OPEN-SOURCE SCRIPT

Aggiornato DECODE Moving Average Toolkit

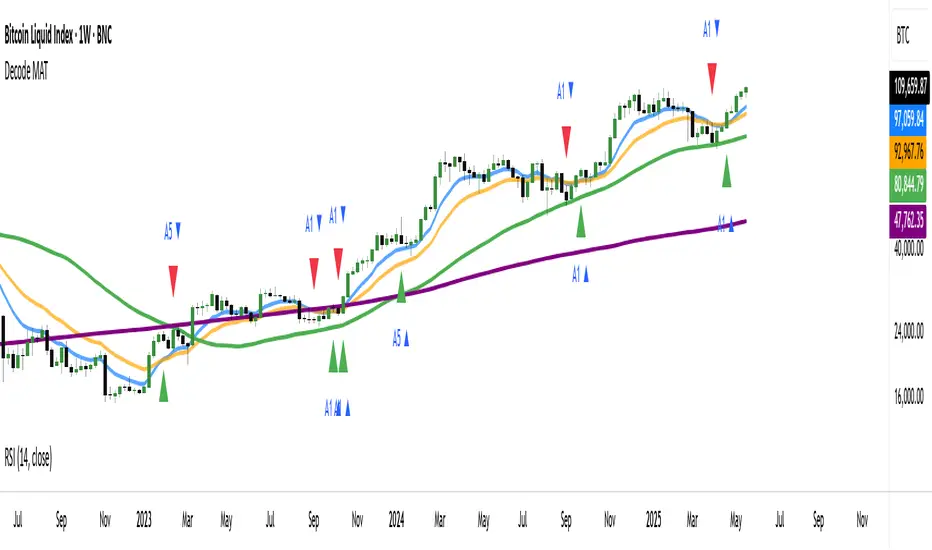

DECODE Moving Average Toolkit: Your All-in-One MA Analysis Powerhouse!

This versatile indicator is designed to be your go-to solution for analysing trends, identifying potential entry/exit points, and staying ahead of market movements using the power of Moving Averages (MAs).

Whether you're a seasoned trader or just starting out, the Decode MAT offers a comprehensive suite of features in a user-friendly package.

Key Features:

Multiple Moving Averages: Visualize up to 10 Moving Averages simultaneously on your chart.

How Can You Use the Decode MAT in Your Trading?

This toolkit is incredibly versatile and can be adapted to various trading strategies:

Trend Identification:

This versatile indicator is designed to be your go-to solution for analysing trends, identifying potential entry/exit points, and staying ahead of market movements using the power of Moving Averages (MAs).

Whether you're a seasoned trader or just starting out, the Decode MAT offers a comprehensive suite of features in a user-friendly package.

Key Features:

Multiple Moving Averages: Visualize up to 10 Moving Averages simultaneously on your chart.

- Includes 5 Exponential Moving Averages (EMAs) and 5 Simple Moving Averages (SMAs).

- Easily toggle the visibility of each MA and customize its length to suit your trading style and the asset you're analyzing.

- Each ribbon is formed between a corresponding EMA and SMA (e.g., EMA 20 / SMA 20).

- The ribbon color changes to indicate bullish (e.g., green) or bearish (e.g., red) sentiment, providing an intuitive visual cue.

- Toggle ribbon visibility with a single click.

- Define your own fast and slow MAs for each alert from any of the 10 available MAs.

- Receive notifications directly through TradingView when your specified MAs cross over or cross under.

- Optionally display visual symbols (e.g., triangles ▲▼) directly on your chart at the exact crossover points for quick identification.

- Adjust the source price (close, open, etc.) for all MA calculations.

- Fine-tune the appearance (colors, line thickness) of every MA line, ribbon, and alert symbol to match your charting preferences.

How Can You Use the Decode MAT in Your Trading?

This toolkit is incredibly versatile and can be adapted to various trading strategies:

Trend Identification:

- Use longer-term MAs (e.g., 50, 100, 200 period) to identify the prevailing market trend. When prices are consistently above these MAs, it suggests an uptrend, and vice-versa.

- Observe the MA ribbons: A consistently green ribbon can indicate a strong uptrend, while a red ribbon can signal a downtrend. The widening or narrowing of the ribbon can also suggest changes in trend momentum.

- Shorter-term MAs (e.g., 10, 20 period EMAs) can act as dynamic levels of support in an uptrend or resistance in a downtrend. Look for price pullbacks to these MAs as potential entry opportunities.

- Golden Cross / Death Cross: Configure alerts for classic crossover signals. For example, a 50-period MA crossing above a 200-period MA (Golden Cross) is often seen as a long-term bullish signal. Conversely, a 50-period MA crossing below a 200-period MA (Death Cross) can be a bearish signal.

- Shorter-Term Signals: Use crossovers of shorter-term MAs (e.g., EMA 10 crossing EMA 20) for more frequent, shorter-term trading signals. A fast MA crossing above a slow MA can signal a buy, while a cross below can signal a sell.

- Use the on-chart symbols for quick visual confirmation of these crossover events.

- Combine the Decode MAT with other indicators (like RSI, MACD, or volume analysis) to confirm signals and increase the probability of successful trades. For instance, a bullish MA crossover combined with an oversold RSI reading could strengthen a buy signal.

- Apply the toolkit across different timeframes to get a broader market perspective. A long-term uptrend on the daily chart, confirmed by a short-term bullish crossover on the 1-hour chart, can provide a higher-confidence entry.

Note di rilascio

BugfixScript open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.