OPEN-SOURCE SCRIPT

Aggiornato ICT Macro Zone Boxes w/ Individual H/L Tracking v3.1

ICT Macro Zones (Grey Box Version

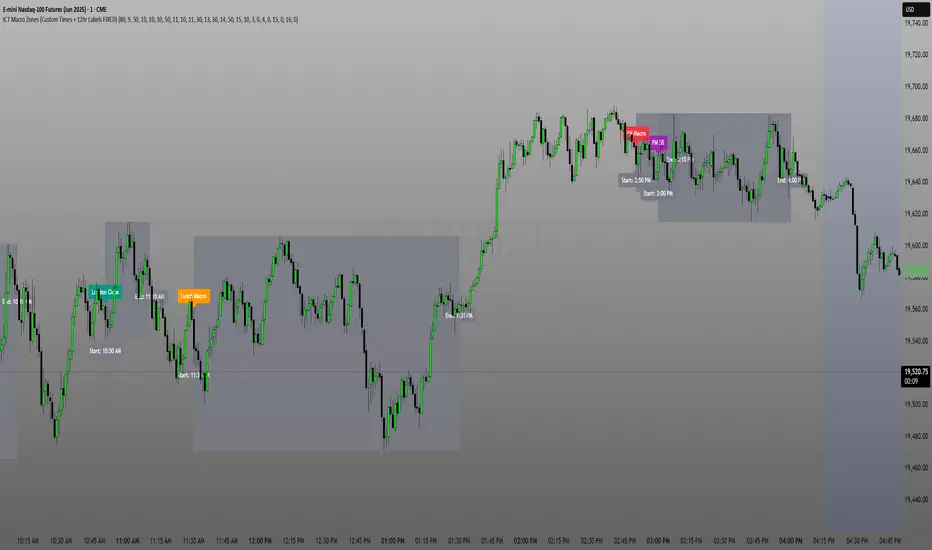

This indicator dynamically highlights key intraday time-based macro sessions using a clean, minimalistic grey box overlay, helping traders align with institutional trading cycles. Inspired by ICT (Inner Circle Trader) concepts, it tracks real-time highs and lows for each session and optionally extends the zone box after the session ends — making it a precision tool for intraday setups, order flow analysis, and macro-level liquidity sweeps.

### 🔍 **What It Does**

- Plots **six predefined macro sessions** used in Smart Money Concepts:

- AM Macro (09:50–10:10)

- London Close (10:50–11:10)

- Lunch Macro (11:30–13:30)

- PM Macro (14:50–15:10)

- London SB (03:00–04:00)

- PM SB (15:00–16:00)

- Each zone:

- **Tracks high and low dynamically** throughout the session.

- **Draws a consistent grey shaded box** to visualize price boundaries.

- **Displays a label** at the first bar of the session (optional).

- **Optionally extends** the box to the right after the session closes.

### 🧠 **How It Works**

- Uses Pine Script arrays to define each session’s time window, label, and color.

- Detects session entry using `time()` within a New York timezone context.

- High/Low values are updated per bar inside the session window.

- Once a session ends, the box is optionally closed and fixed in place.

- All visual zones use a standardized grey tone for clarity and consistency across charts.

### 🛠️ **Settings**

- **Shade Zone High→Low:** Enable/disable the grey macro box.

- **Extend Box After Session:** Keep the zone visible after it ends.

- **Show Entry Label:** Display a label at the start of each session.

### 🎯 **Why This Script is Unique**

Unlike basic session markers or colored backgrounds, this tool:

- Focuses on **macro moments of liquidity and reversal**, not just open/close times.

- Uses **per-session logic** to individually track price behavior inside key time windows.

- Supports **real-time high/low tracking and clean zone drawing**, ideal for Smart Money and ICT-style strategies.

Perfect — based on your list, here's a **bundle-style description** that not only explains the function of each script but also shows how they **work together** in a Smart Money/ICT workflow. This kind of cross-script explanation is exactly what TradingView wants to see to justify closed-source mashups or interdependent tools.

---

📚 ICT SMC Toolkit — Script Integration Guide

This set of advanced Smart Money Concept (SMC) tools is designed for traders who follow ICT-based methodologies, combining liquidity theory, time-based precision, and engineered confluences for high-probability trades. Each indicator is optimized to work both independently and synergistically, forming a comprehensive trading framework.

---

First FVG Custom Time Range

**Purpose:**

Plots the **first Fair Value Gap (FVG)** that appears within a defined session (e.g., NY Kill Zone, Custom range). Includes optional retest alerts.

