OPEN-SOURCE SCRIPT

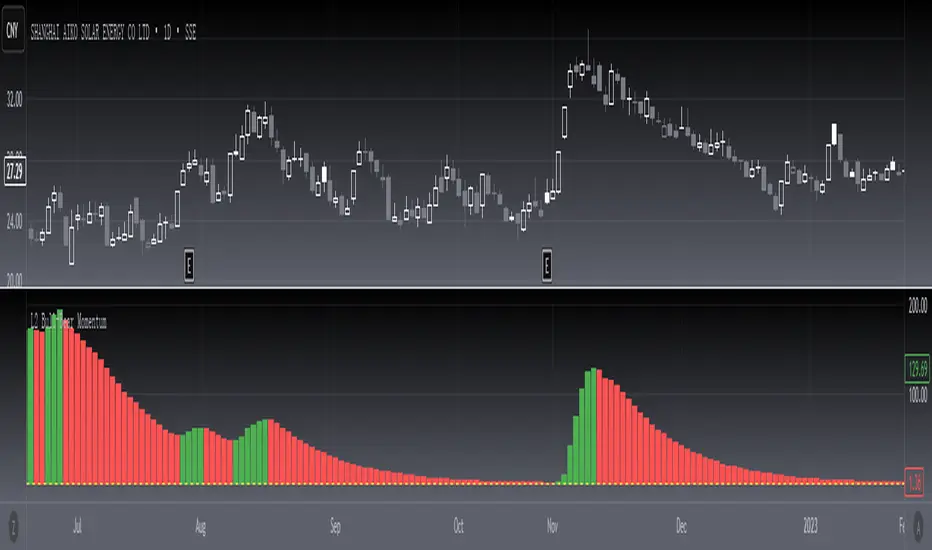

Aggiornato [blackcat] L2 Bull-Bear Momentum

Level 2

Background

Momentum effect is generally called "inertia effect". Momentum effect was proposed by Jegadeesh and Titman (1993), which refers to the tendency of the return rate of the stock to continue the original direction of movement, that is, the return rate of the stock with a higher return rate in the past period will still be higher than the return rate in the past low-yielding stocks.

Function

The Bullish and Bearish Momentum Technical Indicator is a strategy for buying and selling by analyzing the strength and weakness of recent price trends. Traders seek to take advantage of the rising or falling trend of stock prices. When this technical indicator indicates that the stock is entering a strong upward trend, the trader will buy the stock; Will choose to short the stock.

In short, momentum trading is trading with the trend. Momentum trading is based on the idea that if there is enough momentum behind the current price action, it will continue to move in the same direction. When an asset reaches a higher price, it usually attracts more investor attention, driving up the market price. The price rise continues until sellers start to enter the market consistently, and once sellers slowly outpace buyers, momentum weakens and the trend may reverse.

I have not marked special tags for this indicator usage. Users are expected to define according to their own understanding. On the whole, the basic usage is to start long positions when the first green column appears; when the first red column appears, close long positions or open short positions.

Remarks

Feedbacks are appreciated.

Background

Momentum effect is generally called "inertia effect". Momentum effect was proposed by Jegadeesh and Titman (1993), which refers to the tendency of the return rate of the stock to continue the original direction of movement, that is, the return rate of the stock with a higher return rate in the past period will still be higher than the return rate in the past low-yielding stocks.

Function

The Bullish and Bearish Momentum Technical Indicator is a strategy for buying and selling by analyzing the strength and weakness of recent price trends. Traders seek to take advantage of the rising or falling trend of stock prices. When this technical indicator indicates that the stock is entering a strong upward trend, the trader will buy the stock; Will choose to short the stock.

In short, momentum trading is trading with the trend. Momentum trading is based on the idea that if there is enough momentum behind the current price action, it will continue to move in the same direction. When an asset reaches a higher price, it usually attracts more investor attention, driving up the market price. The price rise continues until sellers start to enter the market consistently, and once sellers slowly outpace buyers, momentum weakens and the trend may reverse.

I have not marked special tags for this indicator usage. Users are expected to define according to their own understanding. On the whole, the basic usage is to start long positions when the first green column appears; when the first red column appears, close long positions or open short positions.

Remarks

Feedbacks are appreciated.

Note di rilascio

OVERVIEW The **L2 Bull-Bear Momentum** indicator provides traders with a sophisticated approach to identifying market trends using both bullish and bearish momentum calculations. It combines multiple technical analysis techniques including EMAs, price ranges, and volume-weighted averages to generate accurate trading signals. 📈This advanced indicator uses complex mathematical formulas to detect potential entry points in the market, making it particularly useful for day traders and swing traders looking for precise timing opportunities. The script employs customizable scaling factors to adjust signal sensitivity according to individual trader preferences. ⚙️

FEATURES

• Advanced momentum calculation combining:

Price range analysis

EMA crossovers

Volume-weighted price products

Deviation factors

• Customizable scaling factor for signal adjustment 🔧

• Real-time buy/sell signal generation ✅

• Visual representation through colored columns and labels 🎨

HOW TO USE

Apply the indicator to your chart

Adjust the scaling factor input to fine-tune signal strength

Monitor column colors:

Green columns indicate bullish momentum 👆

Red columns show bearish momentum 👇

Watch for crossover points between green and red zones

Use labeled signals as confirmation points for trades

LIMITATIONS

• May produce false signals during highly volatile periods ⚠️

• Best results on daily charts or higher timeframes

• Requires careful parameter tuning for optimal performance

NOTES

The indicator uses multiple smoothing techniques to reduce noise

Signal strength varies based on market conditions

Always combine with other tools for robust trade decisions

THANKS

Special thanks to the TradingView community for providing inspiration and feedback. This script builds upon shared knowledge from various contributors. 💡

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.