PROTECTED SOURCE SCRIPT

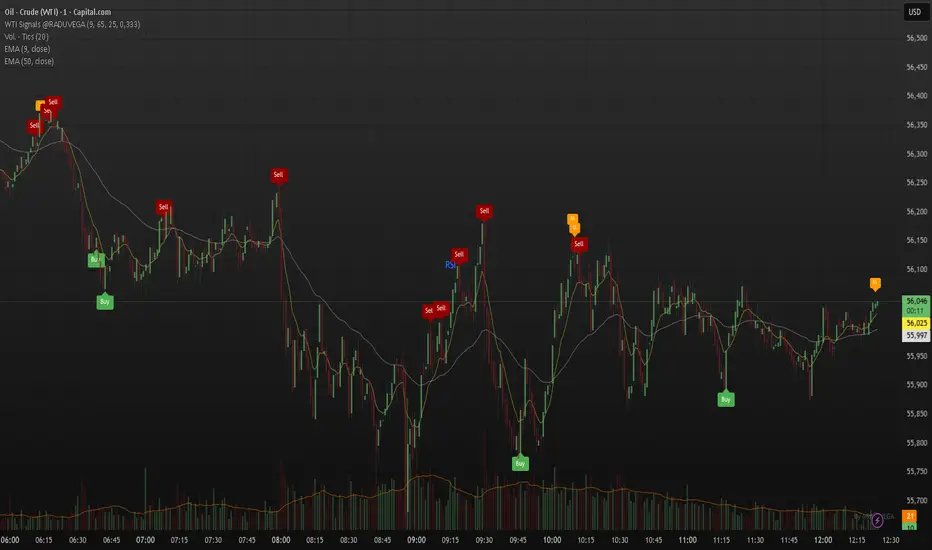

WTI Scalp Signals @RADUVEGA

WTI Scalp Signals Pro [Optimized for Crude Oil] V1.3

Description:

Overview This indicator is a specialized mean-reversion tool designed specifically for the high volatility of the Crude Oil (WTI) market. It combines momentum exhaustion (using a fast RSI) with classic Price Action patterns to identify high-probability scalping opportunities.

Unlike standard indicators that use generic settings, this script has been tuned to react to the "whipsaw" nature of modern energy markets.

Key Features & Logic

Optimized RSI Settings: Uses a 9-period RSI (instead of the standard 14) to catch rapid momentum shifts.

Asymmetric Levels: Tuned with a Sell Threshold at 65 and a Buy Threshold at 25. This asymmetry reflects the market's tendency to drop sharper than it rises (panic selling vs. accumulation).

Pattern Recognition: The script validates RSI signals only when confirmed by specific candlestick patterns:

Bullish/Bearish Engulfing

Hammer / Shooting Star

2-Bar Reversals

Smart Stacking Technology (v1.2): Includes a custom logic to prevent label overlapping. If multiple signals occur on the same bar (e.g., a "Sell" signal + a "Shooting Star"), the labels automatically stack vertically so the chart remains clean and readable.

How to Use

Timeframe: Best used on lower timeframes (1m, 5m, 15m) for scalping sessions.

Sell Signals (Red/Maroon): Look for these during rapid price pumps. The script identifies when price is overextended (RSI > 65) and prints a bearish candle pattern.

Buy Signals (Green): Look for these during sharp sell-offs. The script waits for the RSI to dip below 25 and confirms with a bullish reversal pattern.

Secondary Patterns: Small labels like "SS" (Shooting Star) or "2Bear" serve as additional confirmation of trend weakness.

Settings

RSI Length: Default 9 (Adjustable).

Overbought/Oversold: Default 65/25 (Adjustable).

Pattern Toggles: You can turn on/off specific patterns (Engulfing, Hammers, etc.) to suit your visual preference.

Disclaimer This tool is designed to assist in technical analysis and does not constitute financial advice. Always use proper risk management.

Author: RADUVEGA

Description:

Overview This indicator is a specialized mean-reversion tool designed specifically for the high volatility of the Crude Oil (WTI) market. It combines momentum exhaustion (using a fast RSI) with classic Price Action patterns to identify high-probability scalping opportunities.

Unlike standard indicators that use generic settings, this script has been tuned to react to the "whipsaw" nature of modern energy markets.

Key Features & Logic

Optimized RSI Settings: Uses a 9-period RSI (instead of the standard 14) to catch rapid momentum shifts.

Asymmetric Levels: Tuned with a Sell Threshold at 65 and a Buy Threshold at 25. This asymmetry reflects the market's tendency to drop sharper than it rises (panic selling vs. accumulation).

Pattern Recognition: The script validates RSI signals only when confirmed by specific candlestick patterns:

Bullish/Bearish Engulfing

Hammer / Shooting Star

2-Bar Reversals

Smart Stacking Technology (v1.2): Includes a custom logic to prevent label overlapping. If multiple signals occur on the same bar (e.g., a "Sell" signal + a "Shooting Star"), the labels automatically stack vertically so the chart remains clean and readable.

How to Use

Timeframe: Best used on lower timeframes (1m, 5m, 15m) for scalping sessions.

Sell Signals (Red/Maroon): Look for these during rapid price pumps. The script identifies when price is overextended (RSI > 65) and prints a bearish candle pattern.

Buy Signals (Green): Look for these during sharp sell-offs. The script waits for the RSI to dip below 25 and confirms with a bullish reversal pattern.

Secondary Patterns: Small labels like "SS" (Shooting Star) or "2Bear" serve as additional confirmation of trend weakness.

Settings

RSI Length: Default 9 (Adjustable).

Overbought/Oversold: Default 65/25 (Adjustable).

Pattern Toggles: You can turn on/off specific patterns (Engulfing, Hammers, etc.) to suit your visual preference.

Disclaimer This tool is designed to assist in technical analysis and does not constitute financial advice. Always use proper risk management.

Author: RADUVEGA

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarle liberamente e senza alcuna limitazione – ulteriori informazioni qui.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarle liberamente e senza alcuna limitazione – ulteriori informazioni qui.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.