OPEN-SOURCE SCRIPT

Aggiornato Bounty Seeker

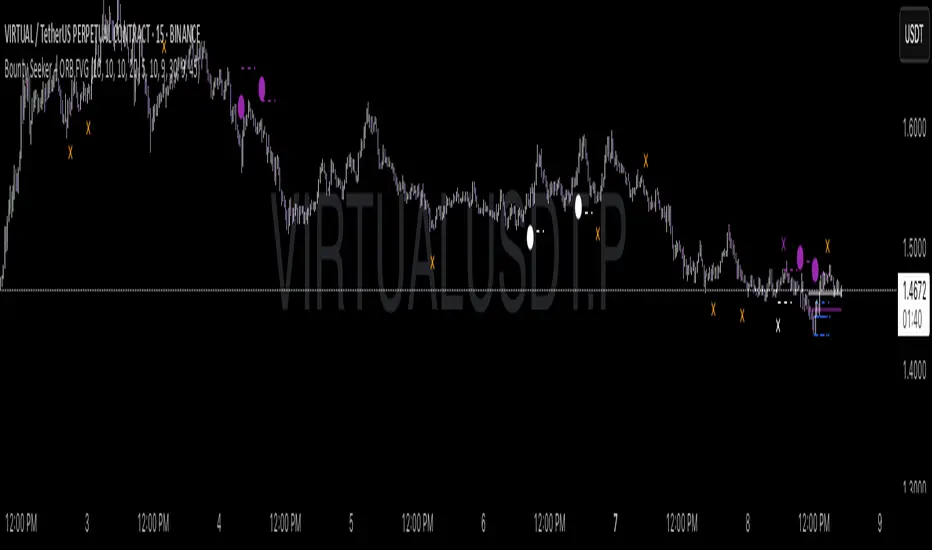

Bounty Seeker - Advanced Market Structure & Order Block Detection

A sophisticated indicator that identifies high-probability reversal zones through the analysis of market structure, volume patterns, and institutional order blocks. This tool helps traders spot potential reversals and fake-outs with precision.

Core Components:

1. Pivot Detection System

• Smart pivot high/low identification

• Volume-enhanced confirmation

• RSI confluence validation

• Real-time market structure analysis

2. Order Block Detection

• Institutional buying/selling zones

• Historical support/resistance levels

• Smart volume threshold analysis

• Dynamic level adaptation

Signal Types:

1. Bull Pivots (White X)

• Strong volume confirmation

• RSI oversold conditions

• Price action validation

• Order block confluence

2. Bear Pivots (Purple X)

• Volume surge confirmation

• RSI overbought alignment

• Bearish price action

• Resistance zone validation

3. Fake Pivots (Orange X)

• Low volume warning signals

• Trap zone identification

• False breakout detection

• Risk management guide

Visual Elements:

• Dashed Lines: Order block zones

• White/Purple X's: Major pivot points

• Orange X's: Potential fake moves

• Dynamic support/resistance levels

Best Usage Practices:

• Most effective on 1H+ timeframes

• Focus on major market pairs

• Wait for complete signal formation

• Combine with trend direction

• Monitor volume confirmation

• Use proper position sizing

The indicator excels at:

1. Identifying potential reversal zones

2. Detecting institutional order blocks

3. Warning of potential fake moves

4. Providing clear entry/exit levels

5. Highlighting strong volume zones

Risk Management:

• Always wait for signal confirmation

• Use appropriate stop loss levels

• Consider multiple timeframe analysis

• Don't trade against major trends

• Monitor volume for validation

This indicator combines advanced market structure analysis with volume profiling to help traders identify high-probability trading opportunities while warning of potential traps and fake-outs.

Note: Past performance does not guarantee future results. Always use proper risk management techniques.

A sophisticated indicator that identifies high-probability reversal zones through the analysis of market structure, volume patterns, and institutional order blocks. This tool helps traders spot potential reversals and fake-outs with precision.

