BMM V2.1 FINAL VERSION

🕒 Recommended Timeframe

✅ 15-Minute Chart (M15) — the most balanced and accurate for MWABUFX.

Why M15 Works Best:

Filters out small, noisy market movements found on 1m–5m charts.

Responds faster than 1H or 4H, perfect for daily profits.

Aligns well with market session volatility (London & New York).

Gives 2–5 high-probability trades per day depending on the pair.

Ideal for traders using PineConnector automation or manual execution.

🧭 How to Trade on 15-Minute

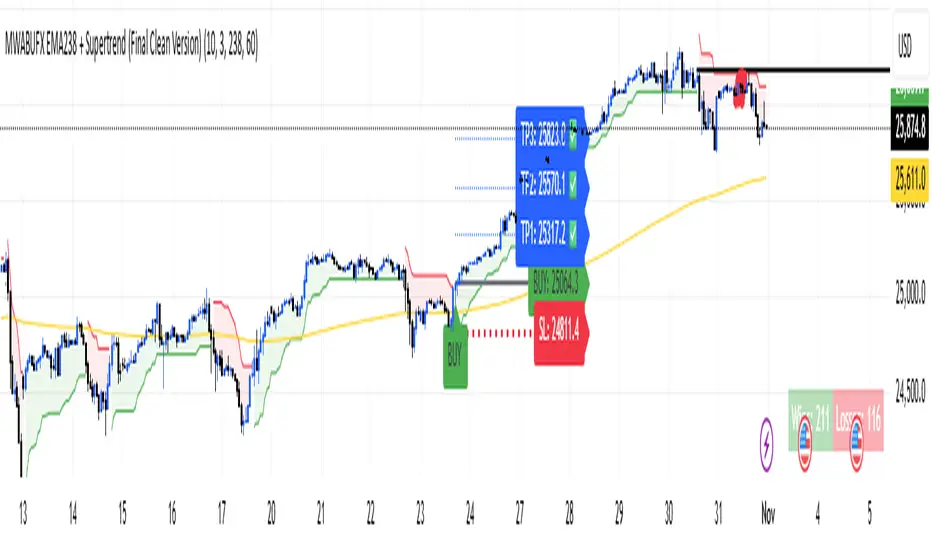

🟢 Buy Setup

EMA 238 is sloping upward and price is above it.

Supertrend flips green — wait for candle to close above the line.

Confirm trend direction on 1H timeframe (optional filter).

Enter trade at the close of the signal candle.

Stop-Loss: below recent swing low.

Take Profits:

TP1 → 1:1

TP2 → 1:2

TP3 → 1:3

Move SL to breakeven after TP1 is hit.

🔴 Sell Setup

EMA 238 is sloping downward and price is below it.

Supertrend flips red — wait for candle to close below the line.

Confirm 1H trend also bearish (optional).

Enter trade at the candle close.

Stop-Loss: above recent swing high.

Take Profits: TP1, TP2, TP3 as above.

🕐 Best Trading Hours (Kenya Time / GMT+3)

Session Time Ideal Pairs Notes

London Session 10:00 AM – 2:00 PM GBPUSD, EURUSD, Gold Cleanest 15-min trends

New York Session 3:30 PM – 7:00 PM US30, NAS100, XAUUSD, GBPUSD Strong volatility, high RR trades

Avoid After 8:30 PM — Market slows down, spreads widen

📌 If you must choose one — trade 15-minute charts during London–New York overlap (3:30 PM – 6:30 PM).

⚖️ Risk & Profit Strategy

Risk only 1–2% of balance per trade.

Focus on 1–3 solid setups per session — no overtrading.

Aim for minimum 1:2 reward-to-risk ratio.

Avoid entries when EMA 238 is flat (ranging market).

💡 Pro Tips

Use “Close of Candle” confirmation — avoid jumping in mid-bar.

Combine with session bias (e.g. buy Gold during bullish NY momentum).

Use alerts through PineConnector to catch trades instantly.

Don’t trade during major red news (NFP, CPI, FOMC).

Journal every trade — review TP/SL behavior to improve timing.

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente Mwabu_Fx_Sniper.

TradingView NON consiglia di pagare o utilizzare uno script a meno che non ci si fidi pienamente del suo autore e non si comprenda il suo funzionamento. Puoi anche trovare alternative gratuite e open-source nei nostri script della comunità.

Istruzioni dell'autore

Declinazione di responsabilità

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente Mwabu_Fx_Sniper.

TradingView NON consiglia di pagare o utilizzare uno script a meno che non ci si fidi pienamente del suo autore e non si comprenda il suo funzionamento. Puoi anche trovare alternative gratuite e open-source nei nostri script della comunità.