OPEN-SOURCE SCRIPT

Aggiornato anand ha + Rsi

How it works:

Green Line: When RSI > 50 AND Heikin Ashi is bullish (uptrend)

Red Line: When RSI < 50 AND Heikin Ashi is bearish (downtrend)

The line dynamically positions itself below price during uptrends and above price during downtrends

Uses ATR to maintain appropriate distance from price action

Includes subtle background fill between price and the trend line

Key Features:

Single clean trend line (no candles, no extra indicators)

Color changes based on trend direction

Self-adjusting position using ATR

Smooth transitions to avoid whipsaws

Minimal visual clutter, just like SuperTrend

The line will stay green below price when both RSI is above 50 and Heikin Ashi shows bullish momentum, and red above price when both conditions turn bearish. This gives you a clear visual trend following system in a simple line format.

Green Line: When RSI > 50 AND Heikin Ashi is bullish (uptrend)

Red Line: When RSI < 50 AND Heikin Ashi is bearish (downtrend)

The line dynamically positions itself below price during uptrends and above price during downtrends

Uses ATR to maintain appropriate distance from price action

Includes subtle background fill between price and the trend line

Key Features:

Single clean trend line (no candles, no extra indicators)

Color changes based on trend direction

Self-adjusting position using ATR

Smooth transitions to avoid whipsaws

Minimal visual clutter, just like SuperTrend

The line will stay green below price when both RSI is above 50 and Heikin Ashi shows bullish momentum, and red above price when both conditions turn bearish. This gives you a clear visual trend following system in a simple line format.

Note di rilascio

How to Set Up Alerts in TradingView:Apply the indicator to your chart

Right-click on the chart → "Add Alert"

Choose your preferred alert condition:

"HA-RSI Buy/Sell Alerts" (combined)

"HA-RSI Buy Alert" (buy only)

"HA-RSI Sell Alert" (sell only)

Set your notification preferences (popup, email, webhook, etc.)

Alert Messages Include:

Clear BUY/SELL indication with colored emojis (🟢/🔴)

Ticker symbol

Current price

Descriptive message about the signal

Note di rilascio

HA-RSI 50 Trend Line IndicatorOverview

This Pine Script indicator combines Heikin Ashi candles, RSI (Relative Strength Index), and ATR-based dynamic trend lines to create a comprehensive trend-following system. It's designed to identify strong trending moves while filtering out market noise.

How It Works

Core Components

RSI Filter: Uses RSI above/below 50 as a momentum filter

Heikin Ashi Filter: Confirms trend direction using smoothed candlestick data

Dynamic Trend Line: ATR-based line that adapts to market volatility

Dual Signal System: Choose between trend change or price crossover signals

Trend Detection Logic

Bullish Trend: RSI > 50 AND Heikin Ashi close > Heikin Ashi open

Bearish Trend: RSI < 50 AND Heikin Ashi close < Heikin Ashi open

Trend Line: Positioned below price (bullish) or above price (bearish) using ATR for dynamic spacing

Signal Types

Option 1 - Trend Change Signals (Default)

Triggers when market conditions shift from bearish to bullish or vice versa

More predictive but may generate signals before price confirmation

Option 2 - Close Cross Signals

Triggers when price actually crosses above/below the trend line

More conservative, waits for price action confirmation

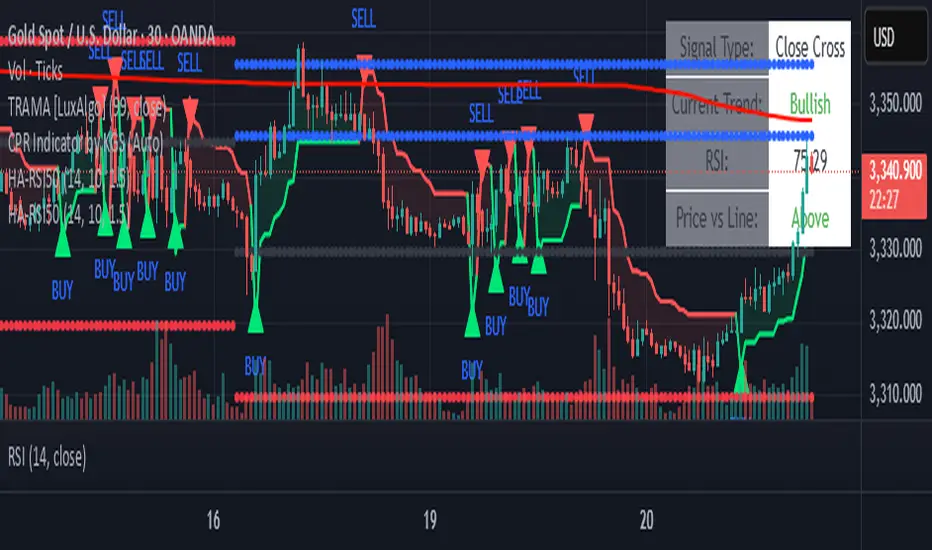

Visual Elements

On Chart Display

Green Line: Bullish trend (support line below price)