**Best Used With:**

- Use with **ICT Macro Zones (Grey Box Version)** to isolate FVGs during high-probability times like AM Macro or PM SB.

- Combine with **Liquidity Levels** to assess whether FVGs form near swing points or liquidity voids.

---

ICT SMC Liquidity Grabs and OBs

**Purpose:**

Detects **liquidity grabs** (stop hunts above/below swing highs/lows) and **bullish/bearish order blocks**. Includes optional Fibonacci OTE levels for sniper entries.

**Best Used With:**

- Use with **ICT Turtle Soup (Reversal)** for confirmation after a liquidity grab.

- Combine with **Macro Zones** to catch order blocks forming inside timed macro windows.

- Match with **Smart Swing Levels** to confirm structure breaks before entry.

ICT SMC Liquidity Levels (Smart Swing Lows)

**Purpose:**

Automatically marks swing highs/lows based on user-defined lookbacks. Tracks whether those levels have been breached or respected.

**Best Used With:**

- Combine with **Turtle Soup** to detect if a swing level was swept, then reversed.

- Use with **Liquidity Grabs** to confirm a grab occurred at a meaningful structural point.

- Align with **Macro Zones** to understand when liquidity events occur within macro session timing.

ICT Turtle Soup (Liquidity Reversal)

**Purpose:**

Implements the classic ICT Turtle Soup model. Looks for swing failure and quick reversals after a liquidity sweep — ideal for catching traps.

Best Used With:

- Confirm with **Liquidity Grabs + OBs** to identify institutional activity at the reversal point.

- Use **Liquidity Levels** to ensure the reversal is happening at valid previous swing highs/lows.

- Amplify probability when pattern appears during **Macro Zones** or near the **First FVG**.

ICT Turtle Soup Ultimate V2

**Purpose:**

An enhanced, multi-layer version of the Turtle Soup setup that includes built-in liquidity checks, OTE levels, structure validation, and customizable visual output.

**Best Used With:**

- Use as an **entry signal generator** when other indicators (e.g., OBs, liquidity grabs) are aligned.

- Pair with **Macro Zones** for high-precision timing.

- Combine with **First FVG** to anticipate price rebalancing before explosive moves.

---

## 🧠 Workflow Example:

1. **Start with Macro Zones** to focus only on institutional trading windows.

2. Look for **Liquidity Grabs or Swing Sweeps** around key highs/lows.

3. Check for a **Turtle Soup Reversal** or **Order Block Reaction** near that level.

4. Confirm confluence with a **Fair Value Gap**.

5. Execute using the **OTE level** from the Liquidity Grabs + OB script.

---

Let me know which script you want to publish first — I’ll tailor its **individual TradingView description** and flag its ideal **“Best Used With” partners** to help users see the value in your ecosystem.

This indicator dynamically highlights key intraday time-based macro sessions using a clean, minimalistic grey box overlay, helping traders align with institutional trading cycles. Inspired by ICT (Inner Circle Trader) concepts, it tracks real-time highs and lows for each session and optionally extends the zone box after the session ends — making it a precision tool for intraday setups, order flow analysis, and macro-level liquidity sweeps.

### 🔍 **What It Does**

- Plots **six predefined macro sessions** used in Smart Money Concepts:

- AM Macro (09:50–10:10)

- London Close (10:50–11:10)

- Lunch Macro (11:30–13:30)

- PM Macro (14:50–15:10)

- London SB (03:00–04:00)

- PM SB (15:00–16:00)

- Each zone:

- **Tracks high and low dynamically** throughout the session.

- **Draws a consistent grey shaded box** to visualize price boundaries.

- **Displays a label** at the first bar of the session (optional).

- **Optionally extends** the box to the right after the session closes.

### 🧠 **How It Works**

- Uses Pine Script arrays to define each session’s time window, label, and color.

- Detects session entry using `time()` within a New York timezone context.

- High/Low values are updated per bar inside the session window.

- Once a session ends, the box is optionally closed and fixed in place.

- All visual zones use a standardized grey tone for clarity and consistency across charts.

### 🛠️ **Settings**

- **Shade Zone High→Low:** Enable/disable the grey macro box.

- **Extend Box After Session:** Keep the zone visible after it ends.

- **Show Entry Label:** Display a label at the start of each session.

### 🎯 **Why This Script is Unique**

Unlike basic session markers or colored backgrounds, this tool:

- Focuses on **macro moments of liquidity and reversal**, not just open/close times.

