OPEN-SOURCE SCRIPT

Aggiornato Scalping, Swing Pro: Urban Towers + Bollinger(0.5)+ WMA by Kidev

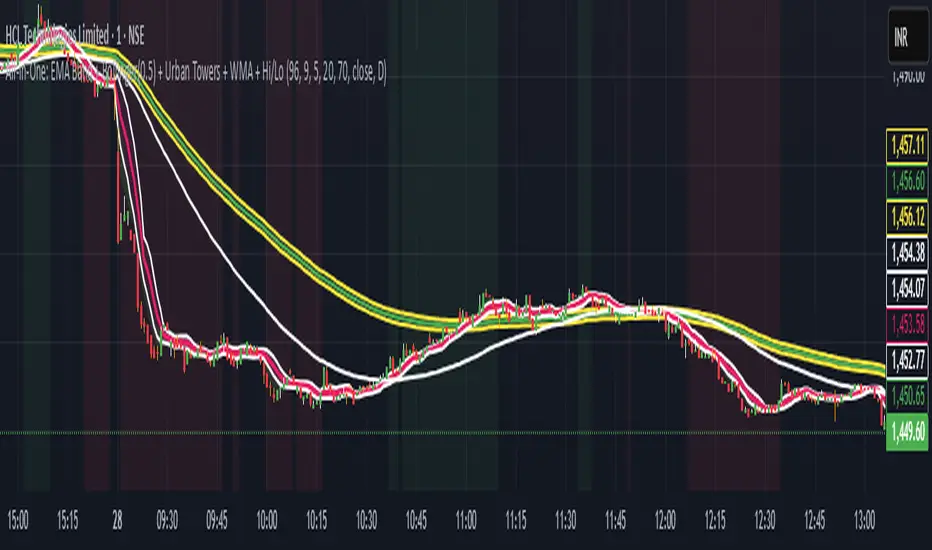

This indicator combines narrow Bollinger Bands (σ = 0.5) with a Weighted Moving Average (WMA-96) to provide traders with a reliable framework for identifying both short-term scalps and medium-term swing setups.

Bollinger Bands (0.5σ):

Traditional Bollinger Bands at 2σ cover ~95% of price movement, while 0.5σ bands narrow the focus to ~50% of price activity. This tighter structure makes them ideal for detecting volatility contractions, consolidations, and early breakout signals.

WMA-96 as Trend Reference:

The 96-period WMA acts as a slower, more stable directional guide. Unlike shorter WMAs, this longer setting filters noise and serves as a reference line for the dominant trend. Traders can use it as an anchor for intraday or swing positions.

Scalping & Swing Benefits:

Price holding above the WMA-96 while staying near the upper 0.5σ band often signals strength.

Contractions (squeezes) in the 0.5σ band followed by expansion frequently mark breakout zones.

Pullbacks toward the WMA-96 combined with band signals can act as re-entry or risk-defined trade areas.

This script provides a balanced view of momentum and stability — the 0.5σ bands reveal short-term volatility shifts, while the WMA-96 grounds the trader in the prevailing trend.

Bollinger Bands (0.5σ):

Traditional Bollinger Bands at 2σ cover ~95% of price movement, while 0.5σ bands narrow the focus to ~50% of price activity. This tighter structure makes them ideal for detecting volatility contractions, consolidations, and early breakout signals.

WMA-96 as Trend Reference:

The 96-period WMA acts as a slower, more stable directional guide. Unlike shorter WMAs, this longer setting filters noise and serves as a reference line for the dominant trend. Traders can use it as an anchor for intraday or swing positions.

Scalping & Swing Benefits:

Price holding above the WMA-96 while staying near the upper 0.5σ band often signals strength.

Contractions (squeezes) in the 0.5σ band followed by expansion frequently mark breakout zones.

Pullbacks toward the WMA-96 combined with band signals can act as re-entry or risk-defined trade areas.

This script provides a balanced view of momentum and stability — the 0.5σ bands reveal short-term volatility shifts, while the WMA-96 grounds the trader in the prevailing trend.

Note di rilascio

This indicator combines narrow Bollinger Bands (σ = 0.5) with a Weighted Moving Average (WMA-96) to provide traders with a reliable framework for identifying both short-term scalps and medium-term swing setups.Bollinger Bands (0.5σ):

Traditional Bollinger Bands at 2σ cover ~95% of price movement, while 0.5σ bands narrow the focus to ~50% of price activity. This tighter structure makes them ideal for detecting volatility contractions, consolidations, and early breakout signals.

WMA-96 as Trend Reference:

The 96-period WMA acts as a slower, more stable directional guide. Unlike shorter WMAs, this longer setting filters noise and serves as a reference line for the dominant trend. Traders can use it as an anchor for intraday or swing positions.

Scalping & Swing Benefits:

Price holding above the WMA-96 while staying near the upper 0.5σ band often signals strength.

Contractions (squeezes) in the 0.5σ band followed by expansion frequently mark breakout zones.

Pullbacks toward the WMA-96 combined with band signals can act as re-entry or risk-defined trade areas.

This script provides a balanced view of momentum and stability — the 0.5σ bands reveal short-term volatility shifts, while the WMA-96 grounds the trader in the prevailing trend.

Note di rilascio

This indicator combines narrow Bollinger Bands (σ = 0.5) with a Weighted Moving Average (WMA-96) to provide traders with a reliable framework for identifying both short-term scalps and medium-term swing setups.Bollinger Bands (0.5σ):

Traditional Bollinger Bands at 2σ cover ~95% of price movement, while 0.5σ bands narrow the focus to ~50% of price activity. This tighter structure makes them ideal for detecting volatility contractions, consolidations, and early breakout signals.

WMA-96 as Trend Reference:

The 96-period WMA acts as a slower, more stable directional guide. Unlike shorter WMAs, this longer setting filters noise and serves as a reference line for the dominant trend. Traders can use it as an anchor for intraday or swing positions.

Scalping & Swing Benefits:

Price holding above the WMA-96 while staying near the upper 0.5σ band often signals strength.

Contractions (squeezes) in the 0.5σ band followed by expansion frequently mark breakout zones.

Pullbacks toward the WMA-96 combined with band signals can act as re-entry or risk-defined trade areas.

This script provides a balanced view of momentum and stability — the 0.5σ bands reveal short-term volatility shifts, while the WMA-96 grounds the trader in the prevailing trend.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.