OPEN-SOURCE SCRIPT

Linear Regression Channel [TradingFinder] Existing Trend Line

🔵Introduction

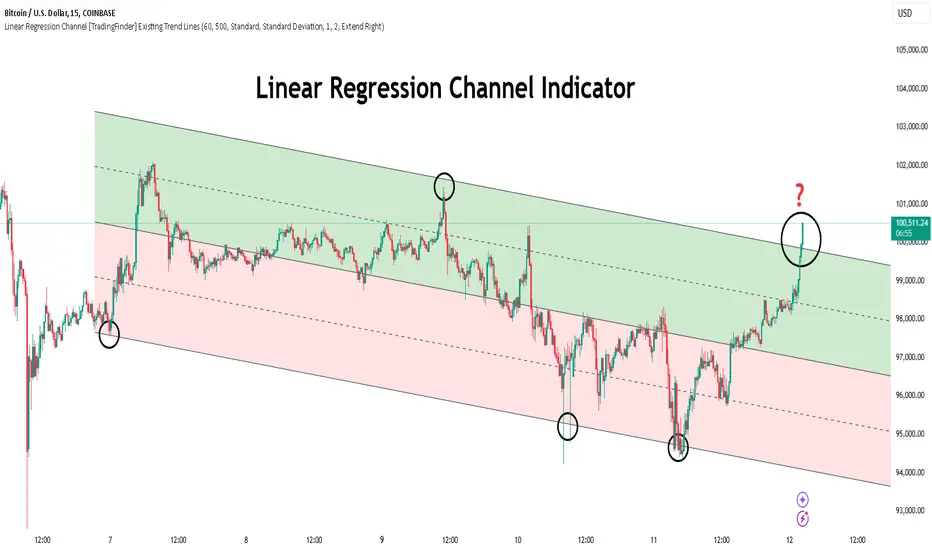

The Linear Regression Channel indicator is one of the technical analysis tool, widely used to identify support, resistance, and analyze upward and downward trends.

The Linear Regression Channel comprises five main components: the midline, representing the linear regression line, and the support and resistance lines, which are calculated based on the distance from the midline using either standard deviation or ATR.

This indicator leverages linear regression to forecast price changes based on historical data and encapsulates price movements within a price channel.

The upper and lower lines of the channel, which define resistance and support levels, assist traders in pinpointing entry and exit points, ultimately aiding better trading decisions.

When prices approach these channel lines, the likelihood of interaction with support or resistance levels increases, and breaking through these lines may signal a price reversal or continuation.

Due to its precision in identifying price trends, analyzing trend reversals, and determining key price levels, the Linear Regression Channel indicator is widely regarded as a reliable tool across financial markets such as Forex, stocks, and cryptocurrencies.

🔵How to Use

🟣Identifying Entry Signals

One of the primary uses of this indicator is recognizing buy signals. The lower channel line acts as a support level, and when the price nears this line, the likelihood of an upward reversal increases.

In an uptrend: When the price approaches the lower channel line and signs of upward reversal (e.g., reversal candlesticks or high trading volume) are observed, it is considered a buy signal.

In a downtrend: If the price breaks the lower channel line and subsequently re-enters the channel, it may signal a trend change, offering a buying opportunity.

🟣Identifying Exit Signals

The Linear Regression Channel is also used to identify sell signals. The upper channel line generally acts as a resistance level, and when the price approaches this line, the likelihood of a price decrease increases.

In an uptrend: Approaching the upper channel line and observing weakness in the uptrend (e.g., declining volume or reversal patterns) indicates a sell signal.

In a downtrend: When the price reaches the upper channel line and reverses downward, this is considered a signal to exit trades.

🟣Analyzing Channel Breakouts

The Linear Regression Channel allows traders to identify price breakouts as strong signals of potential trend changes.

Breaking the upper channel line: Indicates buyer strength and the likelihood of a continued uptrend, often accompanied by increased trading volume.

Breaking the lower channel line: Suggests seller dominance and the possibility of a continued downtrend, providing a strong sell signal.

🟣Mean Reversion Analysis

A key concept in using the Linear Regression Channel is the tendency for prices to revert to the midline of the channel, which acts as a dynamic moving average, reflecting the price's equilibrium over time.

In uptrends: Significant deviations from the midline increase the likelihood of a price retracement toward the midline.

In downtrends: When prices deviate considerably from the midline, a return toward the midline can be used to identify potential reversal points.

🔵Settings

🟣Time Frame

The time frame setting enables users to view higher time frame data on a lower time frame chart. This feature is especially useful for traders employing multi-time frame analysis.

🟣Regression Type

Standard: Utilizes classical linear regression to draw the midline and channel lines.

Advanced: Produces similar results to the standard method but may provide slightly different alignment on the chart.

🟣Scaling Type

Standard Deviation: Suitable for markets with stable volatility.

ATR (Average True Range): Ideal for markets with higher volatility.

🟣Scaling Coefficients

Larger coefficients create broader channels for broader trend analysis.

Smaller coefficients produce tighter channels for precision analysis.

🟣Channel Extension

None: No extension.

Left: Extends lines to the left to analyze historical trends.

Right: Extends lines to the right for future predictions.

Both: Extends lines in both directions.

🔵Conclusion

The Linear Regression Channel indicator is a versatile and powerful tool in technical analysis, providing traders with support, resistance, and midline insights to better understand price behavior. Its advanced settings, including time frame selection, regression type, scaling options, and customizable coefficients, allow for tailored and precise analysis.

