OPEN-SOURCE SCRIPT

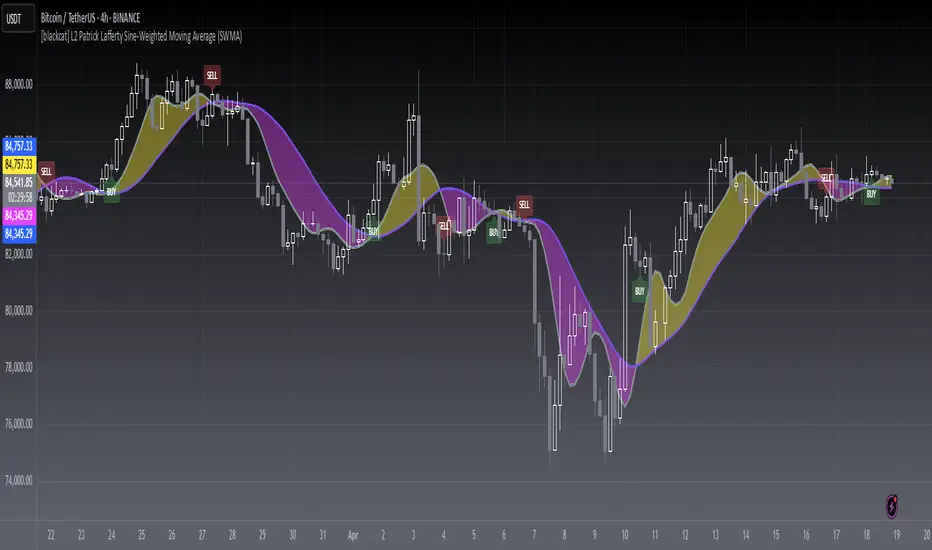

Aggiornato [blackcat] L2 Sine-Weighted Moving Average (SWMA)

Level: 2

Background

Invented by Patrick Lafferty in 1999, a Sine Weighted Moving Average (SWMA) takes its weighting from the first half of a Sine wave cycle and accordingly, the most weighting is given to the data in the middle of the data set. It is therefore very similar to the Triangular Moving Average.

Function

A sine weighted moving average (Sine-MA) applies weights to each bar in the shape of the bulge in a sine curve from 0 to pi. For an N-bar average the weightings are

/ 1 \ / 2 \ / N \

sin | --- * pi |, sin | --- * pi |, ..., sin | --- * pi |

\ N+1 / \ N+1 / \ N+1 /

The effect is that middle prices have the greatest weight (much like the TMA, Triangular Moving Average). A Sine Weighted Moving Average ( Sine WMA ) takes its weighting from the first half of a Sine wave cycle and accordingly, the most weighting is given to the data in the middle of the data set.

Key Signal

SWMA(FastLength) --> SWMA Fast Line.

SWMA(SlowLength) --> SWMA Slow Line.

Remarks

This is a Level 2 free and open source indicator.

Feedbacks are appreciated.

Background

Invented by Patrick Lafferty in 1999, a Sine Weighted Moving Average (SWMA) takes its weighting from the first half of a Sine wave cycle and accordingly, the most weighting is given to the data in the middle of the data set. It is therefore very similar to the Triangular Moving Average.

Function

A sine weighted moving average (Sine-MA) applies weights to each bar in the shape of the bulge in a sine curve from 0 to pi. For an N-bar average the weightings are

/ 1 \ / 2 \ / N \

sin | --- * pi |, sin | --- * pi |, ..., sin | --- * pi |

\ N+1 / \ N+1 / \ N+1 /

The effect is that middle prices have the greatest weight (much like the TMA, Triangular Moving Average). A Sine Weighted Moving Average ( Sine WMA ) takes its weighting from the first half of a Sine wave cycle and accordingly, the most weighting is given to the data in the middle of the data set.

Key Signal

SWMA(FastLength) --> SWMA Fast Line.

SWMA(SlowLength) --> SWMA Slow Line.

Remarks

This is a Level 2 free and open source indicator.

Feedbacks are appreciated.

Note di rilascio

**OVERVIEW**This indicator implements Patrick Lafferty's Sine-Weighted Moving Average (SWMA), a sophisticated technical analysis tool designed to filter out noise while maintaining sensitivity to price movements 📈📉. It utilizes a unique sine-weighting algorithm to assign varying importance to different time periods within each calculation window ⚖️.

The script features dual-timeframe averaging capabilities through adjustable fast and slow periods, creating clear visual signals for trend identification and potential entry points 🔄.

FEATURES

• Customizable Price Source selection [bold]close, open, high, or low[/bold]

• Adjustable Fast & Slow Periods with default values set at 8 and 21 respectively

• Visually striking crossover/crossunder alerts using BUY/SSELL labels ❗

• Real-time histogram coloring reflecting relative position of indicators ✨

• Alert functionality for automated trade notifications 🔔

HOW TO USE

Add the indicator to your chart using the "Add Strategy" button ➕

Adjust the timeframe settings as per your trading strategy requirements 🎯

Monitor the interaction between the yellow (fast) and purple (slow) lines

Watch for crossovers: • Green UPWARD arrows indicate potential buying opportunities 💰 • Red DOWNWARD arrows suggest possible selling moments 📉

TIPS AND NOTES

• Higher period lengths will produce smoother signals but may lag more during volatile markets ⏳

• Lower period lengths increase responsiveness but might generate false signals in choppy environments 😐

• Ideal for both intraday scalping and medium-term swing trading strategies 📊

• Consider combining with volume indicators for enhanced accuracy ✅

LIMITATIONS

⚠️ No built-in stop-loss management

⚠️ Does not account for market depth/volume effects

⚠️ Performance may vary across different asset classes

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.