Core Components:

1. Pivot Detection System

• Smart pivot high/low identification

• Volume-enhanced confirmation

• RSI confluence validation

• Real-time market structure analysis

2. Order Block Detection

• Institutional buying/selling zones

• Historical support/resistance levels

• Smart volume threshold analysis

• Dynamic level adaptation

Signal Types:

1. Bull Pivots (White X)

• Strong volume confirmation

• RSI oversold conditions

• Price action validation

• Order block confluence

2. Bear Pivots (Purple X)

• Volume surge confirmation

• RSI overbought alignment

• Bearish price action

• Resistance zone validation

3. Fake Pivots (Orange X)

• Low volume warning signals

• Trap zone identification

• False breakout detection

• Risk management guide

Visual Elements:

• Dashed Lines: Order block zones

• White/Purple X's: Major pivot points

• Orange X's: Potential fake moves

• Dynamic support/resistance levels

Best Usage Practices:

• Most effective on 1H+ timeframes

• Focus on major market pairs

• Wait for complete signal formation

• Combine with trend direction

• Monitor volume confirmation

• Use proper position sizing

The indicator excels at:

1. Identifying potential reversal zones

2. Detecting institutional order blocks

3. Warning of potential fake moves

4. Providing clear entry/exit levels

5. Highlighting strong volume zones

Risk Management:

• Always wait for signal confirmation

• Use appropriate stop loss levels

• Consider multiple timeframe analysis

• Don't trade against major trends

• Monitor volume for validation

This indicator combines advanced market structure analysis with volume profiling to help traders identify high-probability trading opportunities while warning of potential traps and fake-outs.

Note: Past performance does not guarantee future results. Always use proper risk management techniques.

Note di rilascio

Bounty SeekerDescription:

Bounty Seeker is a unique price action and liquidity visualization tool designed to help traders identify high-probability reversal and revisit zones on any market and timeframe. This script combines three advanced concepts—major swing failure patterns (SFPs), significant single prints, and major pivots—into a single, clean, and efficient indicator.

What does it do?

Major SFPs (Swing Failure Patterns):

The script automatically detects and highlights major bullish and bearish SFPs at key support and resistance levels.

Bullish SFPs are shown as white dashed lines at major swing lows, indicating potential areas where price may reverse upward.

Bearish SFPs are shown as purple dashed lines at major swing highs, indicating potential areas where price may reverse downward.

SFPs are only drawn at significant pivots, filtering out noise and focusing on the most actionable levels.

Significant Single Prints:

The script identifies price levels where only a single bar traded at that price within a lookback window (a "single print"), which often act as magnets for future price action.

These are shown as blue dashed lines with moderate opacity and do not extend across the entire chart, keeping the display clean.

Only the most recent and significant single prints are shown, helping traders spot likely revisit zones.

Major Pivots:

The script marks major bullish and bearish pivots with "×" symbols:

White "×" below bars for major bullish pivots (potential support/reversal).

Purple "×" above bars for major bearish pivots (potential resistance/reversal).

Orange "×" for fake-out pivots, helping traders spot potential traps.

How does it work?

SFP Detection:

The script uses a configurable lookback period to find major swing highs and lows. It then checks for price wicks that break these levels but close back inside, confirming a swing failure. Only SFPs with a significant price move and sufficient spacing are shown, ensuring only the most relevant levels are highlighted.

Single Print Detection:

For each bar, the script checks if the high or low is unique within a configurable lookback window. If so, it draws a short blue dashed line at that price, indicating a potential future revisit zone.

Pivot Detection:

Major pivots are detected using a configurable lookback for swing highs/lows and volume/momentum filters. Fake-out pivots are also detected based on low volume and small candle bodies.

Why is it unique?

Noise Filtering:

Unlike most SFP or liquidity indicators, Bounty Seeker only shows the most significant and actionable levels, keeping your chart clean and focused.

Multi-Concept Integration:

By combining SFPs, single prints, and pivots, the script provides a comprehensive view of where price is likely to react, reverse, or revisit.

Customizable and Lightweight:

All lookbacks, line lengths, and opacities are fully adjustable, and the script is optimized for performance.

