PROTECTED SOURCE SCRIPT

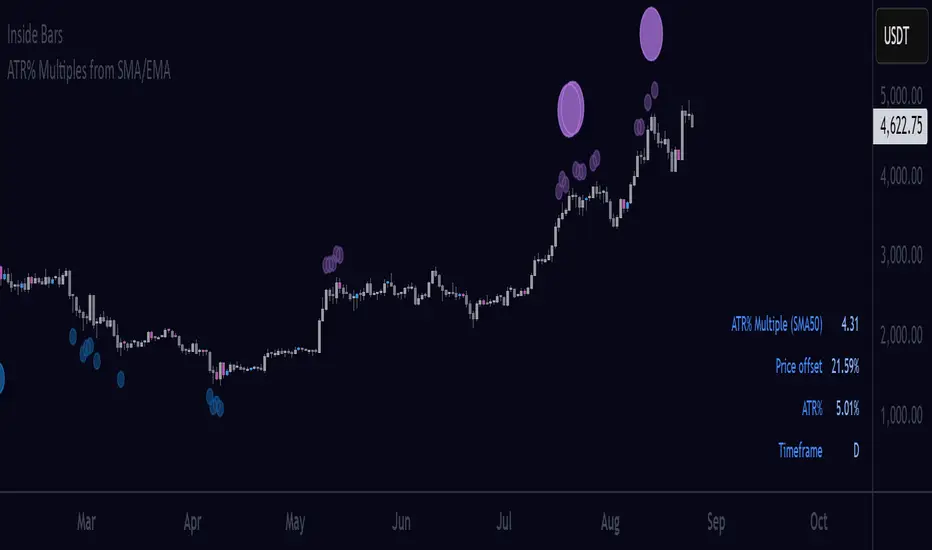

ATR% Multiples from SMA/EMA

Inspired by the indicator ATR% multiple from 50-MA by jfsrev, this tool measures how far price is extended from a Moving Average using an ATR% multiple.

What’s added vs. ATR% multiple from 50-MA indicator:

How to use the indicator:

I find the ATR multiple to be a very versatile tool that can be used for profit taking, mean reverting, and to make better assumption about what market environment to expect.

Which thresholds should you use?

It's up to you really. Personally I use them in a quite discretionary manner where I will change inputs depending on market and it's current regime - E.g. if we are in a strong uptrend I might use higher multiples to the upside and lower multiples to the downside, and if the market is in a range I will use them in a different manner. Be creative, test things, and work out what makes sense to you and the market and timeframe you are trading in.

What’s added vs. ATR% multiple from 50-MA indicator:

- Downside multiples — flags extensions below and above the MA.

- Timeframe selection — compute on Daily/Weekly/Monthly or intraday, independent of your chart.

- EMA/SMA toggle — choose the MA type (EMA/SMA).

- Multi-thresholds — set several ATR% multiple levels.

How to use the indicator:

I find the ATR multiple to be a very versatile tool that can be used for profit taking, mean reverting, and to make better assumption about what market environment to expect.

Which thresholds should you use?

It's up to you really. Personally I use them in a quite discretionary manner where I will change inputs depending on market and it's current regime - E.g. if we are in a strong uptrend I might use higher multiples to the upside and lower multiples to the downside, and if the market is in a range I will use them in a different manner. Be creative, test things, and work out what makes sense to you and the market and timeframe you are trading in.

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarle liberamente e senza alcuna limitazione – ulteriori informazioni qui.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script protetto

Questo script è pubblicato come codice protetto. Tuttavia, è possibile utilizzarle liberamente e senza alcuna limitazione – ulteriori informazioni qui.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.