OPEN-SOURCE SCRIPT

KEMAD | QuantumResearch

QuantumResearch KEMAD Indicator

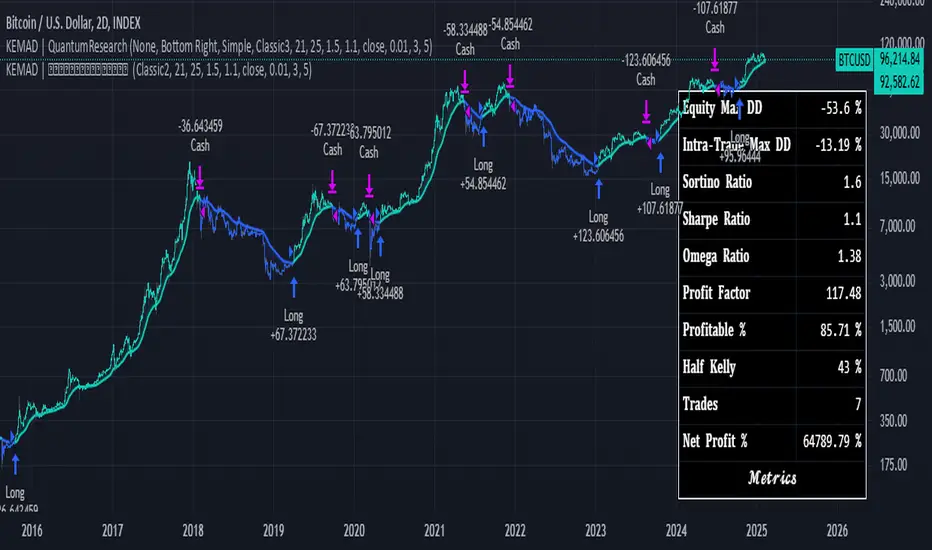

The QuantumResearch KEMAD Indicator is a sophisticated trend-following and volatility-based tool designed for traders who demand precision in detecting market trends and price reversals. By leveraging advanced techniques implemented in PineScript, this indicator integrates a Kalman filter, an Exponential Moving Average (EMA), and dynamic ATR-based deviation bands to produce clear, actionable trading signals.

1. Overview

The KEMAD Indicator aims to:

2. How It Works

A. Kalman Filter Smoothing

B. EMA-Based Trend Detection

C. ATR Deviation Bands

3. Visual Representation

The indicator’s design emphasizes clarity and ease of use:

4. Customization & Parameters

5. Trading Applications

6.Final Thoughts

The QuantumResearch KEMAD Indicator is a sophisticated trend-following and volatility-based tool designed for traders who demand precision in detecting market trends and price reversals. By leveraging advanced techniques implemented in PineScript, this indicator integrates a Kalman filter, an Exponential Moving Average (EMA), and dynamic ATR-based deviation bands to produce clear, actionable trading signals.

1. Overview

The KEMAD Indicator aims to:

- Reduce Market Noise: Employ a Kalman filter to smooth price data.

- Identify Trends: Use an EMA of the filtered price to define the prevailing market direction.

- Set Dynamic Thresholds: Adjust breakout levels with ATR-based deviation bands.

- Generate Signals: Provide clear long and short trading signals along with intuitive visual cues.

2. How It Works

A. Kalman Filter Smoothing

- Purpose: The Kalman filter refines the selected price source (e.g., close price) by reducing short-term fluctuations, thus offering a clearer view of the underlying price movement.

- Customization: Users can adjust key parameters such as:

- Process Noise: Controls the filter’s sensitivity to recent changes.

- Measurement Noise: Determines how responsive the filter is to incoming price data.

- Filter Order: Sets the number of data points considered in the smoothing process.

B. EMA-Based Trend Detection

- Primary Trend EMA: A 25-period EMA is applied to the Kalman-filtered price, serving as the core trend indicator.

- Signal Mechanism:

- Long Signal: Triggered when the price exceeds the EMA plus an ATR-based upper deviation.

- Short Signal: Triggered when the price falls below the EMA minus an ATR-based lower deviation.