One of its standout advantages is its ability to support multi-time frame analysis, enabling traders to view higher time frame data within a lower time frame context. The option to use scaling methods like ATR or standard deviation further enhances its adaptability to markets with varying volatility.

Designed to identify entry and exit signals, analyze mean reversion, and assess channel breakouts, this indicator is suitable for a wide range of markets, including Forex, stocks, and cryptocurrencies. By incorporating this tool into your trading strategy, you can make more informed decisions and improve the accuracy of your market predictions.

The Linear Regression Channel indicator is one of the technical analysis tool, widely used to identify support, resistance, and analyze upward and downward trends.

The Linear Regression Channel comprises five main components: the midline, representing the linear regression line, and the support and resistance lines, which are calculated based on the distance from the midline using either standard deviation or ATR.

This indicator leverages linear regression to forecast price changes based on historical data and encapsulates price movements within a price channel.

The upper and lower lines of the channel, which define resistance and support levels, assist traders in pinpointing entry and exit points, ultimately aiding better trading decisions.

When prices approach these channel lines, the likelihood of interaction with support or resistance levels increases, and breaking through these lines may signal a price reversal or continuation.

Due to its precision in identifying price trends, analyzing trend reversals, and determining key price levels, the Linear Regression Channel indicator is widely regarded as a reliable tool across financial markets such as Forex, stocks, and cryptocurrencies.

🔵How to Use

🟣Identifying Entry Signals

One of the primary uses of this indicator is recognizing buy signals. The lower channel line acts as a support level, and when the price nears this line, the likelihood of an upward reversal increases.

In an uptrend: When the price approaches the lower channel line and signs of upward reversal (e.g., reversal candlesticks or high trading volume) are observed, it is considered a buy signal.

In a downtrend: If the price breaks the lower channel line and subsequently re-enters the channel, it may signal a trend change, offering a buying opportunity.

🟣Identifying Exit Signals

The Linear Regression Channel is also used to identify sell signals. The upper channel line generally acts as a resistance level, and when the price approaches this line, the likelihood of a price decrease increases.

In an uptrend: Approaching the upper channel line and observing weakness in the uptrend (e.g., declining volume or reversal patterns) indicates a sell signal.

In a downtrend: When the price reaches the upper channel line and reverses downward, this is considered a signal to exit trades.

🟣Analyzing Channel Breakouts

The Linear Regression Channel allows traders to identify price breakouts as strong signals of potential trend changes.

Breaking the upper channel line: Indicates buyer strength and the likelihood of a continued uptrend, often accompanied by increased trading volume.

Breaking the lower channel line: Suggests seller dominance and the possibility of a continued downtrend, providing a strong sell signal.

🟣Mean Reversion Analysis

A key concept in using the Linear Regression Channel is the tendency for prices to revert to the midline of the channel, which acts as a dynamic moving average, reflecting the price's equilibrium over time.

In uptrends: Significant deviations from the midline increase the likelihood of a price retracement toward the midline.

In downtrends: When prices deviate considerably from the midline, a return toward the midline can be used to identify potential reversal points.

🔵Settings

🟣Time Frame

The time frame setting enables users to view higher time frame data on a lower time frame chart. This feature is especially useful for traders employing multi-time frame analysis.

🟣Regression Type

Standard: Utilizes classical linear regression to draw the midline and channel lines.

Advanced: Produces similar results to the standard method but may provide slightly different alignment on the chart.

🟣Scaling Type

Standard Deviation: Suitable for markets with stable volatility.

ATR (Average True Range): Ideal for markets with higher volatility.

🟣Scaling Coefficients

Larger coefficients create broader channels for broader trend analysis.

Smaller coefficients produce tighter channels for precision analysis.

🟣Channel Extension

None: No extension.

Left: Extends lines to the left to analyze historical trends.

Right: Extends lines to the right for future predictions.

Both: Extends lines in both directions.

🔵Conclusion

The Linear Regression Channel indicator is a versatile and powerful tool in technical analysis, providing traders with support, resistance, and midline insights to better understand price behavior. Its advanced settings, including time frame selection, regression type, scaling options, and customizable coefficients, allow for tailored and precise analysis.

One of its standout advantages is its ability to support multi-time frame analysis, enabling traders to view higher time frame data within a lower time frame context. The option to use scaling methods like ATR or standard deviation further enhances its adaptability to markets with varying volatility.

Designed to identify entry and exit signals, analyze mean reversion, and assess channel breakouts, this indicator is suitable for a wide range of markets, including Forex, stocks, and cryptocurrencies. By incorporating this tool into your trading strategy, you can make more informed decisions and improve the accuracy of your market predictions.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

💎Get instant (Demo/Vip) access here: tradingFinder.com/

✅Get access to our support team: t.me/TFLABS

🧠Free Forex, Crypto & Stock Trading tutorial, same as ICT, Smart Money & Price Action:

tradingfinder.com/education/forex/

✅Get access to our support team: t.me/TFLABS

🧠Free Forex, Crypto & Stock Trading tutorial, same as ICT, Smart Money & Price Action:

tradingfinder.com/education/forex/

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

💎Get instant (Demo/Vip) access here: tradingFinder.com/

✅Get access to our support team: t.me/TFLABS

🧠Free Forex, Crypto & Stock Trading tutorial, same as ICT, Smart Money & Price Action:

tradingfinder.com/education/forex/

✅Get access to our support team: t.me/TFLABS

🧠Free Forex, Crypto & Stock Trading tutorial, same as ICT, Smart Money & Price Action:

tradingfinder.com/education/forex/

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.