OPEN-SOURCE SCRIPT

Quantum Dip Hunter | AlphaNatt

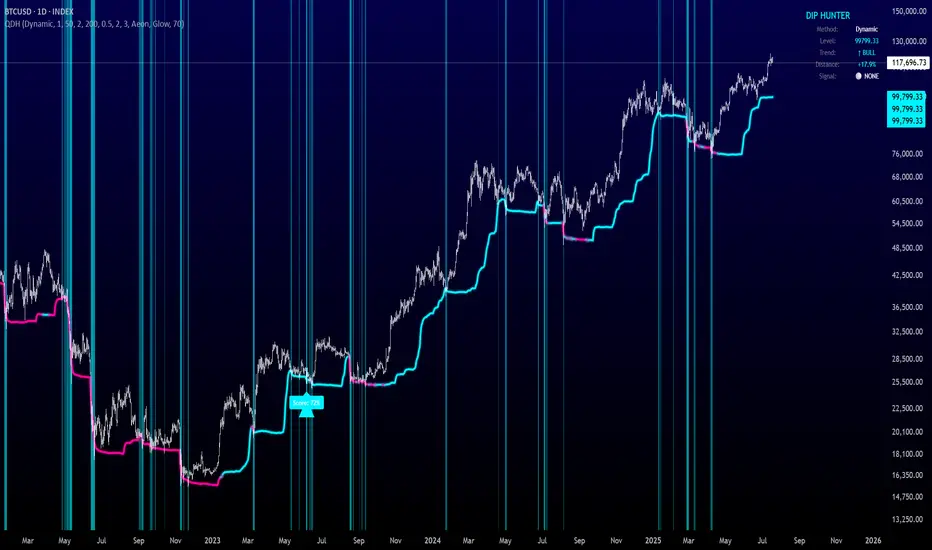

Quantum Dip Hunter | AlphaNatt

🎯 Overview

The Quantum Dip Hunter is an advanced technical indicator designed to identify high-probability buying opportunities when price temporarily dips below dynamic support levels. Unlike simple oversold indicators, this system uses a sophisticated quality scoring algorithm to filter out low-quality dips and highlight only the best entry points.

⚡ Key Features

📊 How It Works

🚀 Detection Methods Explained

Dynamic Support

Fibonacci Support

Volatility Support

Volume Profile Support

Hybrid Mode

⚙️ Key Settings

Dip Detection Engine

Quality Filters

📈 Trading Strategies

Conservative Approach

Aggressive Approach

Scalping Setup

🎨 Visual Customization

Color Themes:

Line Styles:

💡 Pro Tips

⚠️ Important Notes

📊 Statistics Panel

The live statistics panel shows:

🤝 Support

Created by AlphaNatt

For questions or suggestions, please comment below!

Happy dip hunting! 🎯

Not financial advice, always do your own research

🎯 Overview

The Quantum Dip Hunter is an advanced technical indicator designed to identify high-probability buying opportunities when price temporarily dips below dynamic support levels. Unlike simple oversold indicators, this system uses a sophisticated quality scoring algorithm to filter out low-quality dips and highlight only the best entry points.

"Buy the dip" - but only the right dips. Not all dips are created equal.

⚡ Key Features

- 5 Detection Methods: Choose from Dynamic, Fibonacci, Volatility, Volume Profile, or Hybrid modes

- Quality Scoring System: Each dip is scored from 0-100% based on multiple factors

- Smart Filtering: Only signals above your quality threshold are displayed

- Visual Effects: Glow, Pulse, and Wave animations for the support line

- Risk Management: Automatic stop-loss and take-profit calculations

- Real-time Statistics: Live dashboard showing current market conditions

📊 How It Works

- The indicator calculates a dynamic support line using your selected method

- When price dips below this line, it evaluates the dip quality

- Quality score is calculated based on: trend alignment (30%), volume (20%), RSI (20%), momentum (15%), and dip depth (15%)

- If the score exceeds your minimum threshold, a buy signal arrow appears

- Stop-loss and take-profit levels are automatically calculated and displayed

🚀 Detection Methods Explained

Dynamic Support

- Adapts to recent price action

- Best for: Trending markets

- Uses ATR-adjusted lowest points

Fibonacci Support

- Based on 61.8% and 78.6% retracement levels

- Best for: Pullbacks in strong trends

- Automatically switches between fib levels

Volatility Support

- Uses Bollinger Band methodology

- Best for: Range-bound markets

- Adapts to changing volatility

Volume Profile Support

- Finds high-volume price levels

- Best for: Identifying institutional support

- Updates dynamically as volume accumulates

Hybrid Mode

- Combines all methods for maximum accuracy

- Best for: All market conditions

- Takes the most conservative support level

⚙️ Key Settings

Dip Detection Engine

- Detection Method: Choose your preferred support calculation

- Sensitivity: Higher = more sensitive to price movements (0.5-3.0)

- Lookback Period: How far back to analyze (20-200 bars)

- Dip Depth %: Minimum dip size to consider (0.5-10%)

Quality Filters

- Trend Filter: Only buy dips in uptrends when enabled

- Minimum Dip Score: Quality threshold for signals (0-100%)

- Trend Strength: Required trend score when filter is on

📈 Trading Strategies

Conservative Approach

- Use Dynamic method with Trend Filter ON

- Set minimum score to 80%

- Risk:Reward ratio of 2:1 or higher

- Best for: Swing trading

Aggressive Approach

- Use Hybrid method with Trend Filter OFF

- Set minimum score to 60%

- Risk:Reward ratio of 1:1

- Best for: Day trading

Scalping Setup

- Use Volatility method

- Set sensitivity to 2.0+

- Focus on Target 1 only

- Best for: Quick trades

🎨 Visual Customization

Color Themes:

- Neon: Bright cyan/magenta for dark backgrounds

- Ocean: Cool blues and teals

- Solar: Warm yellows and oranges

- Matrix: Classic green terminal look

- Gradient: Smooth color transitions

Line Styles:

- Solid: Clean, simple line

- Glow: Adds depth with glow effect

- Pulse: Animated breathing effect

- Wave: Oscillating wave pattern

💡 Pro Tips

- Start with the Trend Filter ON to avoid catching falling knives

- Higher quality scores (80%+) have better win rates but fewer signals

- Use Volume Profile method near major support/resistance levels

- Combine with your favorite momentum indicator for confirmation

- The pulse animation can help draw attention to key levels

⚠️ Important Notes

- This indicator identifies potential entries, not guaranteed profits

- Always use proper risk management

- Works best on liquid instruments with good volume

- Backtest your settings before live trading

- Not financial advice - use at your own risk

📊 Statistics Panel

The live statistics panel shows:

- Current detection method

- Support level value

- Trend direction

- Distance from support

- Current signal status

🤝 Support

Created by AlphaNatt

For questions or suggestions, please comment below!

Happy dip hunting! 🎯

Not financial advice, always do your own research

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.