OPEN-SOURCE SCRIPT

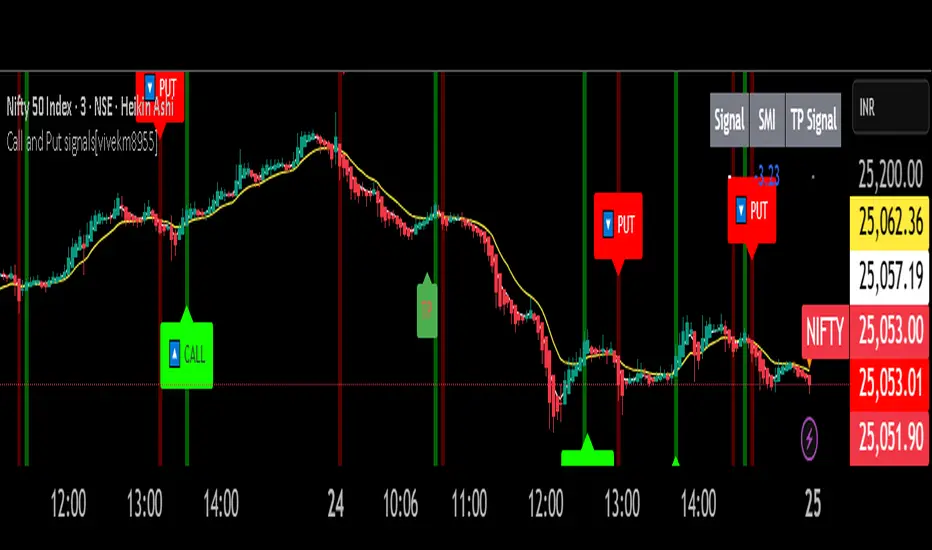

Call and Put signals[vivekm8955]

🔍 Strategy Overview

This adaptive strategy generates clear CALL (Buy) and PUT (Sell) signals by combining:

✅ Dual EMA structure

✅ Heikin Ashi trend confirmation

✅ Smoothed Stochastic Momentum Index (SMI)

✅ Take Profit (TP) signals via momentum reversal

✅ Dynamic support from average price action

The goal: Give retail traders institutional-grade signals with clarity, without lag.

📊 Trade Entry Logic

🔼 CALL Signal (Buy):

Fast EMA < Avg Price

Slow EMA < Avg Price

Slow EMA < Fast EMA

Confirmed by crossover

➡️ This implies price has dipped below value zones and is showing strength.

🔽 PUT Signal (Sell):

Fast EMA > Avg Price

Slow EMA > Avg Price

Slow EMA > Fast EMA

Confirmed by crossover

➡️ Indicates price is elevated and showing weakness.

🏁 Exit Logic (Take Profit)

✅ TP Buy Signal: SMI crosses below 0 → Weakening upside

✅ TP Sell Signal: SMI crosses above 0 → Weakening downside

These act as exit cues or partial booking areas.

📌 Visualization & Alerts

🔼 CALL Signal → Green label below candle

🔽 PUT Signal → Red label above candle

✅ TP Signal → Small label (TP) showing ideal exit points

🔔 Real-time alerts enabled (CALL, PUT, TP alerts)

Background color changes based on EMA crossovers for added confirmation.

🕯️ Additional Filters Used

Heikin Ashi Candles: For smoothing out noise and validating trends.

SMI (Double EMA): A momentum indicator better suited for trending markets.

📈 Dashboard Included

Displays current signal, SMI value, and TP status in real-time

Color-coded for easy interpretation

Auto-adaptive table (fixes out-of-bound issues)

📎 Ideal Timeframes

Timeframe Use Case

5m – 15m Intraday Scalping

1h – 4h Swing Trading

1D Positional Plays

🚦 Suggested Usage

Step Action

1️⃣ Confirm signal (CALL or PUT) on 1TF and 1 higher TF

2️⃣ Enter near signal candle close

3️⃣ Exit on TP label OR SMI reversal

4️⃣ Avoid entry during high volatility news events

⚠️ Disclaimer – Use with Caution!

⚠️ This script is for educational & analytical purposes only.

It does NOT guarantee profits, nor is it a financial advisory tool.

Always use risk management: Stop-losses, position sizing, capital preservation.

Do not trade blindly. Backtest it across market conditions.

Past performance is not indicative of future results.

Consult a SEBI-registered advisor for real trading decisions.

This adaptive strategy generates clear CALL (Buy) and PUT (Sell) signals by combining:

✅ Dual EMA structure

✅ Heikin Ashi trend confirmation

✅ Smoothed Stochastic Momentum Index (SMI)

✅ Take Profit (TP) signals via momentum reversal

✅ Dynamic support from average price action

The goal: Give retail traders institutional-grade signals with clarity, without lag.

📊 Trade Entry Logic

🔼 CALL Signal (Buy):

Fast EMA < Avg Price

Slow EMA < Avg Price

Slow EMA < Fast EMA

Confirmed by crossover

➡️ This implies price has dipped below value zones and is showing strength.

🔽 PUT Signal (Sell):

Fast EMA > Avg Price

Slow EMA > Avg Price

Slow EMA > Fast EMA

Confirmed by crossover

➡️ Indicates price is elevated and showing weakness.

🏁 Exit Logic (Take Profit)

✅ TP Buy Signal: SMI crosses below 0 → Weakening upside

✅ TP Sell Signal: SMI crosses above 0 → Weakening downside

These act as exit cues or partial booking areas.

📌 Visualization & Alerts

🔼 CALL Signal → Green label below candle

🔽 PUT Signal → Red label above candle

✅ TP Signal → Small label (TP) showing ideal exit points

🔔 Real-time alerts enabled (CALL, PUT, TP alerts)

Background color changes based on EMA crossovers for added confirmation.

🕯️ Additional Filters Used

Heikin Ashi Candles: For smoothing out noise and validating trends.

SMI (Double EMA): A momentum indicator better suited for trending markets.

📈 Dashboard Included

Displays current signal, SMI value, and TP status in real-time

Color-coded for easy interpretation

Auto-adaptive table (fixes out-of-bound issues)

📎 Ideal Timeframes

Timeframe Use Case

5m – 15m Intraday Scalping

1h – 4h Swing Trading

1D Positional Plays

🚦 Suggested Usage

Step Action

1️⃣ Confirm signal (CALL or PUT) on 1TF and 1 higher TF

2️⃣ Enter near signal candle close

3️⃣ Exit on TP label OR SMI reversal

4️⃣ Avoid entry during high volatility news events

⚠️ Disclaimer – Use with Caution!

⚠️ This script is for educational & analytical purposes only.

It does NOT guarantee profits, nor is it a financial advisory tool.

Always use risk management: Stop-losses, position sizing, capital preservation.

Do not trade blindly. Backtest it across market conditions.

Past performance is not indicative of future results.

Consult a SEBI-registered advisor for real trading decisions.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.