OPEN-SOURCE SCRIPT

Volume Overbought/Oversold Zones

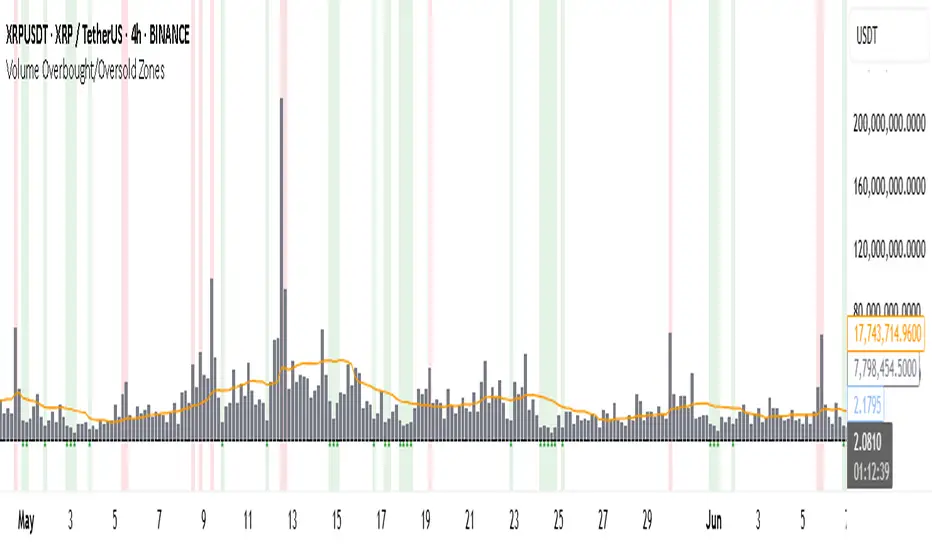

📊 What You’ll See on the Chart

Red Background or Red Triangle ABOVE a Candle

🔺 Means: Overbought Volume

→ Volume on that bar is much higher than average (as defined by your settings).

→ Suggests strong activity, possible exhaustion in the trend or an emotional spike.

→ It’s a warning: consider watching for signs of reversal, especially if price is already stretched.

Green Background or Green Triangle BELOW a Candle

🔻 Means: Oversold Volume

→ Volume on that bar is much lower than normal.

→ Suggests the market may be losing momentum, or few sellers are left.

→ Could signal an upcoming reversal or recovery if confirmed by price action.

Orange Line Below the Candles (Volume Moving Average)

📈 Shows the "normal" average volume over the last X candles (default is 20).

→ Helps you visually compare each bar’s volume to the average.

Gray Columns (Actual Volume Bars)

📊 These are your regular volume bars — they rise and fall based on how active each candle is.

🔍 What This Indicator Does (In Simple Words)

This indicator looks at trading volume—which is how many shares/contracts were traded in a given period—and compares it to what's considered "normal" for recent history. When volume is unusually high or low, it highlights those moments on the chart.

It tells you:

• When volume is much higher than normal → market might be overheated or experiencing a buying/selling frenzy.

• When volume is much lower than normal → market might be quiet, potentially indicating lack of interest or indecision.

These conditions are marked visually, so you can instantly spot them.

💡 How It Helps You As a Trader

1. Spotting Exhaustion in Trends (Overbought Signals)

If a market is going up and suddenly volume spikes way above normal, it may mean:

• The move is getting crowded (lots of buyers are already in).

• A reversal or pullback could be near because smart money may be taking profits.

Trading idea: Wait for high-volume up bars, then look for price weakness to consider a short or exit.

2. Identifying Hidden Opportunities (Oversold Signals)

If price is falling but volume drops unusually low, it might mean:

• Panic is fading.

• Sellers are losing energy.

• A bounce or trend reversal could happen soon.

Trading idea: After a volume drop in a downtrend, watch for bullish price patterns or momentum shifts to consider a buy.

3. Confirming or Doubting Breakouts

Volume is critical for confirming breakouts:

• If price breaks a key level with strong volume, it's more likely to continue.

• A breakout without volume could be a fake-out.

This indicator highlights volume surges that can help you confirm such moves.

📈 How to Use It in Practice

• Combine it with candlestick patterns, support/resistance, or momentum indicators.

• Use the background colors or shapes as a visual cue to pause and analyze.

• Adjust the sensitivity to suit fast-moving markets (like crypto) or slow ones (like large-cap stocks).

Red Background or Red Triangle ABOVE a Candle

🔺 Means: Overbought Volume

→ Volume on that bar is much higher than average (as defined by your settings).

→ Suggests strong activity, possible exhaustion in the trend or an emotional spike.

→ It’s a warning: consider watching for signs of reversal, especially if price is already stretched.

Green Background or Green Triangle BELOW a Candle

🔻 Means: Oversold Volume

→ Volume on that bar is much lower than normal.

→ Suggests the market may be losing momentum, or few sellers are left.

→ Could signal an upcoming reversal or recovery if confirmed by price action.

Orange Line Below the Candles (Volume Moving Average)

📈 Shows the "normal" average volume over the last X candles (default is 20).

→ Helps you visually compare each bar’s volume to the average.

Gray Columns (Actual Volume Bars)

📊 These are your regular volume bars — they rise and fall based on how active each candle is.

🔍 What This Indicator Does (In Simple Words)

This indicator looks at trading volume—which is how many shares/contracts were traded in a given period—and compares it to what's considered "normal" for recent history. When volume is unusually high or low, it highlights those moments on the chart.

It tells you:

• When volume is much higher than normal → market might be overheated or experiencing a buying/selling frenzy.

• When volume is much lower than normal → market might be quiet, potentially indicating lack of interest or indecision.

These conditions are marked visually, so you can instantly spot them.

💡 How It Helps You As a Trader

1. Spotting Exhaustion in Trends (Overbought Signals)

If a market is going up and suddenly volume spikes way above normal, it may mean:

• The move is getting crowded (lots of buyers are already in).

• A reversal or pullback could be near because smart money may be taking profits.

Trading idea: Wait for high-volume up bars, then look for price weakness to consider a short or exit.

2. Identifying Hidden Opportunities (Oversold Signals)

If price is falling but volume drops unusually low, it might mean:

• Panic is fading.

• Sellers are losing energy.

• A bounce or trend reversal could happen soon.

Trading idea: After a volume drop in a downtrend, watch for bullish price patterns or momentum shifts to consider a buy.

3. Confirming or Doubting Breakouts

Volume is critical for confirming breakouts:

• If price breaks a key level with strong volume, it's more likely to continue.

• A breakout without volume could be a fake-out.

This indicator highlights volume surges that can help you confirm such moves.

📈 How to Use It in Practice

• Combine it with candlestick patterns, support/resistance, or momentum indicators.

• Use the background colors or shapes as a visual cue to pause and analyze.

• Adjust the sensitivity to suit fast-moving markets (like crypto) or slow ones (like large-cap stocks).

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Trade forex, indices, stocks and metals with up to US$100.000 in company's funding.

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Trade forex, indices, stocks and metals with up to US$100.000 in company's funding.

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.