🕰️ Volume Rotor Clock

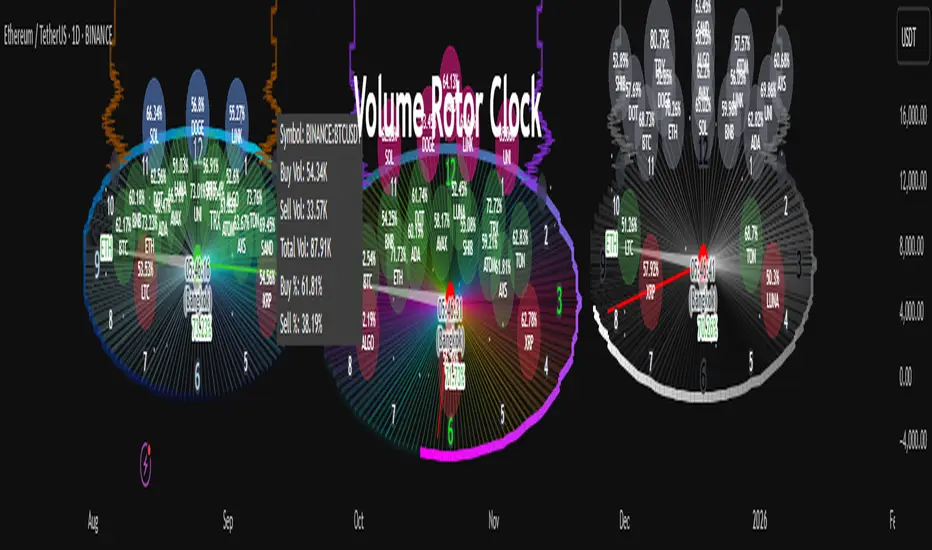

The Volume Rotor Clock is an indicator that separates buy and sell volume, compiling these volumes over a recent number of bars or a specified past period, as defined by the user. This helps to reveal accumulation (buying) or distribution (selling) behavior, showing which side has superior volume. With its unique and beautiful display, the Volume Rotor Clock is more than just a timepiece; it's a dynamic dashboard that visualizes the buying and selling pressure of your favorite symbols, all wrapped in an elegant and fully customizable interface.

Instead of just tracking price, this indicator focuses on the engine behind the movement: volume. It helps you instantly identify which assets are under accumulation (buying) and which are under distribution (selling).

---

🎨 20 Pre-configured Templates

---

🧐 Interpreting the Clock Display

The interface is designed to give you multiple layers of information at a glance. Let's break down what each part represents.

1. The Main Clock Hands (Current Chart Symbol)

The clock hands—hour, minute, and second—are dedicated to the symbol on your current active chart.

2. The Volume Scanner: Bulls & Bears (Symbols Inside the Clock) 🐂🐻

The circular symbols scattered inside the clock face are your multi-symbol volume scanner. They represent the assets you've selected in the indicator's settings.

3. The Bullish Watchlist (Symbols Above the Clock) ⭐

The symbols arranged neatly along the top edge of the clock are the "best of the bulls." They are symbols that are not only bullish but have also passed an additional, powerful strength filter.

---

⚙️ Indicator Settings Explained

The Volume Rotor Clock is highly customizable. Here’s a detailed walkthrough of every setting available in the "Inputs" tab.

🎨 Color Scheme

This group allows you to control the entire aesthetic of the clock.

🖌️ Custom Appearance & Colors

These settings are only active when "Use Template" is unchecked.

📡 Volume Scanner

Control the behavior of the multi-symbol scanner.

⭐ Bullish Watchlist Filter

Configure the criteria for the elite watchlist symbols displayed above the clock.

📏 Position & Size

Adjust the clock's placement and dimensions on your chart.

The Volume Rotor Clock is an indicator that separates buy and sell volume, compiling these volumes over a recent number of bars or a specified past period, as defined by the user. This helps to reveal accumulation (buying) or distribution (selling) behavior, showing which side has superior volume. With its unique and beautiful display, the Volume Rotor Clock is more than just a timepiece; it's a dynamic dashboard that visualizes the buying and selling pressure of your favorite symbols, all wrapped in an elegant and fully customizable interface.

Instead of just tracking price, this indicator focuses on the engine behind the movement: volume. It helps you instantly identify which assets are under accumulation (buying) and which are under distribution (selling).

---

🎨 20 Pre-configured Templates

---

🧐 Interpreting the Clock Display

The interface is designed to give you multiple layers of information at a glance. Let's break down what each part represents.

1. The Main Clock Hands (Current Chart Symbol)

The clock hands—hour, minute, and second—are dedicated to the symbol on your current active chart.

- Minute Hand: Displays the base currency of the current symbol (e.g., USDT, USD) at its tip.

- Hour Hand: Displays the percentage of the winning volume side (buy vs. sell) at its tip.

- Color Gauge: The color of the text characters at the tip of both the hour and minute hands acts as your primary volume gauge for the current symbol.

If buy volume is dominant, the text will be green.

If sell volume is dominant, the text will be red. - Tooltip: Hovering your mouse over the text at the tip of the hour or minute or other spherical elements hand will reveal a detailed tooltip with the precise Buy Volume, Sell Volume, Total Volume, Buy %, and Sell % for the current chart's symbol.

2. The Volume Scanner: Bulls & Bears (Symbols Inside the Clock) 🐂🐻

The circular symbols scattered inside the clock face are your multi-symbol volume scanner. They represent the assets you've selected in the indicator's settings.

- Green Circles (Bulls - Upper Half): These represent symbols from your list where the total buy volume is greater than the total sell volume over the defined "Lookback" period. They are considered to be under bullish accumulation. The size of the circle and its text grows larger as the buy percentage becomes more dominant. The percentage shown within the circle represents the buy volume's share of the total volume, calculated over the 'Lookback (Bars)' you've set.