How to use:

Entry/Exit:

Use the SFP and single print levels as potential entry, exit, or take-profit zones. Watch for price reactions at these lines, especially when confirmed by the "×" pivot markers.

Confluence:

Look for confluence between SFPs, single prints, and pivots for higher-probability trades.

Customization:

Adjust the lookback and line settings to fit your market and timeframe.

Note di rilascio

Changelog for Bounty Seeker + ORB FVGv2.0 – Latest Update

Pivot Signals Improved:

Now only shows pivots at local highs and lows when volume is above average, reducing noise.

Strong pivots (with much higher volume) are shown as circles (●) instead of Xs, so you can spot the most important reversal points at a glance.

Fakeout Detection:

Orange Xs appear for fakeout pivots (low volume, small candle body) to help you avoid false signals.

ATR Filtering:

Pivots are spaced out using a volatility filter, so you don’t get too many signals close together.

ORB (Opening Range Breakout) Lines:

White and purple lines show the high and low of the opening range for each session.

Fair Value Gap (FVG) Highlight:

Pink dotted lines show potential fair value gaps inside the opening range.

How to Use:

White X: Possible bullish reversal (bottom).

Purple X: Possible bearish reversal (top).

White ●: Strong bullish reversal (bottom, high volume).

Purple ●: Strong bearish reversal (top, high volume).

Orange X: Fakeout signal (be careful!).

ORB Lines: Use for breakout or range strategies.

Pink Dots: Watch for price reaction at fair value gaps.

Tip:

Combine these signals with your own strategy and always use risk management.

Note di rilascio

🧾 Golden Pocket Syndicate [GPS] — Official Change LogVersion: v2.0

Updated: July 8, 2025

⸻

🔄 What’s New in This Version

1. ✅ Simplified Bullish/Bearish Signal Logic

• All previously separate signals (WaveTrend divergence, Market Maker reversals, liquidation clusters) have been unified into one clear bullish or bearish print.

• These appear as white diamonds (bullish) and purple diamonds (bearish) at high-confluence reversal zones.

• Signals now only trigger when multiple confluences align, including volume trend, momentum crossovers, and structural breaks.

2. 📈 Print Trail Visualization

• Connected line trails are now drawn between consecutive bullish or bearish diamonds to help track the progression of signal sequences over time.

• White trails connect bullish signals, purple trails connect bearish ones.

• This provides better trend flow context without adding clutter.

3. 🔁 Preserved Original Golden Pocket System

• Daily, weekly, monthly, and yearly golden pocket zones remain unchanged.

• These are auto-calculated based on Fibonacci retracements between swing highs/lows from key timeframes and plotted when price is nearby.

• Colors remain consistent:

• 🟩 Green = Daily/Previous Day

• 🟧 Orange = Weekly/Prev Week

• 🟪 Purple = Monthly/Prev Month

• 🔵 Blue = Yearly

⸻

🧠 How It Works (User-Facing Explanation)

🔹 Signal Prints (White & Purple Diamonds):

• These prints combine multiple layers of logic:

• Momentum reversal via WaveTrend cross

• Market maker trap detection via local price structure

• Volume spike and wick expansion (simulated liquidation clusters)

• White Diamond: High-confidence bullish reversal zone

• Purple Diamond: High-confidence bearish reversal zone

🔸 Print Trails:

• Visually connect sequential signals

• Helps traders identify clean flow setups or trend shift sequences

🔹 Golden Pockets:

• Displays key Fibonacci retracement zones from daily, weekly, monthly, and yearly pivots.

• Used for targeting, support/resistance, or sniper-style entries.

⸻

🧩 Why This Is Useful

• Traders no longer need to interpret multiple separate plots — the GPS system now filters all confluences into one optimized signal per bias.

• The new visuals reduce noise while retaining power behind the scenes.

• Ideal for traders who want cleaner, smarter entry points without sacrificing edge.

⸻

✅ Script Compliance Note

• No mashups or reused code without logic integration.

• This script combines original logic from multiple detection systems into a new unified signal method.

• Descriptions provided help both moderators and users understand what it does, how it works, and how to use it.

Note di rilascio

No new update.Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.