OPEN-SOURCE SCRIPT

Aggiornato Egg vs Tennis Ball — Drop/Rebound Strength

Egg vs Tennis Ball — Drop/Rebound Meter

What it does

Classifies selloffs as either:

Core features

Visuals at a glance

How the decision is made

Scoring system (−100 to +100)

Meter Table

Columns (toggle on/off)

Rows

Alerts

Inputs

① Drop Detection

② Bounce Requirement

③ Timing

④ Display

⑤ Meter Columns

⑥ Scoring Weights

How to use it

Tips

Defaults

Interpreting results

What it does

Classifies selloffs as either:

- []Eggs — dead‑cat, no bounce

[]Tennis Balls — fast, decisive rebound

Core features

- []Detects swing drops from a Pivot High (PH) to a Pivot Low (PL)

[]Requires drops to be meaningful (volatility‑aware, ATR‑scaled)

[]Draws a bounce threshold line and a deadline

[]Decides outcome based on speed and extent of rebound

[]Tracks scores and win rates across multiple lookback windows

[]Includes a color‑coded meter and current streak display

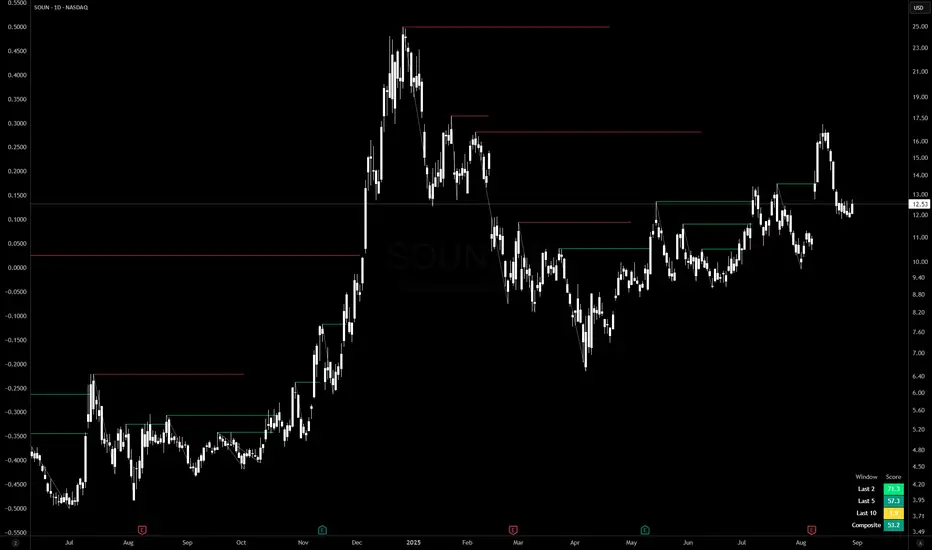

Visuals at a glance

- []Gray diagonal — drop from PH to PL

[]Teal dotted horizontal — bounce threshold, from PH to the deadline

[]Solid green — Tennis Ball (bounce line broken before the deadline)

[]Solid red — Egg (deadline expired before the bounce) - Optional PH / PL labels for clarity

How the decision is made

- []1) Find pivots — symmetric pivots using Pivot Left / Right; PL confirms after Right bars.

[]2) Qualify the drop — Drop Size = PH − PL; must be ≥ (Drop Threshold × ATR at PL).

[]3) Define the bounce line — PL + (Bounce Multiple × Drop Size). 1.00× = full retrace to PH; up to 2.00× for overshoot.

[]4) Set the deadline — Drop Bars = PL index − PH index; Deadline = Drop Bars × Recovery Factor; timer starts from PH or PL. - 5) Resolve — Tennis Ball if price hits the bounce line before the deadline; Egg if the deadline passes first.

Scoring system (−100 to +100)

- []+100 = perfect Tennis Ball (fastest possible + full overshoot)

[]−100 = perfect Egg (no recovery) - In between: scored by rebound speed and extent, shaped by your weight settings

Meter Table

Columns (toggle on/off)

- []All (off by default)

[]Last N1 (default 5)

[]Last N2 (default 10)

[]Last N3 (default 20)

Rows

- []Tennis / Eggs — counts

[]% Tennis — win rate

[]Avg Score — normalized quality from −100 to +100

[]Streak — overall (not windowed), e.g., +3 = 3 Tennis Balls in a row, −4 = 4 Eggs in a row

Alerts

- []Tennis Ball – Fast Rebound — triggers when the bounce line is broken in time

[]Egg – Window Expired — triggers when the deadline passes without a bounce

Inputs

① Drop Detection

- []Pivot Left / Right

[]ATR Length - Drop Threshold × ATR

② Bounce Requirement

- Bounce Multiple × Drop Size (0.10–2.00×)

③ Timing

- []Timer Start — PH or PL

[]Recovery Factor × Drop Bars - Break Trigger — Close or High

④ Display

- []Show Pivot/Outcome Labels

[]Line Width - Table Position (corner)

⑤ Meter Columns

- []Show All (off by default)

[]Show N1 / N2 / N3 (5, 10, 20 by default)

⑥ Scoring Weights

- []Tennis — Base, Speed, Extent

[]Egg — Base, Strength

How to use it

- []Pick strictness — start with Drop Threshold = 2.0 ATR, Bounce Multiple = 1.0×, Recovery Factor = 3.0×; adjust to timeframe and volatility.

[]Watch the dotted line — it ends at the deadline; turns solid green (Tennis) if broken in time, solid red (Egg) if it expires.

[]Read the meter — short windows (5–10) show current behavior; Avg Score captures quality; Streak shows momentum.

[]Blend with your system — combine with trend filters, volume, or regime detection.

Tips

- []Close vs High trigger: Close is stricter; High is more responsive.

[]PH vs PL timer start: PH measures round‑trip; PL measures recovery only.

[]Increase pivot strength for fewer, more reliable signals.

[]Higher timeframes generally produce cleaner patterns.

Defaults

- []Pivot L/R: 5 / 5

[]ATR Length: 14

[]Drop Threshold: 2.0× ATR

[]Bounce Multiple: 1.00×

[]Recovery Factor: 3.0×

[]Break Trigger: Close - Windows: Last 5, 10, 20 (All off)

Interpreting results

- []Tennis‑y: Avg Score +30 to +70, %Tennis > 55%

[]Mixed: Avg Score near 0 - Egg‑y: Avg Score −30 to −80, %Tennis < 45%

Note di rilascio

Updated table to default to a "Simple" version and added a composite scoreScript open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.