- Red Circles (Bears - Lower Half): These represent symbols where the total sell volume is greater than the total buy volume. They are considered to be under bearish distribution or selling pressure. The size of the circle indicates the dominance of the sell-side volume. The percentage shown within the circle represents the sell volume's share of the total volume, calculated over the 'Lookback (Bars)' you've set.

3. The Bullish Watchlist (Symbols Above the Clock) ⭐

The symbols arranged neatly along the top edge of the clock are the "best of the bulls." They are symbols that are not only bullish but have also passed an additional, powerful strength filter.

- What it Means: A symbol appears here when it shows signs of sustained, high-volume buying interest. It's a way to filter out noise and focus on assets with potentially significant accumulation phases.

- The Filter Logic: For a bullish symbol (where total buy volume > total sell volume) to be promoted to the watchlist, its trading volume must meet specific criteria based on this formula:In plain English, this means: The indicator checks how many consecutive bars the `volume` has been greater than its `X`-bar Simple Moving Average (`ta.sma(volume, X)`). If this count is greater than or equal to `Y` bars, the condition is met.

Pine Script® ta.barssince(not(volume > ta.sma(volume, X))) >= Y

(You can configure `X` (Volume MA Length) and `Y` (Consecutive Days Above MA) in the settings.) - Why it's Useful: This filter is powerful because it looks for consistency. A single spike in volume can be an anomaly. However, when an asset's volume remains consistently above its recent average for several consecutive days, it strongly suggests that larger players or a significant portion of the market are actively accumulating the asset. This sustained interest can often precede a significant upward price trend.

---

⚙️ Indicator Settings Explained

The Volume Rotor Clock is highly customizable. Here’s a detailed walkthrough of every setting available in the "Inputs" tab.

🎨 Color Scheme

This group allows you to control the entire aesthetic of the clock.

- Template: Choose from a wide variety of professionally designed color themes.

- Use Template: A simple checkbox to switch between using a pre-designed theme and creating your own.

- `Checked`: You can select a theme from the dropdown menu, which offers 20 unique templates like "Cyberpunk Neon" or "Forest Green". All custom color settings below will be disabled (grayed out and unclickable).

`Unchecked`:The template dropdown is disabled, and you gain full control over every color element in the sections below.

- `Checked`: You can select a theme from the dropdown menu, which offers 20 unique templates like "Cyberpunk Neon" or "Forest Green". All custom color settings below will be disabled (grayed out and unclickable).

🖌️ Custom Appearance & Colors

These settings are only active when "Use Template" is unchecked.

- Flame Head / Tail: Sets the start and end colors for the dynamic flame effect that traces the clock's border, representing the second hand.

- Numbers / Main Numbers: Customize the color of the regular hour numbers (1, 2, 4, 5...) and the main cardinal numbers (3, 6, 9, 12).

- Sunburst Colors (1-6): Controls the six colors used in the gradient background for the "sunburst" effect inside the clock face.

- Hands & Digital: Fine-tune the colors for the Hour/Minute Hand, Second Hand, central Pivot point, and the digital time display.

- Chain Color / Width: Customize the appearance of the two chains holding the clock.

📡 Volume Scanner

Control the behavior of the multi-symbol scanner.

- Show Scanner Labels: A master switch to show or hide all the bull/bear symbol circles inside the clock.

- Lookback (Bars): A crucial setting that defines the calculation period for buy/sell volume for all scanned symbols. The calculation is a sum over the specified number of recent bars.

`0`: Calculates using the current bar only.

`7`: Calculates the sum of volume over the last 8 bars (the current bar + 7 historical bars). - Symbols List: Here you can enable/disable up to 20 slots and input the ticker for each symbol you want to scan (e.g.,

BTCUSDT,

AAPL).

⭐ Bullish Watchlist Filter

Configure the criteria for the elite watchlist symbols displayed above the clock.

- Enable Watchlist: A master switch to turn the entire watchlist feature on or off.

- Volume MA Length: Sets the lookback period `(X)` for the Simple Moving Average of volume used in the filter.

- Consecutive Days Above MA: Sets the minimum number of consecutive days `(Y)` that volume must close above its MA to qualify.

- Symbols Per Row: Determines the maximum number of watchlist symbols that can fit in a single row before a new row is created above it.

- Background / Text Color: When not using a template, you can set custom colors for the watchlist symbols' background and text.

📏 Position & Size

Adjust the clock's placement and dimensions on your chart.

- Clock Timezone: Sets the timezone for the digital and analog time display. You can use standard formats like "America/New_York" or enter "Exchange" to sync with the chart's timezone.

- Radius (Bars): Controls the overall size of the clock. The radius is measured in terms of the number of bars on the x-axis.

- X Offset (Bars): Moves the entire clock horizontally. Positive values shift it to the right; negative values shift it to the left.

- Y Offset (Price %): Moves the entire clock vertically as a percentage of your screen's price pane. Positive values move it up; negative values move it down.

Note di rilascio

Minor improvementsNote di rilascio

library. Thanks to n00btraders for the recommendationScript open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

✨ Access premium indicators at: hapharmonic.com

📧 Email: hapharmonic@gmail.com

🤖 To request access, please send me a message with your details.

Thank you!

📧 Email: hapharmonic@gmail.com

🤖 To request access, please send me a message with your details.

Thank you!

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

✨ Access premium indicators at: hapharmonic.com

📧 Email: hapharmonic@gmail.com

🤖 To request access, please send me a message with your details.

Thank you!

📧 Email: hapharmonic@gmail.com

🤖 To request access, please send me a message with your details.

Thank you!

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.