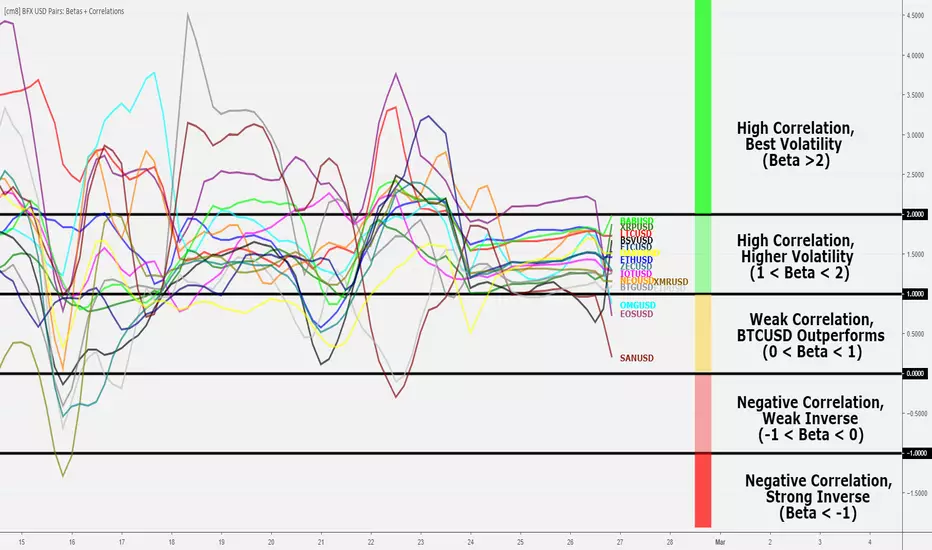

Bitfinex USD Pairs: Betas and Correlations [checkm8]

This indicator is meant to be used to assess trading alternatives to BTCUSD on Bitfinex, examining alt-USD pairs that can be traded on margin. This list is as follows:

- ETHUSD

- LTCUSD

- EOSUSD

- NEOUSD

- OMGUSD

- XRPUSD

- IOTUSD

- BCHUSD

- SANUSD

- ETPUSD

- ETCUSD

- XMRUSD

- ZECUSD

- DSHUSD

Before dwelling further on the script, let's revisit the definitions of beta and correlation:

- Beta is a statistical measure of a %-change in an asset relative to a 1% change in a benchmark. In our case - this is BTCUSD. For example, if the beta is 1.5, it means that the particular asset moves 1.5% in the same direction as the 1% change of the benchmark. If the beta is negative, the asset is moving in opposite direction of the benchmark. Note: beta is not confined to any range.

- Correlation is a statistical measure of the relationship between two assets, from a range of +1 to -1, where a score of +1 implies perfect positive correlation (prices move in the same direction), -1 implies perfect negative correlation (inverse relationship), and 0 implies no relationship in price changes.

For the calculations, BITFINEX:BTCUSD is used as the benchmark.

Through the script's settings:

- You can select whether to plot betas or the correlations

- You can select the desired length to be used in the measure of beta and correlations

- You can enable smoothing for less choppy results. This is accompanied by options to modify the smoothing length and the smoothing method, where SMA, EMA, RMA, and WMA are available.

- You can enable and disable individual alt pairs from being displayed (ie. if you do not want LTCUSD plotted, you can turn it off)

Below is an example of the correlation setting.

I would recommend using a smoothing input of 3-6, on SMA, and the 4-hour timeframe for good results. I use this indicator for help in deciding what alt pairs to trade on a particular day, where you will want to trade alts with the highest correlations. Note: be weary of less liquid markets, such as ETP and SAN.

Also note: the labels shown in the snapshot are for presentation purposes only. You can enable Indicator Labels by right clicking the oscillator -> "Price Scale" -> "Indicator Labels".

Please let me know if you have any questions, suggestions, or concerns.

Happy trading!

For additional information as to why you should be using this indicator and trading alts instead of BTCUSD, please refer to my study:

This version has been updated to add the following pairs to the list of margin tradeable alt-USD pairs on Bitfinex:

-BABUSD

-BSVUSD

-BTGUSD

As always, below are updated screenshots to give reference for how to read the script:

Note: The extra text and pair name titles are purely for visual appeal - they will not be generated as a part of the script.

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente checkm8.

TradingView NON consiglia di pagare o utilizzare uno script a meno che non ci si fidi pienamente del suo autore e non si comprenda il suo funzionamento. Puoi anche trovare alternative gratuite e open-source nei nostri script della comunità.

Istruzioni dell'autore

Attenzione: prima di richiedere l'accesso, leggi la nostra guida per gli script su invito.

Declinazione di responsabilità

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente checkm8.

TradingView NON consiglia di pagare o utilizzare uno script a meno che non ci si fidi pienamente del suo autore e non si comprenda il suo funzionamento. Puoi anche trovare alternative gratuite e open-source nei nostri script della comunità.

Istruzioni dell'autore

Attenzione: prima di richiedere l'accesso, leggi la nostra guida per gli script su invito.