LTPI Global Liquidity | JeffreyTimmermans

The "Long-Term Probability Indicator (LTPI)" on a generic liquidity ticker is a custom-built analytical tool designed to evaluate market conditions over a long-term horizon, with a strong focus on global liquidity trends. By combining six carefully selected input signals into a single probability score, this indicator helps traders and analysts identify prevailing long-term market states: Bullish, Bearish, or Neutral.

Where short-term systems/timeframes react quickly to price fluctuations, LTPI smooths out noise and focuses on the bigger picture, allowing for informed strategic decision-making rather than short-term speculation.

Key Features

Multi-Input Aggregation:

- Uses six independent inputs, each based on long-term liquidity and macro-related data, to generate a composite market probability score.

Long-Term Focus:

- Prioritizes medium-to-long-term trends, ignoring smaller fluctuations that often mislead traders in volatile markets.

Simplified Market States:

Classifies the global market into three primary states:

- Bullish: Favorable liquidity and conditions for long-term risk-taking.

- Bearish: Tightening liquidity and conditions that require caution.

- Neutral: Transitional phases or uncertain conditions.

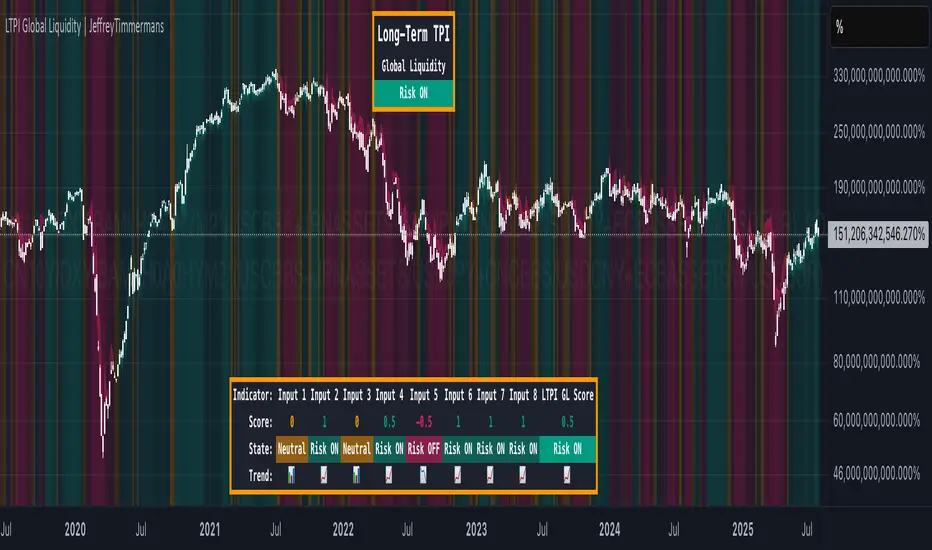

Background Coloring:

- Visual cues on the chart help identify which regime is active at a glance.

Global Liquidity Perspective:

- Designed for use on a generic liquidity ticker, based on M2 money supply, to track macroeconomic liquidity flows and risk appetite.

Dashboard Display:

- A compact on-screen table summarizes all six inputs, their states, and the resulting LTPI score.

Dynamic Alerts:

- Real-time alerts signal when the LTPI shifts from one regime to another.

Inputs & Settings

LTPI Inputs:

- Input Sources (6): Each input is a carefully chosen trend following indicator.

- Weighting: Each input contributes equally to the final score.

Score Calculation:

- Bullish = +1

- Bearish = -1

- Neutral = 0

Color Settings:

- Strong Bullish: Bright Green

- Weak Bullish: Light Green

- Neutral: Gray/Orange

- Weak Bearish: Light Red

- Strong Bearish: Bright Red

(Colors can be customized.)

Calculation Process

Collect Data:

- Six long-term inputs are evaluated at each bar.

Scoring:

- Each input’s state contributes +1 (bullish), -1 (bearish), or around 0 (neutral).

Aggregate Probability:

- The LTPI Score is calculated as the sum of all six scores divided by 6, resulting in a value between -1 and +1.

Market Classification:

- Score > 0.1: Bullish regime

- Score < -0.1: Bearish regime

- -0.1 ≤ Score ≤ 0.1: Neutral

Background Coloring:

- Background colors are applied to highlight the current regime.

How to Use LTPI

Strategic Positioning:

- Bullish: Favor holding or adding to long-term positions.

- Bearish: Reduce risk, protect capital.

- Neutral: Wait for confirmation before making significant moves.

Confirmation Tool:

- LTPI works best when combined with shorter-term indicators like MTPI or trend-following tools to confirm alignment across multiple timeframes.

Dynamic Alerts:

- Bullish Regime Entry: When the LTPI Score crosses above 0.1.

- Bearish Regime Entry: When the LTPI Score crosses below -0.1.

- Neutral Zone: When the score moves back between -0.1 and 0.1.

These alerts help identify significant macro-driven shifts in market conditions.

Conclusion

The Long-Term Probability Indicator (LTPI) is an advanced, liquidity-focused tool for identifying macro-driven market phases. By consolidating six inputs into a single probability score and presenting the results visually, LTPI helps long-term investors and analysts stay aligned with global liquidity trends and avoid being distracted by short-term volatility.

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente JeffreyTimmermans.

TradingView NON consiglia di acquistare o utilizzare uno script a meno che non si abbia piena fiducia nel suo autore e se ne comprenda il funzionamento. È inoltre possibile trovare alternative gratuite e open source nei nostri script della community.

Istruzioni dell'autore

Declinazione di responsabilità

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente JeffreyTimmermans.

TradingView NON consiglia di acquistare o utilizzare uno script a meno che non si abbia piena fiducia nel suo autore e se ne comprenda il funzionamento. È inoltre possibile trovare alternative gratuite e open source nei nostri script della community.