- Uses **per-session logic** to individually track price behavior inside key time windows.

- Supports **real-time high/low tracking and clean zone drawing**, ideal for Smart Money and ICT-style strategies.

Perfect — based on your list, here's a **bundle-style description** that not only explains the function of each script but also shows how they **work together** in a Smart Money/ICT workflow. This kind of cross-script explanation is exactly what TradingView wants to see to justify closed-source mashups or interdependent tools.

---

📚 ICT SMC Toolkit — Script Integration Guide

This set of advanced Smart Money Concept (SMC) tools is designed for traders who follow ICT-based methodologies, combining liquidity theory, time-based precision, and engineered confluences for high-probability trades. Each indicator is optimized to work both independently and synergistically, forming a comprehensive trading framework.

---

First FVG Custom Time Range

**Purpose:**

Plots the **first Fair Value Gap (FVG)** that appears within a defined session (e.g., NY Kill Zone, Custom range). Includes optional retest alerts.

**Best Used With:**

- Use with **ICT Macro Zones (Grey Box Version)** to isolate FVGs during high-probability times like AM Macro or PM SB.

- Combine with **Liquidity Levels** to assess whether FVGs form near swing points or liquidity voids.

---

ICT SMC Liquidity Grabs and OBs

**Purpose:**

Detects **liquidity grabs** (stop hunts above/below swing highs/lows) and **bullish/bearish order blocks**. Includes optional Fibonacci OTE levels for sniper entries.

**Best Used With:**

- Use with **ICT Turtle Soup (Reversal)** for confirmation after a liquidity grab.

- Combine with **Macro Zones** to catch order blocks forming inside timed macro windows.

- Match with **Smart Swing Levels** to confirm structure breaks before entry.

ICT SMC Liquidity Levels (Smart Swing Lows)

**Purpose:**

Automatically marks swing highs/lows based on user-defined lookbacks. Tracks whether those levels have been breached or respected.

**Best Used With:**

- Combine with **Turtle Soup** to detect if a swing level was swept, then reversed.

- Use with **Liquidity Grabs** to confirm a grab occurred at a meaningful structural point.

- Align with **Macro Zones** to understand when liquidity events occur within macro session timing.

ICT Turtle Soup (Liquidity Reversal)

**Purpose:**

Implements the classic ICT Turtle Soup model. Looks for swing failure and quick reversals after a liquidity sweep — ideal for catching traps.

Best Used With:

- Confirm with **Liquidity Grabs + OBs** to identify institutional activity at the reversal point.

- Use **Liquidity Levels** to ensure the reversal is happening at valid previous swing highs/lows.

- Amplify probability when pattern appears during **Macro Zones** or near the **First FVG**.

ICT Turtle Soup Ultimate V2

**Purpose:**

An enhanced, multi-layer version of the Turtle Soup setup that includes built-in liquidity checks, OTE levels, structure validation, and customizable visual output.

**Best Used With:**

- Use as an **entry signal generator** when other indicators (e.g., OBs, liquidity grabs) are aligned.

- Pair with **Macro Zones** for high-precision timing.

- Combine with **First FVG** to anticipate price rebalancing before explosive moves.

---

## 🧠 Workflow Example:

1. **Start with Macro Zones** to focus only on institutional trading windows.

2. Look for **Liquidity Grabs or Swing Sweeps** around key highs/lows.

3. Check for a **Turtle Soup Reversal** or **Order Block Reaction** near that level.

4. Confirm confluence with a **Fair Value Gap**.

5. Execute using the **OTE level** from the Liquidity Grabs + OB script.

---

Let me know which script you want to publish first — I’ll tailor its **individual TradingView description** and flag its ideal **“Best Used With” partners** to help users see the value in your ecosystem.

Note di rilascio

## 📘 **ICT Macro Zones (Grey Box Version)**This indicator dynamically highlights key intraday time-based macro sessions using a clean, minimalistic grey box overlay, helping traders align with institutional trading cycles. Inspired by ICT (Inner Circle Trader) concepts, it tracks real-time highs and lows for each session and optionally extends the zone box after the session ends — making it a precision tool for intraday setups, order flow analysis, and macro-level liquidity sweeps.

### 🔍 **What It Does**

- Plots **six predefined macro sessions** used in Smart Money Concepts:

- AM Macro (09:50–10:10)

- London Close (10:50–11:10)

- Lunch Macro (11:30–13:30)

- PM Macro (14:50–15:10)

- London SB (03:00–04:00)

- PM SB (15:00–16:00)

- Each zone:

- **Tracks high and low dynamically** throughout the session.

