how well companies in the sector are expected to perform. Sector analysis is typically employed by investors who specialize in a particular sector, or who use a top-down or sector rotation approach to investing.

Sector analysis is based on the premise that certain sectors perform better during different stages of the business cycle. The business cycle refers to the up and down changes in economic activity that occur in an economy over time. The business cycle consists of expansions, which are periods of economic growth, and contractions, which are periods of economic decline.

Investors who employ a top-down approach to sector analysis focus first on macroeconomic conditions in their search for companies that have the potential to outperform. They start by looking at those macroeconomic factors that have the biggest impact on the largest part of the population and the economy, such as unemployment rates, economic outputs, and inflation.

Every sector shows the average return from three ETFs - SPDR, Vanguard, iShares. There is a possibility to see the returns from every ETF by just holding the cursor on the sector name.

There are few valuation methods/steps

- Macroeconomics - analyse the current economic;

- Define how the sector is performing;

- Relative valuation method - compare few stocks and find the Outlier;

- Absolute valuation method historically- define how the stock performed in the past;

- Absolute valuation method - define how the stock is performed now and find the fair value;

- Technical analysis

How to use:

1. Once you have completed the initial evaluation step, simply load the indicator.

2. Analyse which sector is outperforming.

Sector analysis is based on the premise that certain sectors perform better during different stages of the business cycle. The business cycle refers to the up and down changes in economic activity that occur in an economy over time. The business cycle consists of expansions, which are periods of economic growth, and contractions, which are periods of economic decline.

Investors who employ a top-down approach to sector analysis focus first on macroeconomic conditions in their search for companies that have the potential to outperform. They start by looking at those macroeconomic factors that have the biggest impact on the largest part of the population and the economy, such as unemployment rates, economic outputs, and inflation.

Every sector shows the average return from three ETFs - SPDR, Vanguard, iShares. There is a possibility to see the returns from every ETF by just holding the cursor on the sector name.

There are few valuation methods/steps

- Macroeconomics - analyse the current economic;

- Define how the sector is performing;

- Relative valuation method - compare few stocks and find the Outlier;

- Absolute valuation method historically- define how the stock performed in the past;

- Absolute valuation method - define how the stock is performed now and find the fair value;

- Technical analysis

How to use:

1. Once you have completed the initial evaluation step, simply load the indicator.

2. Analyse which sector is outperforming.

Note di rilascio

- added more benchmarks- minor bugs fixed

Note di rilascio

- added industry and sector for the current ticker- added large cap sector

Note di rilascio

-added 5Y and 10Y CAGR-added 10Y return

Note di rilascio

-added daily and weekly returnScript protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarle liberamente e senza alcuna limitazione – ulteriori informazioni qui.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarle liberamente e senza alcuna limitazione – ulteriori informazioni qui.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.