PROTECTED SOURCE SCRIPT

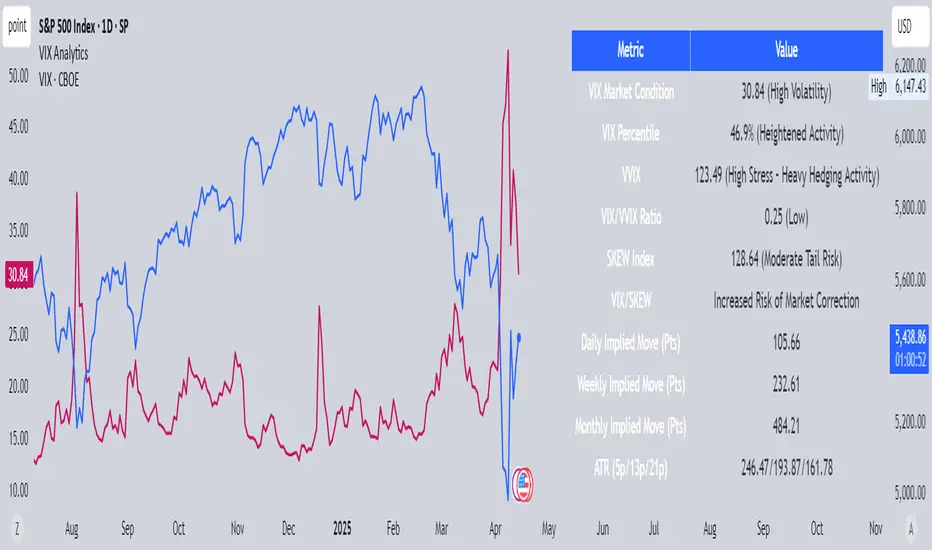

VIX Analytics

This script is designed to serve traders, analysts, and investors who want a real-time, comprehensive view of market volatility, risk sentiment, and implied movements. It combines multiple institutional-grade volatility indices into one clear dashboard and interprets them with actionable insights — directly on your chart.

🔍 Features Included

🟦VIX (CBOE Volatility Index)

Measures market expectation of 30-day S&P 500 volatility.

Color-coded interpretation ranges:

Under 13: Extreme Complacency

15–20: Stable Market

20–30: Moderate Risk

30–40: High Volatility

Over 40: Panic

🟪 VVIX (Volatility of Volatility Index)

Tracks the volatility of VIX itself.

Interpreted as a risk gauge of how aggressively traders are hedging volatility exposure.

Under 80: Market Complacency

80–100: Normal Environment

100–120: Caution — Rising Volatility of Volatility

Over 120: High Stress — Elevated Hedging Activity

🟨 SKEW Index

Measures the perceived tail risk of the S&P 500 — i.e., the probability of a black swan event.

Below 110: Potential Complacency

120–140: Moderate Tail Risk

Above 140: High Tail Risk

🧮 VIX/VVIX Ratio

Gauges relative fear levels between expected volatility and the volatility of volatility.

Under 0.5: Low Ratio — VVIX Overextended

Over 0.9: High Ratio — VIX Leading

📈 VIX Percentile (1-Year Range)

Shows where the current VIX sits relative to its 1-year high/low.

Under 20%: Volatility is Cheap

Over 70%: Fear is Elevated — Reversal Possible

📉 SPX Implied Point Moves

Projects expected moves in SPX using VIX-derived volatility:

Daily

Weekly

Monthly

Helps size positions or define expected price ranges based on volatility regime.

📊 ATR Values (5, 13, 21 periods)

Traditional volatility using historical prices.

Provided alongside implied data for comparison.

🧠 Unique Logic & Interpretation Layer

This script doesn’t just show raw data — it interprets it. It reads the relationship between VIX, VVIX, and SKEW to highlight:

When market volatility may be underpriced

When hidden tail risks are forming

When to be cautious of volatility expansions

How current implied movement compares to past realized volatility

✅ Use Cases

Day traders: Know when volatility is low or expanding before scalping or swinging.

Options traders: Identify whether implied volatility is cheap or expensive.

Portfolio managers: Gauge when hedging is in demand and adjust exposure.

Risk managers: Crosscheck if current volatility aligns with macro risk events.

⚙️ Settings

Customizable table placement: Move the dashboard to any corner of your chart.

No repainting or lag: Data updates in real-time using official CBOE and SPX feeds.

🔍 Features Included

🟦VIX (CBOE Volatility Index)

Measures market expectation of 30-day S&P 500 volatility.

Color-coded interpretation ranges:

Under 13: Extreme Complacency

15–20: Stable Market

20–30: Moderate Risk

30–40: High Volatility

Over 40: Panic

🟪 VVIX (Volatility of Volatility Index)

Tracks the volatility of VIX itself.

Interpreted as a risk gauge of how aggressively traders are hedging volatility exposure.

Under 80: Market Complacency

80–100: Normal Environment

100–120: Caution — Rising Volatility of Volatility

Over 120: High Stress — Elevated Hedging Activity

🟨 SKEW Index

Measures the perceived tail risk of the S&P 500 — i.e., the probability of a black swan event.

Below 110: Potential Complacency

120–140: Moderate Tail Risk

Above 140: High Tail Risk

🧮 VIX/VVIX Ratio

Gauges relative fear levels between expected volatility and the volatility of volatility.

Under 0.5: Low Ratio — VVIX Overextended

Over 0.9: High Ratio — VIX Leading

📈 VIX Percentile (1-Year Range)

Shows where the current VIX sits relative to its 1-year high/low.

Under 20%: Volatility is Cheap

Over 70%: Fear is Elevated — Reversal Possible

📉 SPX Implied Point Moves

Projects expected moves in SPX using VIX-derived volatility:

Daily

Weekly

Monthly

Helps size positions or define expected price ranges based on volatility regime.

📊 ATR Values (5, 13, 21 periods)

Traditional volatility using historical prices.

Provided alongside implied data for comparison.

🧠 Unique Logic & Interpretation Layer

This script doesn’t just show raw data — it interprets it. It reads the relationship between VIX, VVIX, and SKEW to highlight:

When market volatility may be underpriced

When hidden tail risks are forming

When to be cautious of volatility expansions

How current implied movement compares to past realized volatility

✅ Use Cases

Day traders: Know when volatility is low or expanding before scalping or swinging.

Options traders: Identify whether implied volatility is cheap or expensive.

Portfolio managers: Gauge when hedging is in demand and adjust exposure.

Risk managers: Crosscheck if current volatility aligns with macro risk events.

⚙️ Settings

Customizable table placement: Move the dashboard to any corner of your chart.

No repainting or lag: Data updates in real-time using official CBOE and SPX feeds.

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarle liberamente e senza alcuna limitazione – ulteriori informazioni qui.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarle liberamente e senza alcuna limitazione – ulteriori informazioni qui.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.