OPEN-SOURCE SCRIPT

Combo RSI + MACD + ADX MTF (Avec Alertes)

✅ Recommended Title:

Multi-Signal Oscillator: ADX Trend + DI + RSI + MACD (MTF, Cross Alerts)

✅ Detailed Description

📝 Overview

This indicator combines advanced technical analysis tools to identify trend direction, capture reversals, and filter false signals.

It includes:

ADX (Multi-TimeFrame) for trend and trend strength detection.

DI+ / DI- for directional bias.

RSI + ZLSMA for oscillation analysis and divergence detection.

Zero-Lag Normalized MACD for momentum and entry timing.

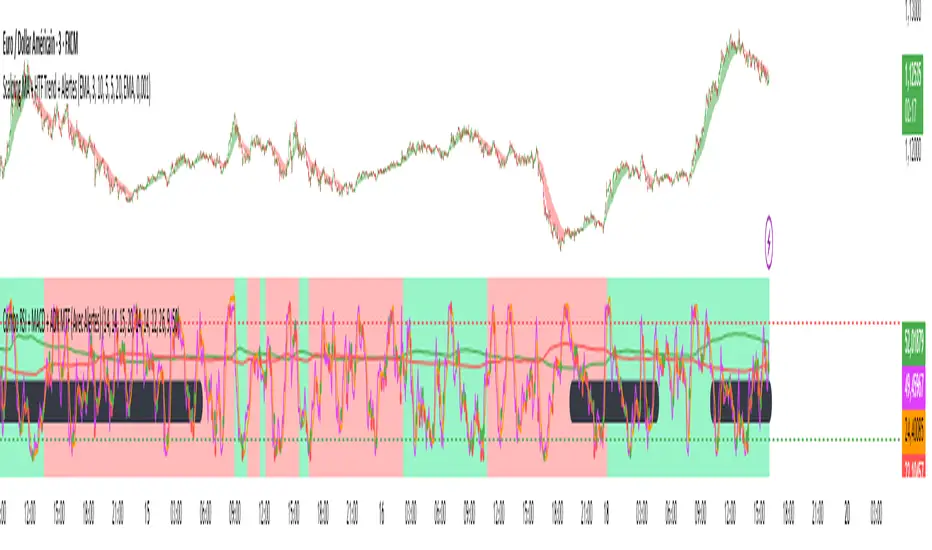

⚙️ Visual Components

✅ Green/Red Background: Displays overall trend based on Multi-TimeFrame ADX.

✅ DI+ / DI- Lines: Green and red curves showing directional bias.

✅ Normalized RSI: Blue oscillator with orange ZLSMA smoothing.

✅ Zero-Lag MACD: Violet or fuchsia/orange oscillator depending on the version.

✅ Crossover Points: Colored circles marking buy and sell signals.

✅ ADX Strength Dots: Small black dots when ADX exceeds the strength threshold.

🚨 Included Alert System

✅ RSI / ZLSMA Crossovers (Buy / Sell).

✅ MACD / Signal Line Crossovers (Buy / Sell).

✅ DI+ / DI- Crossovers (Buy / Sell).

✅ Double Confirmation DI+ / RSI or DI+ / MACD.

✅ Double Confirmation DI- / RSI or DI- / MACD.

✅ Trend Change Alerts via Background Color.

✅ ADX Strength Alerts (Above Threshold).

🛠️ Suggested Configuration Examples

1. Short-Term Reversal Detection:

RSI Length: 7 to 14

ZLSMA Length: 7 to 14

MACD Fast/Slow: 5 / 13

ADX MTF Period: 5 to 15

ADX Threshold: 15 to 20

2. Long-Term Trend Following:

RSI Length: 21 to 30

ZLSMA Length: 21 to 30

MACD Fast/Slow: 12 / 26

ADX MTF Period: 30 to 50

ADX Threshold: 20 to 25

3. Scalping / Day Trading:

RSI Length: 5 to 9

ZLSMA Length: 5 to 9

MACD Fast/Slow: 3 / 7

ADX MTF Period: 5 to 10

ADX Threshold: 10 to 15

🎯 Why Use This Tool?

Filters false signals using ADX-based background coloring.

Provides multi-source alerting (RSI, MACD, ADX).

Helps identify true market strength zones.

Works on all markets: Forex, Crypto, Stocks, Indices.

Multi-Signal Oscillator: ADX Trend + DI + RSI + MACD (MTF, Cross Alerts)

✅ Detailed Description

📝 Overview

This indicator combines advanced technical analysis tools to identify trend direction, capture reversals, and filter false signals.

It includes:

ADX (Multi-TimeFrame) for trend and trend strength detection.

DI+ / DI- for directional bias.

RSI + ZLSMA for oscillation analysis and divergence detection.

Zero-Lag Normalized MACD for momentum and entry timing.

⚙️ Visual Components

✅ Green/Red Background: Displays overall trend based on Multi-TimeFrame ADX.

✅ DI+ / DI- Lines: Green and red curves showing directional bias.

✅ Normalized RSI: Blue oscillator with orange ZLSMA smoothing.

✅ Zero-Lag MACD: Violet or fuchsia/orange oscillator depending on the version.

✅ Crossover Points: Colored circles marking buy and sell signals.

✅ ADX Strength Dots: Small black dots when ADX exceeds the strength threshold.

🚨 Included Alert System

✅ RSI / ZLSMA Crossovers (Buy / Sell).

✅ MACD / Signal Line Crossovers (Buy / Sell).

✅ DI+ / DI- Crossovers (Buy / Sell).

✅ Double Confirmation DI+ / RSI or DI+ / MACD.

✅ Double Confirmation DI- / RSI or DI- / MACD.

✅ Trend Change Alerts via Background Color.

✅ ADX Strength Alerts (Above Threshold).

🛠️ Suggested Configuration Examples

1. Short-Term Reversal Detection:

RSI Length: 7 to 14

ZLSMA Length: 7 to 14

MACD Fast/Slow: 5 / 13

ADX MTF Period: 5 to 15

ADX Threshold: 15 to 20

2. Long-Term Trend Following:

RSI Length: 21 to 30

ZLSMA Length: 21 to 30

MACD Fast/Slow: 12 / 26

ADX MTF Period: 30 to 50

ADX Threshold: 20 to 25

3. Scalping / Day Trading:

RSI Length: 5 to 9

ZLSMA Length: 5 to 9

MACD Fast/Slow: 3 / 7

ADX MTF Period: 5 to 10

ADX Threshold: 10 to 15

🎯 Why Use This Tool?

Filters false signals using ADX-based background coloring.

Provides multi-source alerting (RSI, MACD, ADX).

Helps identify true market strength zones.

Works on all markets: Forex, Crypto, Stocks, Indices.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.