OPEN-SOURCE SCRIPT

Aggiornato CISD [TakingProphets]

🧠 Indicator Purpose:

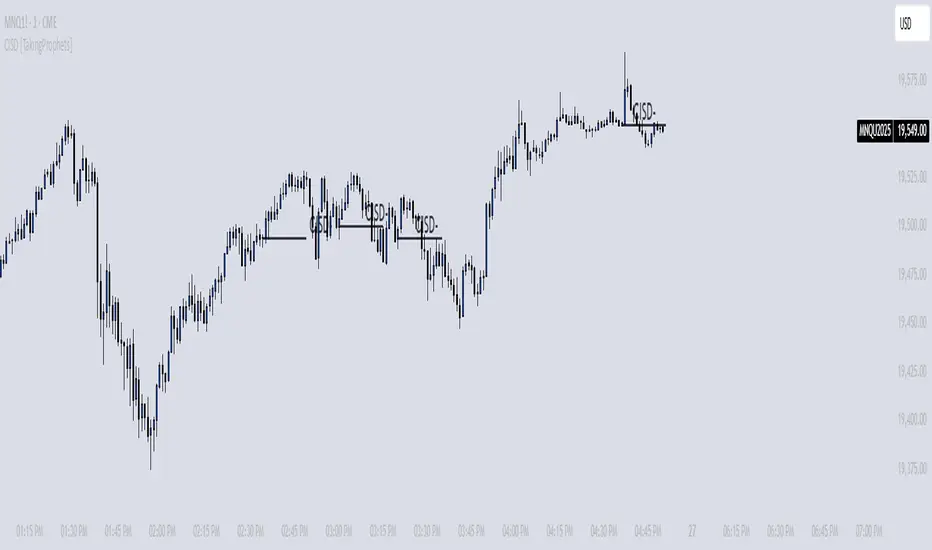

The "CISD - Change in State of Delivery" is a precision tool designed for traders utilizing ICT (Inner Circle Trader) conecpets. It detects critical shifts in delivery conditions after liquidity sweeps — helping you spot true smart money activity and optimal trade opportunities. This script is especially valuable for traders applying liquidity concepts, displacement recognition, and market structure shifts at both intraday and swing levels.

🌟 What Makes This Indicator Unique:

Unlike basic trend-following or scalping tools, CISD operates through a two-phase smart money logic:

Liquidity Sweep Detection (sweeping Buyside or Sellside Liquidity).

State of Delivery Change Identification (through bearish or bullish displacement after the sweep).

It intelligently tracks candle sequences and only signals a CISD event after true displacement — offering a much deeper context than ordinary indicators.

⚙️ How the Indicator Works:

Swing Point Detection: Identifies recent pivot highs/lows to map Buyside Liquidity (BSL) and Sellside Liquidity (SSL) zones.

Liquidity Sweeps: Watches for price breaches of these liquidity points to detect institutional stop hunts.

Sequence Recognition: Finds series of same-direction candles before sweeps to mark institutional accumulation/distribution.

Change of Delivery Confirmation: Confirms CISD only after significant displacement moves price against the initial candle sequence.

Visual Markings: Automatically plots CISD lines and optional labels, customizable in color, style, and size.

🎯 How to Use It:

Identify Liquidity Sweeps: Watch for CISD levels plotted after a liquidity sweep event.

Plan Entries: Look for retracements into CISD lines for high-probability entries.

Manage Risk: Use CISD levels to refine your stop-loss and profit-taking zones.

Best Application:

After stop hunts during Killzones (London Open, New York AM).

As part of the Flow State Model: identify higher timeframe PD Arrays ➔ wait for lower timeframe CISD confirmation.

🔎 Underlying Concepts:

Liquidity Pools: Highs and lows cluster stop orders, attracting institutional sweeps.

Displacement: Powerful price moves post-sweep confirm smart money involvement.

Market Structure: CISD frequently precedes major Change of Character (CHoCH) or Break of Structure (BOS) shifts.

🎨 Customization Options:

Adjustable line color, width, and style (solid, dashed, dotted).

Optional label display with customizable color and sizing.

Line extension settings to keep CISD zones visible for future reference.

✅ Recommended for:

Traders studying ICT Smart Money Concepts.

Intraday scalpers and higher timeframe swing traders.

Traders who want to improve entries around liquidity sweeps and institutional displacement moves.

🚀 Bonus Tip:

For maximum confluence, pair this with the HTF POI, ICT Liquidity Levels, and HTF Market Structure indicators available at TakingProphets.com! 🔥

The "CISD - Change in State of Delivery" is a precision tool designed for traders utilizing ICT (Inner Circle Trader) conecpets. It detects critical shifts in delivery conditions after liquidity sweeps — helping you spot true smart money activity and optimal trade opportunities. This script is especially valuable for traders applying liquidity concepts, displacement recognition, and market structure shifts at both intraday and swing levels.

🌟 What Makes This Indicator Unique:

Unlike basic trend-following or scalping tools, CISD operates through a two-phase smart money logic:

Liquidity Sweep Detection (sweeping Buyside or Sellside Liquidity).

State of Delivery Change Identification (through bearish or bullish displacement after the sweep).

It intelligently tracks candle sequences and only signals a CISD event after true displacement — offering a much deeper context than ordinary indicators.

⚙️ How the Indicator Works:

Swing Point Detection: Identifies recent pivot highs/lows to map Buyside Liquidity (BSL) and Sellside Liquidity (SSL) zones.

Liquidity Sweeps: Watches for price breaches of these liquidity points to detect institutional stop hunts.

Sequence Recognition: Finds series of same-direction candles before sweeps to mark institutional accumulation/distribution.

Change of Delivery Confirmation: Confirms CISD only after significant displacement moves price against the initial candle sequence.

Visual Markings: Automatically plots CISD lines and optional labels, customizable in color, style, and size.

🎯 How to Use It:

Identify Liquidity Sweeps: Watch for CISD levels plotted after a liquidity sweep event.

Plan Entries: Look for retracements into CISD lines for high-probability entries.

Manage Risk: Use CISD levels to refine your stop-loss and profit-taking zones.

Best Application:

After stop hunts during Killzones (London Open, New York AM).

As part of the Flow State Model: identify higher timeframe PD Arrays ➔ wait for lower timeframe CISD confirmation.

🔎 Underlying Concepts:

Liquidity Pools: Highs and lows cluster stop orders, attracting institutional sweeps.

Displacement: Powerful price moves post-sweep confirm smart money involvement.

Market Structure: CISD frequently precedes major Change of Character (CHoCH) or Break of Structure (BOS) shifts.

🎨 Customization Options:

Adjustable line color, width, and style (solid, dashed, dotted).

Optional label display with customizable color and sizing.

Line extension settings to keep CISD zones visible for future reference.

✅ Recommended for:

Traders studying ICT Smart Money Concepts.

Intraday scalpers and higher timeframe swing traders.

Traders who want to improve entries around liquidity sweeps and institutional displacement moves.

🚀 Bonus Tip:

For maximum confluence, pair this with the HTF POI, ICT Liquidity Levels, and HTF Market Structure indicators available at TakingProphets.com! 🔥

Note di rilascio

-Updated ChartScript open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.