- **Draws a consistent grey shaded box** to visualize price boundaries.

- **Displays a label** at the first bar of the session (optional).

- **Optionally extends** the box to the right after the session closes.

### 🧠 **How It Works**

- Uses Pine Script arrays to define each session’s time window, label, and color.

- Detects session entry using `time()` within a New York timezone context.

- High/Low values are updated per bar inside the session window.

- Once a session ends, the box is optionally closed and fixed in place.

- All visual zones use a standardized grey tone for clarity and consistency across charts.

### 🛠️ **Settings**

- **Shade Zone High→Low:** Enable/disable the grey macro box.

- **Extend Box After Session:** Keep the zone visible after it ends.

- **Show Entry Label:** Display a label at the start of each session.

### 🎯 **Why This Script is Unique**

Unlike basic session markers or colored backgrounds, this tool:

- Focuses on **macro moments of liquidity and reversal**, not just open/close times.

- Uses **per-session logic** to individually track price behavior inside key time windows.

- Supports **real-time high/low tracking and clean zone drawing**, ideal for Smart Money and ICT-style strategies.

---

## 📚 ICT SMC Toolkit — Script Integration Guide

This set of advanced Smart Money Concept (SMC) tools is designed for traders who follow ICT-based methodologies, combining liquidity theory, time-based precision, and engineered confluences for high-probability trades. Each indicator is optimized to work both independently and synergistically, forming a comprehensive trading framework.

---

### 🔹 **First FVG Custom Time Range**

**Purpose:**

Plots the **first Fair Value Gap (FVG)** that appears within a defined session (e.g., NY Kill Zone, Custom range). Includes optional retest alerts.

**Best Used With:**

- Use with **ICT Macro Zones (Grey Box Version)** to isolate FVGs during high-probability times like AM Macro or PM SB.

- Combine with **Liquidity Levels** to assess whether FVGs form near swing points or liquidity voids.

---

### 🔹 **ICT SMC Liquidity Grabs and OBs**

**Purpose:**

Detects **liquidity grabs** (stop hunts above/below swing highs/lows) and **bullish/bearish order blocks**. Includes optional Fibonacci OTE levels for sniper entries.

**Best Used With:**

- Use with **ICT Turtle Soup (Reversal)** for confirmation after a liquidity grab.

- Combine with **Macro Zones** to catch order blocks forming inside timed macro windows.

- Match with **Smart Swing Levels** to confirm structure breaks before entry.

---

### 🔹 **ICT SMC Liquidity Levels (Smart Swing Lows)**

**Purpose:**

Automatically marks swing highs/lows based on user-defined lookbacks. Tracks whether those levels have been breached or respected.

**Best Used With:**

- Combine with **Turtle Soup** to detect if a swing level was swept, then reversed.

- Use with **Liquidity Grabs** to confirm a grab occurred at a meaningful structural point.

- Align with **Macro Zones** to understand when liquidity events occur within macro session timing.

---

### 🔹 **ICT Turtle Soup (Liquidity Reversal)**

**Purpose:**

Implements the classic ICT Turtle Soup model. Looks for swing failure and quick reversals after a liquidity sweep — ideal for catching traps.

**Best Used With:**

- Confirm with **Liquidity Grabs + OBs** to identify institutional activity at the reversal point.

- Use **Liquidity Levels** to ensure the reversal is happening at valid previous swing highs/lows.

- Amplify probability when pattern appears during **Macro Zones** or near the **First FVG**.

---

### 🔹 **ICT Turtle Soup Ultimate V2**

**Purpose:**

An enhanced, multi-layer version of the Turtle Soup setup that includes built-in liquidity checks, OTE levels, structure validation, and customizable visual output.

**Best Used With:**

- Use as an **entry signal generator** when other indicators (e.g., OBs, liquidity grabs) are aligned.

- Pair with **Macro Zones** for high-precision timing.

- Combine with **First FVG** to anticipate price rebalancing before explosive moves.

---

## 🧠 Workflow Example:

1. **Start with Macro Zones** to focus only on institutional trading windows.

2. Look for **Liquidity Grabs or Swing Sweeps** around key highs/lows.

3. Check for a **Turtle Soup Reversal** or **Order Block Reaction** near that level.

4. Confirm confluence with a **Fair Value Gap**.

5. Execute using the **OTE level** from the Liquidity Grabs + OB script.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.