Red Line: Bearish trend (resistance line above price)

Fill Area: Light background color between price and trend line

Buy Signals: Green triangles below bars with "BUY" text

Sell Signals: Red triangles above bars with "SELL" text

Information Table

Real-time display showing:

Current signal type (Trend Change or Close Cross)

Current trend direction

Current RSI value

Price position relative to trend line

Input Parameters

Customizable Settings

RSI Length (14): Period for RSI calculation

ATR Length (10): Period for volatility measurement

Line Offset Multiplier (1.5): Distance of trend line from price

Enable Alerts (true): Toggle alert notifications

Signal Only on Candle Close (true): Choose signal type

Alert System

Real-time Alerts: Dynamic messages showing signal type

TradingView Alert Conditions: Three separate alert setups

Combined buy/sell alerts

Individual buy alerts

Individual sell alerts

Best Use Cases

Trending Markets

Excellent for identifying and following strong trends

Helps stay in profitable positions longer

Reduces whipsaws in trending conditions

Timeframes

Works on all timeframes

Higher timeframes (4H, Daily) tend to be more reliable

Lower timeframes provide more signals but with higher noise

Market Conditions

Best: Strong trending markets

Good: Volatile but directional markets

Avoid: Extreme choppy/sideways markets

Trading Strategy Ideas

Entry Signals

Buy: Green trend line appears OR price crosses above trend line

Sell: Red trend line appears OR price crosses below trend line

Exit Strategies

Exit when trend line changes color

Use trailing stops based on the trend line

Combine with other indicators for confirmation

Risk Management

The trend line can serve as a dynamic stop loss

ATR-based positioning naturally adjusts to volatility

Consider position sizing based on ATR values

Advantages

Combines multiple confirmation filters

Adapts to market volatility automatically

Provides clear visual trend identification

Flexible signal generation options

Built-in alert system

Limitations

May lag in very fast-moving markets

Can generate false signals in choppy conditions

Requires trend-following market conditions to perform optimally

RSI filter may miss some valid breakout moves

This indicator works best as part of a comprehensive trading system rather than as a standalone signal generator.

Note di rilascio

Key Changes Made:Removed dynamic string concatenation from alertcondition() functions

Used only Pine Script placeholders like {{ticker}} and {{close}} in alertcondition() messages

Kept the detailed Telegram messages in the alert() function calls within the if enable_alerts block

Why This Fixes The Error:

alertcondition() can only accept constant strings - no dynamic concatenation allowed

alert() function can accept series strings with dynamic concatenation

The detailed Telegram format messages will still work through the alert() calls

This approach gives you both:

Working alertcondition() functions without errors

Detailed Telegram messages with lot size, TP, and ticket numbers through the alert() calls

The error will be resolved and your script will compile successfully.

Note di rilascio

Simplified alert condition: Only one alertcondition() for the combined signalNow the indicator will send only one alert per bar with the format:

"Executed BUY XAUUSD"

"Executed SELL XAUUSD"

The alert.freq_once_per_bar ensures that even if both buy and sell conditions somehow trigger on the same bar, only one alert will be sent.

Note di rilascio

This ensures that whether you get a BUY or SELL signal (or theoretically both), you'll only receive one alert per bar with the appropriate message: "Executed BUY XAUUSD" or "Executed SELL XAUUSD".This makes your alert system clean, reliable, and prevents notification overload!

Note di rilascio

Executed {{strategy.order.action}} {{ticker}}Note di rilascio

ignal Type: Close Cross or Trend ChangeCurrent Trend: Bullish/Bearish

RSI: Current RSI value

Price vs Line: Above/Below trend line

Alert Status: ON/OFF ← NEW

Last Signal: Current signal message ← NEW

Script open-source

In pieno spirito TradingView, il creatore di questo script lo ha reso open-source, in modo che i trader possano esaminarlo e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricorda che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Script open-source

In pieno spirito TradingView, il creatore di questo script lo ha reso open-source, in modo che i trader possano esaminarlo e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricorda che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.