- Long Signal: Triggered when the price exceeds the EMA plus an ATR-based upper deviation.

C. ATR Deviation Bands

- ATR Utilization: The Average True Range (ATR) is computed (default length of 21) to assess market volatility.

- Dynamic Thresholds:

- Upper Deviation: Calculated by adding 1.5× ATR to the EMA (for long signals).

- Lower Deviation: Calculated by subtracting 1.1× ATR from the EMA (for short signals).

- These bands adapt to current volatility, ensuring that signal thresholds are both dynamic and market-sensitive.

- Upper Deviation: Calculated by adding 1.5× ATR to the EMA (for long signals).

3. Visual Representation

The indicator’s design emphasizes clarity and ease of use:

- Color-Coded Bar Signals:

- Green Bars: Indicate bullish conditions when a long signal is active.

- Red Bars: Indicate bearish conditions when a short signal is active.

- Trend Confirmation Line: A 54-period EMA is plotted to further validate trend direction. Its color dynamically changes to reflect the active trend.

- Background Fill: The space between a calculated price midpoint (typically the average of high and low) and the EMA is filled, visually emphasizing the prevailing market trend.

- Green Bars: Indicate bullish conditions when a long signal is active.

4. Customization & Parameters

- The KEMAD Indicator is highly configurable, allowing traders to tailor the tool to their specific trading strategies and market conditions:

- ATR Settings:

ATR Length: Default is 21; adjusts sensitivity to market volatility. - EMA Settings:

Trend EMA Length: Default is 25; smooths price action for trend detection. - Confirmation EMA Length: Default is 54; aids in confirming the trend.

- Kalman Filter Parameters:

Process Noise: Default is 0.01.

Measurement Noise: Default is 3.0.

Filter Order: Default is 5. - Deviation Multipliers:

Long Signal Multiplier: Default is 1.5× ATR.

Short Signal Multiplier: Default is 1.1× ATR. - Appearance: Eight customizable color themes are available to suit individual visual preferences.

- ATR Settings:

5. Trading Applications

- The versatility of the KEMAD Indicator makes it suitable for various trading strategies:

- Trend Following: It helps identify and ride sustained bullish or bearish trends by filtering out market noise.

Breakout Trading: Detects when prices move beyond the ATR-based deviation bands, signaling potential breakout opportunities. - Reversal Detection: Alerts traders to potential trend reversals when price crosses the dynamically smoothed EMA.

- Risk Management: Offers clearly defined entry and exit points, based on volatility-adjusted thresholds, enhancing trade precision and risk control.

6.Final Thoughts

- The QuantumResearch KEMAD Indicator represents a unique blend of advanced filtering (via the Kalman filter), robust trend analysis (using EMAs), and dynamic volatility assessment (through ATR deviation bands).

- Its PineScript implementation allows for a high degree of customization, making it an invaluable tool for traders looking to reduce noise, accurately detect trends, and manage risk effectively.

- Whether used for trend following, breakout strategies, or reversal detection, the KEMAD Indicator is designed to adapt to varying market conditions and trading styles.

- Important Disclaimer: Past data does not predict future behavior. This indicator is provided for informational purposes only; no indicator or strategy can guarantee future results. Always perform thorough analysis and use proper risk management before trading.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

🌐 Gain access to our cutting-edge tools:

whop.com/quantum-whop/

⚒️ Get access to our toolbox here for free:

quantumresearchportfolio.carrd.co

All tools and content provided are for informational and educational purposes only.

whop.com/quantum-whop/

⚒️ Get access to our toolbox here for free:

quantumresearchportfolio.carrd.co

All tools and content provided are for informational and educational purposes only.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

🌐 Gain access to our cutting-edge tools:

whop.com/quantum-whop/

⚒️ Get access to our toolbox here for free:

quantumresearchportfolio.carrd.co

All tools and content provided are for informational and educational purposes only.

whop.com/quantum-whop/

⚒️ Get access to our toolbox here for free:

quantumresearchportfolio.carrd.co

All tools and content provided are for informational and educational purposes only.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.