OPEN-SOURCE SCRIPT

25-75 Percentile SuperTrend | Mattes

25-75 Percentile SuperTrend | Mattes

Overview

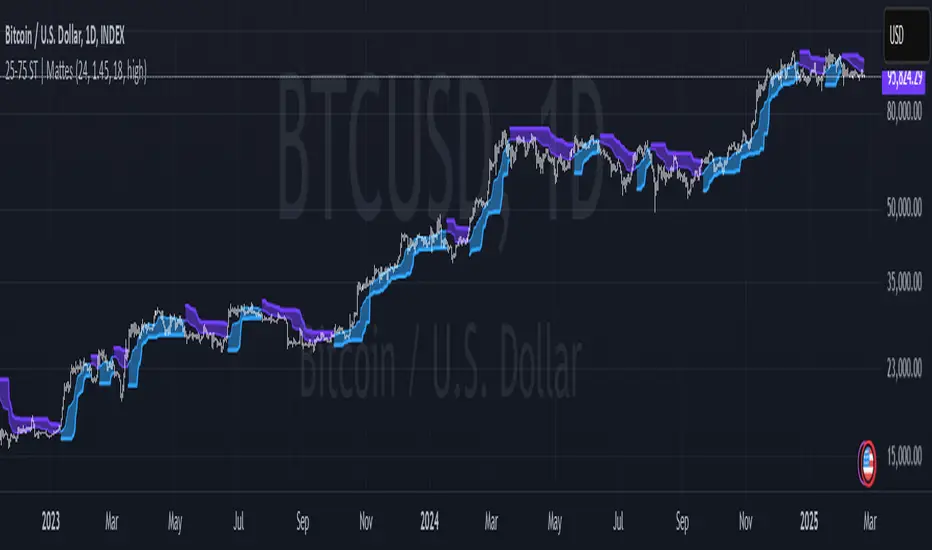

The 25-75 Percentile SuperTrend is an advanced trend-following indicator that enhances the traditional SuperTrend concept by incorporating percentile-based smoothing. Instead of using a simple moving average or median price, this indicator calculates the 25th and 75th percentiles over a user-defined period. These percentiles act as dynamic trend levels, adjusting more responsively to price volatility while reducing noise.

How It’s Calculated

Percentile Smoothing:

SuperTrend Logic:

Signal Generation:

Uses Percentiles Instead of a Moving Average:

Traditional SuperTrend relies on ATR-based offsets from a moving average.

This version replaces the moving average with percentile smoothing, which adapts better to price behavior.

Better Noise Filtering:

Since percentiles are less sensitive to outliers, this indicator reduces false signals in choppy markets.

More Adaptive to Market Conditions:

Application Examples

Risks & Disclaimers

Not a Standalone Strategy: This indicator should be used with other confirmation tools like volume analysis, momentum oscillators, or support/resistance levels.

False Signals in Sideways Markets: Although it reduces noise, choppy markets can still generate occasional false trend flips.

Market Adaptation Required: The best parameters may vary depending on the asset and timeframe.

This indicator was heavily inspired and influenced by the IRS/viResearch Median SuperTrend, improving upon its concept by transforming its median based calculation into a more responsive & effective counterpart of its former self.

Shoutout to all my Masterclass Brothers and L4 Gs!

Overview

The 25-75 Percentile SuperTrend is an advanced trend-following indicator that enhances the traditional SuperTrend concept by incorporating percentile-based smoothing. Instead of using a simple moving average or median price, this indicator calculates the 25th and 75th percentiles over a user-defined period. These percentiles act as dynamic trend levels, adjusting more responsively to price volatility while reducing noise.

How It’s Calculated

Percentile Smoothing:

- The 25th percentile of the selected source (low-end smoothing).

- The 75th percentile of the selected source (high-end smoothing).

SuperTrend Logic:

- The upper band is set at the 75th percentile + ATR multiplier.

- The lower band is set at the 25th percentile - ATR multiplier.

- The trend flips when the price crosses above/below these dynamic bands.

Signal Generation:

- A bullish trend occurs when price remains above the lower band.

- A bearish trend occurs when price remains below the upper band.

- Trend shifts are highlighted with colored bars and lines for easy visualization.

- How It Differs From Traditional SuperTrend

Uses Percentiles Instead of a Moving Average:

Traditional SuperTrend relies on ATR-based offsets from a moving average.

This version replaces the moving average with percentile smoothing, which adapts better to price behavior.

Better Noise Filtering:

Since percentiles are less sensitive to outliers, this indicator reduces false signals in choppy markets.

More Adaptive to Market Conditions:

- The percentile smoothing dynamically adjusts trend detection based on price distribution rather than fixed calculations.

- Why It’s Useful

- ✅ Reduces Whipsaws: Helps minimize false breakouts by using percentile-based bands instead of traditional ATR-only bands.

- ✅ Works in Different Market Conditions: Effective in both trending and ranging environments due to its adaptive nature.

- ✅ Enhances Trend Confidence: Provides clearer signals by filtering noise more effectively than standard SuperTrend indicators.

Application Examples

- Trend Following: Use it to identify strong upward or downward trends.

- Stop-Loss Placement: The upper and lower bands can serve as dynamic stop-loss levels.

- Breakout Confirmation: Trend flips can confirm breakout signals from other indicators.

- Mean Reversion Strategy Filtering: The 25-75 range helps identify strong versus weak reversals.

Risks & Disclaimers

Not a Standalone Strategy: This indicator should be used with other confirmation tools like volume analysis, momentum oscillators, or support/resistance levels.

False Signals in Sideways Markets: Although it reduces noise, choppy markets can still generate occasional false trend flips.

Market Adaptation Required: The best parameters may vary depending on the asset and timeframe.

This indicator was heavily inspired and influenced by the IRS/viResearch Median SuperTrend, improving upon its concept by transforming its median based calculation into a more responsive & effective counterpart of its former self.

Shoutout to all my Masterclass Brothers and L4 Gs!

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.